The California Form 100 is a crucial document for businesses operating in the state, and understanding its requirements is essential for maintaining compliance with the California Secretary of State's regulations. In this article, we will delve into the intricacies of the California Form 100, providing a comprehensive guide on how to file it accurately and efficiently.

The Importance of California Form 100

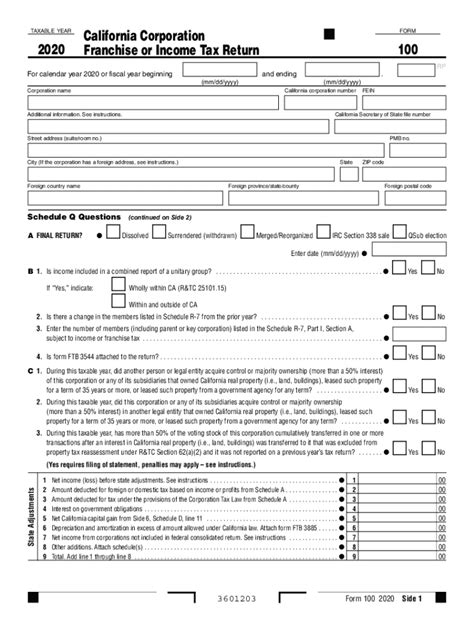

The California Form 100, also known as the Statement of Information, is a biennial filing requirement for businesses registered with the California Secretary of State's office. The form is used to update the state's records with the most current information about the business, including its officers, directors, and address. Failure to file the Form 100 can result in penalties, fines, and even suspension of the business's registration.

Who Needs to File California Form 100?

All businesses registered with the California Secretary of State's office are required to file the Form 100, including:

- Corporations (domestic and foreign)

- Limited liability companies (LLCs)

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

When to File California Form 100

The California Form 100 must be filed every two years, within a specific timeframe:

- Corporations: within 90 days of the anniversary of the initial registration

- LLCs, LPs, and LLPs: within 90 days of the anniversary of the initial registration, or on the last day of the month in which the anniversary falls

How to File California Form 100

Filing the California Form 100 involves several steps:

Filing Methods

Businesses can file the Form 100 using one of the following methods:

-

Online Filing

+ Log in to the California Secretary of State's online portal (bizfileonline.sos.ca.gov) + Complete and submit the Form 100 + Pay the filing fee (currently $25 for online filings) -

Mail Filing

+ Download and complete the Form 100 (available on the California Secretary of State's website) + Attach the required fee (currently $75 for mail filings) + Mail the completed form to the California Secretary of State's office -

In-Person Filing

+ Take the completed Form 100 to the California Secretary of State's office in Sacramento + Pay the filing fee (currently $25 for in-person filings)

Required Information

The California Form 100 requires the following information:

- Business name and address

- Type of business entity (corporation, LLC, LP, or LLP)

- Names and addresses of officers, directors, or members

- Business activity description

- Address of the business's principal office

Additional Requirements

- A $25 or $75 filing fee (depending on the filing method)

- A copy of the business's most recent tax return (if filed with the California Franchise Tax Board)

Common Mistakes to Avoid

When filing the California Form 100, businesses should avoid the following common mistakes:

- Failing to file the form within the required timeframe

- Providing incomplete or inaccurate information

- Failing to pay the required filing fee

Penalties for Non-Compliance

Failure to file the California Form 100 can result in:

- A penalty of $250

- Suspension of the business's registration

- Revocation of the business's registration (in severe cases)

Conclusion

Filing the California Form 100 is a crucial step in maintaining compliance with the California Secretary of State's regulations. By understanding the requirements and following the steps outlined in this guide, businesses can ensure accurate and efficient filing. Remember to avoid common mistakes and file the form within the required timeframe to avoid penalties and fines.

Take Action

If you are a business owner or registered agent, take the necessary steps to ensure compliance with the California Form 100 filing requirements. If you have questions or concerns, consult with a qualified business attorney or the California Secretary of State's office.

What is the purpose of the California Form 100?

+The California Form 100, also known as the Statement of Information, is a biennial filing requirement for businesses registered with the California Secretary of State's office. The form is used to update the state's records with the most current information about the business.

Who needs to file the California Form 100?

+All businesses registered with the California Secretary of State's office are required to file the Form 100, including corporations, limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs).

What is the filing fee for the California Form 100?

+The filing fee for the California Form 100 varies depending on the filing method: $25 for online filings, $75 for mail filings, and $25 for in-person filings.