As a resident of Minnesota, it's essential to understand the state's income tax laws and filing requirements to ensure you're in compliance and taking advantage of all the deductions and credits available to you. Filing your Minnesota state income tax form can seem daunting, but with this comprehensive guide, you'll be able to navigate the process with ease.

Minnesota, also known as the Land of 10,000 Lakes, is home to over 5.7 million people, each with unique financial situations and tax needs. The state's income tax rates range from 5.35% to 9.85%, making it crucial to accurately file your taxes to avoid any penalties or fines.

In this article, we'll walk you through the process of filing your Minnesota state income tax form, highlighting key steps, deductions, and credits. By the end of this guide, you'll be well-equipped to tackle your tax return with confidence.

Understanding Minnesota Income Tax Rates

Before diving into the filing process, it's essential to understand Minnesota's income tax rates. The state has a progressive tax system, meaning that the more you earn, the higher your tax rate. The tax rates for the 2022 tax year are as follows:

- 5.35% on the first $39,400 of taxable income (single filers) or $78,800 (joint filers)

- 7.05% on taxable income between $39,401 and $153,900 (single filers) or $157,800 (joint filers)

- 7.85% on taxable income between $153,901 and $273,800 (single filers) or $275,400 (joint filers)

- 9.85% on taxable income over $273,800 (single filers) or $275,400 (joint filers)

Gathering Necessary Documents

To ensure a smooth filing process, gather all necessary documents before starting your tax return. These may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

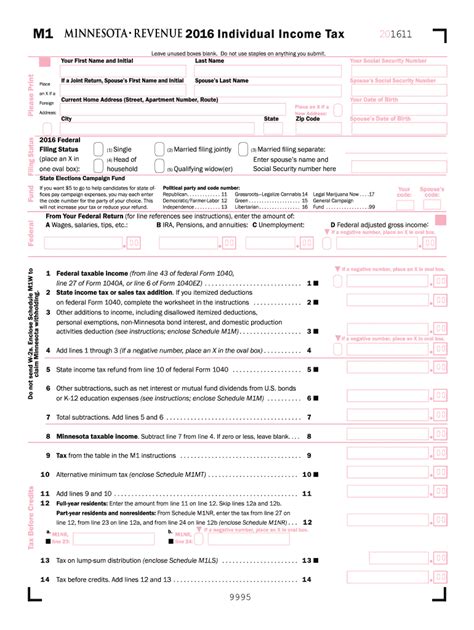

Choosing the Right Filing Status

Your filing status determines the tax rates and deductions you're eligible for. Minnesota recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best reflects your situation, and ensure you have the necessary documentation to support it.

Filing Your Minnesota State Income Tax Form

Minnesota offers two options for filing your state income tax form: e-file or paper file. E-filing is the recommended method, as it's faster, more accurate, and environmentally friendly.

E-Filing

To e-file your Minnesota state income tax form, follow these steps:

- Visit the Minnesota Department of Revenue website and log in to your account.

- Select the "File a Return" option and choose the correct tax year.

- Answer the prompts and follow the instructions to complete your tax return.

- Review your return carefully and submit it electronically.

Paper Filing

If you prefer to paper file, you can download and print the necessary forms from the Minnesota Department of Revenue website or pick them up at a local library or tax office.

- Complete the forms accurately and thoroughly.

- Attach all necessary documentation, such as W-2 forms and charitable donation receipts.

- Mail your return to the address listed on the form.

Minnesota Tax Credits and Deductions

Minnesota offers various tax credits and deductions to help reduce your tax liability. Some of the most common include:

- Minnesota Child and Dependent Care Credit

- Education Expenses Credit

- Mortgage Interest Credit

- Charitable Contributions Deduction

- Medical Expenses Deduction

Minnesota Child and Dependent Care Credit

This credit is available to taxpayers who paid for child or dependent care while working or looking for work. The credit is worth up to $2,400 for one child and $4,800 for two or more children.

Education Expenses Credit

This credit is available to taxpayers who paid for education expenses, such as tuition and fees, for themselves or their dependents. The credit is worth up to $1,400 for one student and $2,800 for two or more students.

Common Filing Mistakes to Avoid

To avoid delays or penalties, steer clear of these common filing mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the return

- Insufficient documentation

- Incorrect filing status

- Missing or incorrect W-2 or 1099 forms

Tax Filing Deadlines and Extensions

The deadline for filing your Minnesota state income tax form is April 15th. If you need an extension, you can file Form M1 by the original deadline to receive an automatic six-month extension.

Conclusion: Take Control of Your Minnesota State Income Tax

Filing your Minnesota state income tax form doesn't have to be a daunting task. By understanding the tax rates, gathering necessary documents, and choosing the right filing status, you'll be well on your way to a stress-free tax season. Take advantage of the tax credits and deductions available to you, and avoid common filing mistakes to ensure a smooth and accurate process.

We encourage you to share your thoughts and questions in the comments below. Have you filed your Minnesota state income tax form before? What challenges did you face, and how did you overcome them? Share your experiences to help others navigate the process with ease.

What is the deadline for filing my Minnesota state income tax form?

+The deadline for filing your Minnesota state income tax form is April 15th.

Can I e-file my Minnesota state income tax form?

+Yes, you can e-file your Minnesota state income tax form through the Minnesota Department of Revenue website.

What tax credits and deductions are available to Minnesota taxpayers?

+Minnesota offers various tax credits and deductions, including the Minnesota Child and Dependent Care Credit, Education Expenses Credit, and Charitable Contributions Deduction.