Filing taxes can be a daunting task, especially when it comes to understanding the various forms and requirements. One such form that often raises questions is Form 4361, Application for Exemption From Self-Employment Tax for Use by the Amish and Certain Other Groups. In this article, we will delve into the world of Form 4361, exploring its purpose, eligibility criteria, and the application process.

What is Form 4361?

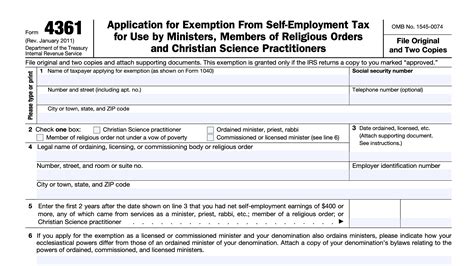

Form 4361 is an application for exemption from self-employment tax, specifically designed for the Amish and certain other groups who have conscientious objections to paying self-employment tax. The form is used to request an exemption from the self-employment tax, which is typically required for individuals who are self-employed or have net earnings from self-employment.

Who is Eligible for Form 4361?

Eligibility Criteria

To be eligible for Form 4361, applicants must meet specific criteria:

- Be a member of a recognized religious sect or division, such as the Amish

- Have a conscientious objection to paying self-employment tax

- File Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits

- Not have filed Form 4361 previously and been approved for an exemption

How to Apply for Form 4361

Application Process

Applying for Form 4361 involves several steps:

- Obtain the necessary forms: Download or request Form 4361 and Form 4029 from the IRS website or by calling the IRS at 1-800-829-1040.

- Complete Form 4361: Fill out Form 4361, providing all required information, including your name, address, Social Security number, and a statement explaining your conscientious objection to paying self-employment tax.

- Complete Form 4029: Fill out Form 4029, waiving your rights to Social Security and Medicare benefits.

- Attach required documentation: Attach a copy of your W-2 forms, a statement from your religious sect or division confirming your membership, and any other required documentation.

- Submit the application: Mail the completed application to the IRS address listed in the instructions.

Key Facts About Form 4361

Essential Information

Here are some essential facts to keep in mind when applying for Form 4361:

- Exemption is not automatic: Approval for an exemption is not guaranteed and is subject to review by the IRS.

- Exemption is only for self-employment tax: Form 4361 only exempts applicants from self-employment tax, not from other taxes, such as income tax.

- Waiver of benefits: By filing Form 4029, applicants waive their rights to Social Security and Medicare benefits.

Common Mistakes to Avoid

Avoiding Errors

When applying for Form 4361, it's essential to avoid common mistakes that can delay or even deny your application:

- Inaccurate or incomplete information: Double-check your application for accuracy and completeness.

- Missing documentation: Ensure you attach all required documentation, including W-2 forms and a statement from your religious sect or division.

- Failure to follow instructions: Carefully follow the instructions for completing and submitting the application.

Tips for a Smooth Application Process

Application Tips

To ensure a smooth application process, keep the following tips in mind:

- Plan ahead: Allow plenty of time to complete and submit the application.

- Seek assistance: If needed, consult with a tax professional or seek guidance from the IRS.

- Keep records: Keep a copy of your application and supporting documentation for your records.

Conclusion

Next Steps

In conclusion, Form 4361 is a specialized application for exemption from self-employment tax, designed for the Amish and certain other groups with conscientious objections. By understanding the eligibility criteria, application process, and key facts about Form 4361, applicants can navigate the process with confidence. If you have any questions or concerns about Form 4361, don't hesitate to reach out to the IRS or a tax professional for guidance.

What is the purpose of Form 4361?

+Form 4361 is an application for exemption from self-employment tax, specifically designed for the Amish and certain other groups who have conscientious objections to paying self-employment tax.

Who is eligible for Form 4361?

+To be eligible for Form 4361, applicants must be a member of a recognized religious sect or division, have a conscientious objection to paying self-employment tax, file Form 4029, and not have filed Form 4361 previously and been approved for an exemption.

What is the application process for Form 4361?

+The application process for Form 4361 involves obtaining the necessary forms, completing Form 4361 and Form 4029, attaching required documentation, and submitting the application to the IRS.