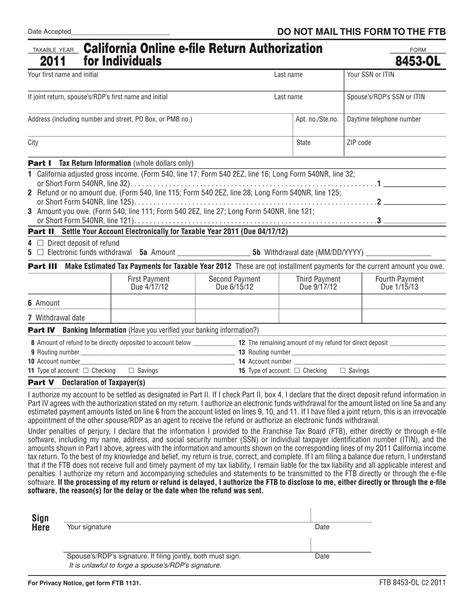

As a taxpayer in California, you may have come across the California Form 8453-OL, also known as the e-File Declaration for an IRS e-filed Return. This form is required for taxpayers who e-file their federal income tax return and are also required to file a state income tax return. In this article, we will explore the different ways to fill out California Form 8453-OL and provide you with the necessary information to ensure you complete the form correctly.

What is California Form 8453-OL?

California Form 8453-OL is a declaration form that taxpayers must complete and sign when e-filing their federal income tax return. The form confirms that the taxpayer has reviewed and approved the information contained in their e-filed return. It also authorizes the IRS to transmit the return to the California Franchise Tax Board (FTB) for state income tax purposes.

Who Needs to Fill Out California Form 8453-OL?

You need to fill out California Form 8453-OL if you:

- E-file your federal income tax return

- Are required to file a state income tax return in California

- Have a valid California driver's license or state ID

- Have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

5 Ways to Fill Out California Form 8453-OL

There are several ways to fill out California Form 8453-OL, depending on your preference and the tax preparation software you use. Here are five common methods:

Method 1: Manual Completion

You can fill out California Form 8453-OL manually by downloading the form from the California Franchise Tax Board (FTB) website or picking one up from a local FTB office. You will need to complete the form by hand, making sure to sign and date it. Once completed, you can attach the form to your e-filed return or mail it to the FTB.

Steps to Complete California Form 8453-OL Manually:

- Download the form from the FTB website or pick one up from a local FTB office.

- Fill out the form by hand, making sure to complete all required fields.

- Sign and date the form.

- Attach the form to your e-filed return or mail it to the FTB.

Method 2: Tax Preparation Software

Most tax preparation software, such as TurboTax or H&R Block, will generate a California Form 8453-OL for you to sign and date. The software will guide you through the completion process, ensuring that all required fields are filled out correctly.

Steps to Complete California Form 8453-OL Using Tax Preparation Software:

- Choose a tax preparation software that supports California e-filing.

- Follow the software's instructions to complete your tax return.

- Review and sign the California Form 8453-OL generated by the software.

- E-file your return, including the signed California Form 8453-OL.

Method 3: E-file with a Tax Professional

If you hire a tax professional to prepare your tax return, they will typically generate a California Form 8453-OL for you to sign and date. The tax professional will ensure that all required fields are filled out correctly and that the form is attached to your e-filed return.

Steps to Complete California Form 8453-OL with a Tax Professional:

- Hire a tax professional to prepare your tax return.

- Review and sign the California Form 8453-OL generated by the tax professional.

- The tax professional will e-file your return, including the signed California Form 8453-OL.

Method 4: Online Tax Filing Services

Online tax filing services, such as Credit Karma Tax or TaxSlayer, offer a convenient way to complete and e-file your tax return, including the California Form 8453-OL.

Steps to Complete California Form 8453-OL with an Online Tax Filing Service:

- Choose an online tax filing service that supports California e-filing.

- Follow the service's instructions to complete your tax return.

- Review and sign the California Form 8453-OL generated by the service.

- E-file your return, including the signed California Form 8453-OL.

Method 5: FTB Website

You can also fill out California Form 8453-OL directly on the FTB website. This method requires you to create an account and log in to access the form.

Steps to Complete California Form 8453-OL on the FTB Website:

- Create an account on the FTB website.

- Log in to your account and access the California Form 8453-OL.

- Fill out the form online, making sure to complete all required fields.

- Sign and date the form electronically.

- Submit the form to the FTB.

In conclusion, filling out California Form 8453-OL is a straightforward process that can be completed in various ways. Whether you choose to complete the form manually, use tax preparation software, or hire a tax professional, it's essential to ensure that all required fields are filled out correctly and that the form is signed and dated. By following the steps outlined in this article, you can ensure that your California Form 8453-OL is completed accurately and efficiently.

What is the purpose of California Form 8453-OL?

+California Form 8453-OL is a declaration form that taxpayers must complete and sign when e-filing their federal income tax return. The form confirms that the taxpayer has reviewed and approved the information contained in their e-filed return.

Who needs to fill out California Form 8453-OL?

+You need to fill out California Form 8453-OL if you e-file your federal income tax return, are required to file a state income tax return in California, have a valid California driver's license or state ID, and have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Can I fill out California Form 8453-OL manually?

+Yes, you can fill out California Form 8453-OL manually by downloading the form from the California Franchise Tax Board (FTB) website or picking one up from a local FTB office. You will need to complete the form by hand, making sure to sign and date it.