As a non-resident individual or business owner with income sourced from California, you're required to file the California Non-Resident or Part-Year Resident Income Tax Return, also known as Form CA 540NR. This form is used to report your income, claim deductions and credits, and calculate your tax liability to the state of California. Completing Form CA 540NR can be a daunting task, but by breaking it down into manageable steps, you'll be able to navigate the process with ease.

Step 1: Gather Required Documents and Information

Before starting the filing process, make sure you have all the necessary documents and information at your disposal. These may include:

- Your federal income tax return (Form 1040)

- W-2 and 1099 forms showing California income

- Records of deductions and credits claimed on your federal return

- Information about any California-specific deductions or credits you're eligible for

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

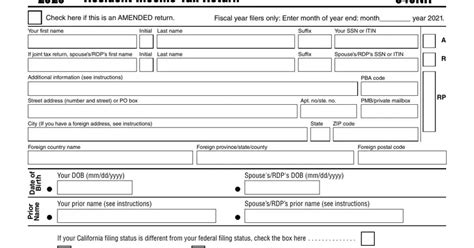

Step 2: Determine Your Filing Status and Residency

Your filing status and residency will determine which sections of Form CA 540NR you need to complete. You'll need to indicate whether you're a non-resident, part-year resident, or a non-resident alien. You'll also need to determine your filing status, which may be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Understanding Your Filing Status and Residency

- Non-resident: You're not a resident of California, but you have income sourced from the state.

- Part-year resident: You're a resident of California for part of the year, but not the entire year.

- Non-resident alien: You're not a U.S. citizen or resident, but you have income sourced from California.

Step 3: Complete the Income Section

In this section, you'll report all your income from California sources. This may include:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

- Rental income

Make sure to report all income, regardless of whether it's subject to California tax or not.

Step 4: Claim Deductions and Credits

In this section, you'll claim any deductions and credits you're eligible for. These may include:

- Standard deduction

- Itemized deductions

- California-specific deductions, such as the mortgage interest deduction

- Credits, such as the earned income tax credit (EITC)

Make sure to review the instructions carefully to ensure you're claiming all the deductions and credits you're eligible for.

Common Deductions and Credits

- Standard deduction: A fixed amount that can be deducted from your income

- Itemized deductions: Expenses such as mortgage interest, charitable donations, and medical expenses

- California-specific deductions: Deductions that are unique to California, such as the mortgage interest deduction

- Credits: Amounts that can be subtracted directly from your tax liability, such as the EITC

Step 5: Calculate Your Tax Liability and Pay Any Amount Due

In this final step, you'll calculate your tax liability based on your income, deductions, and credits. If you owe taxes, you'll need to pay the amount due by the filing deadline to avoid penalties and interest.

By following these 5 essential steps, you'll be able to complete Form CA 540NR with confidence. Remember to review the instructions carefully, and don't hesitate to seek professional help if you need it.

We hope this article has been helpful in guiding you through the process of completing Form CA 540NR. If you have any questions or need further clarification, please don't hesitate to comment below.

Take Action Today!

Complete Form CA 540NR today and ensure you're meeting your tax obligations to the state of California. Don't wait until the last minute – get started now and avoid any potential penalties or fines.

FAQ Section:

What is Form CA 540NR?

+Form CA 540NR is the California Non-Resident or Part-Year Resident Income Tax Return. It's used to report income, claim deductions and credits, and calculate tax liability to the state of California.

Who needs to file Form CA 540NR?

+Non-resident individuals and business owners with income sourced from California need to file Form CA 540NR.

What is the deadline for filing Form CA 540NR?

+The deadline for filing Form CA 540NR is typically April 15th, but it may vary depending on your specific situation. Check the California Franchise Tax Board website for more information.