The Ohio TOD Affidavit Form is a valuable tool for individuals looking to transfer ownership of real property upon their death. Also known as a Transfer on Death (TOD) deed, this document allows property owners to designate beneficiaries who will inherit their property without the need for probate. In this article, we will explore five ways to use Ohio's TOD Affidavit Form, highlighting its benefits and providing practical examples.

Understanding Ohio's TOD Affidavit Form

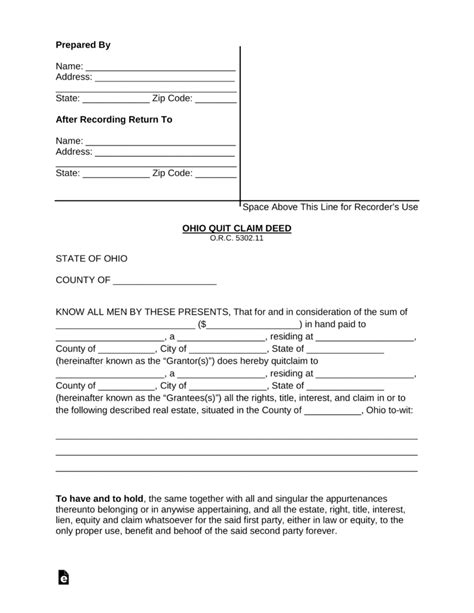

The Ohio TOD Affidavit Form is a legal document that allows property owners to transfer ownership of their real property to designated beneficiaries upon their death. This document is often used in conjunction with a TOD deed, which is recorded with the county recorder's office. By using a TOD affidavit, property owners can avoid the costly and time-consuming probate process, ensuring that their property is transferred quickly and efficiently to their loved ones.

1. Avoiding Probate

One of the primary benefits of using Ohio's TOD Affidavit Form is avoiding probate. Probate is a court-supervised process that is required when a person dies without a valid will or trust. This process can be lengthy, costly, and may result in significant delays in transferring ownership of the property. By using a TOD affidavit, property owners can bypass the probate process, ensuring that their property is transferred directly to their beneficiaries upon their death.

How it Works

To avoid probate using a TOD affidavit, property owners must complete the form and record it with the county recorder's office. The form must include the following information:

- The name and address of the property owner (also known as the grantor)

- The name and address of the beneficiary (also known as the grantee)

- A description of the property being transferred

- The signature of the property owner

Once the form is recorded, the property owner's interest in the property is transferred to the beneficiary upon their death.

2. Maintaining Control During Life

Another benefit of using Ohio's TOD Affidavit Form is that property owners maintain control over their property during their lifetime. Unlike a traditional trust, which requires the property owner to transfer ownership of the property to the trust, a TOD affidavit allows property owners to retain ownership and control of their property until their death.

Example

For example, let's say John owns a home in Ohio and wants to transfer ownership to his daughter, Emily, upon his death. Using a TOD affidavit, John can maintain control over the property during his lifetime, making decisions about its use and management. Upon his death, the property will automatically transfer to Emily, without the need for probate.

3. Reducing Estate Taxes

Understanding Estate Taxes

Estate taxes are taxes imposed on the transfer of wealth from one generation to another. In Ohio, estate taxes are imposed on the value of the property being transferred, minus any exemptions or deductions. By using a TOD affidavit, property owners can reduce the amount of estate taxes owed, ensuring that more of their wealth is transferred to their beneficiaries.

How it Works

To reduce estate taxes using a TOD affidavit, property owners must complete the form and record it with the county recorder's office. The form must include the following information:

- The name and address of the property owner (also known as the grantor)

- The name and address of the beneficiary (also known as the grantee)

- A description of the property being transferred

- The signature of the property owner

Once the form is recorded, the property owner's interest in the property is transferred to the beneficiary upon their death, reducing the amount of estate taxes owed.

4. Providing for Minor Children

Using Ohio's TOD Affidavit Form can also provide for minor children. By designating a beneficiary, such as a trust or a guardian, property owners can ensure that their minor children are provided for in the event of their death.

Example

For example, let's say Sarah owns a home in Ohio and has two minor children. Using a TOD affidavit, Sarah can designate a trust as the beneficiary of her property, ensuring that her children are provided for in the event of her death. The trust can be managed by a trustee, who will make decisions about the property and its use for the benefit of Sarah's children.

5. Simplifying Property Transfer

Finally, using Ohio's TOD Affidavit Form can simplify the property transfer process. By avoiding probate and reducing estate taxes, property owners can ensure that their property is transferred quickly and efficiently to their beneficiaries.

Example

For example, let's say Michael owns a commercial property in Ohio and wants to transfer ownership to his business partner upon his death. Using a TOD affidavit, Michael can ensure that the property is transferred quickly and efficiently, without the need for probate or lengthy court proceedings.

What is an Ohio TOD Affidavit Form?

+An Ohio TOD Affidavit Form is a legal document that allows property owners to transfer ownership of their real property to designated beneficiaries upon their death.

How does an Ohio TOD Affidavit Form work?

+An Ohio TOD Affidavit Form works by allowing property owners to designate beneficiaries who will inherit their property upon their death. The form must be completed and recorded with the county recorder's office.

What are the benefits of using an Ohio TOD Affidavit Form?

+The benefits of using an Ohio TOD Affidavit Form include avoiding probate, maintaining control during life, reducing estate taxes, providing for minor children, and simplifying property transfer.

In conclusion, using Ohio's TOD Affidavit Form can provide a range of benefits for property owners, including avoiding probate, maintaining control during life, reducing estate taxes, providing for minor children, and simplifying property transfer. By understanding how to use this form, property owners can ensure that their property is transferred quickly and efficiently to their beneficiaries, without the need for costly and time-consuming court proceedings.