Hawaii is a beautiful state with a unique tax landscape. For businesses operating in the Aloha State, navigating the tax system can be complex. One crucial aspect of this system is the Hawaii Form G-49, also known as the Annual Return and Reconciliation (G-49). This form is used by employers to report and reconcile their state income tax withholding, as well as pay any applicable taxes.

To ensure you're in compliance with the state's tax regulations, it's essential to understand how to correctly file Hawaii Form G-49. In this article, we'll provide you with five valuable tips to help you through the process.

Tip 1: Understand Your Filing Requirements

Before diving into the filing process, it's crucial to understand your obligations as an employer in Hawaii. You'll need to determine if you're required to file Hawaii Form G-49, as well as any other supporting forms or schedules. Here are a few key points to consider:

- If you have employees who are subject to Hawaii income tax withholding, you'll need to file Form G-49.

- You'll need to file the form even if you have no tax liability or if you're exempt from filing a federal Form 941.

- You may need to file additional forms or schedules, such as Form G-45 (Quarterly Return) or Form G-50 (Annual Reconciliation).

Know Your Filing Deadlines

Mark your calendar with the following important deadlines:

- January 31st: Deadline for filing Form G-49 for the previous tax year.

- April 30th: Deadline for filing Form G-45 for the first quarter of the current tax year.

- July 31st: Deadline for filing Form G-45 for the second quarter of the current tax year.

- October 31st: Deadline for filing Form G-45 for the third quarter of the current tax year.

- January 31st (of the following year): Deadline for filing Form G-45 for the fourth quarter of the previous tax year.

Tip 2: Gather Required Information and Documents

To accurately complete Hawaii Form G-49, you'll need to gather various pieces of information and documents. Here's a checklist to help you prepare:

- Your business's name, address, and FEIN (Federal Employer Identification Number)

- Employee information, including names, addresses, and Social Security numbers

- W-2 forms for each employee

- 1099 forms for contractors or other non-employees

- Records of Hawaii income tax withheld from employees

- Records of any applicable tax credits or deductions

Organize Your Records

Keep your records organized and easily accessible to ensure a smooth filing process. Consider using a spreadsheet or accounting software to track your tax withholding and other relevant information.

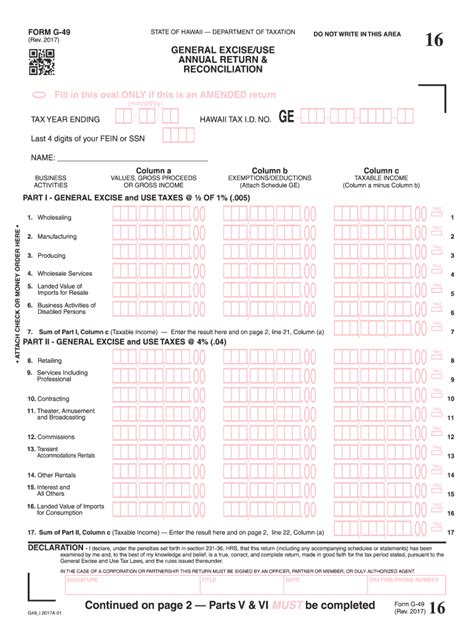

Tip 3: Accurately Complete the Form

When completing Hawaii Form G-49, it's essential to ensure accuracy and attention to detail. Here are some tips to help you avoid common mistakes:

- Use the correct form version and instructions for the tax year you're filing.

- Report all wages, salaries, and other compensation paid to employees.

- Calculate tax withholding accurately, taking into account any applicable tax credits or deductions.

- Report any adjustments or corrections to previously filed forms.

Double-Check Your Math

To avoid errors, double-check your calculations and ensure you're reporting the correct tax withholding. Consider using a calculator or accounting software to help with your calculations.

Tip 4: File Electronically or by Mail

You can file Hawaii Form G-49 electronically or by mail, depending on your preference and the state's requirements. Here are some options to consider:

- Electronic Filing: You can file electronically through the Hawaii Department of Taxation's website or through a third-party filing service.

- Mail Filing: You can mail the completed form to the Hawaii Department of Taxation, but be sure to follow the state's mailing instructions carefully.

Choose the Right Filing Method

Consider the benefits of electronic filing, including faster processing and reduced errors. However, if you prefer to file by mail, make sure to follow the state's instructions carefully to avoid delays or rejection.

Tip 5: Pay Any Applicable Taxes

If you have a tax liability, you'll need to pay any applicable taxes by the filing deadline to avoid penalties and interest. Here are some options to consider:

- Electronic Payment: You can make an electronic payment through the Hawaii Department of Taxation's website or through a third-party payment service.

- Check or Money Order: You can mail a check or money order with your filed form.

Avoid Late Payment Penalties

To avoid late payment penalties and interest, make sure to pay any applicable taxes by the filing deadline. Consider setting up an electronic payment to ensure timely payment.

By following these five tips, you'll be well on your way to accurately and efficiently filing Hawaii Form G-49. Remember to stay organized, double-check your math, and pay any applicable taxes to avoid penalties and interest. If you have any questions or concerns, consider consulting with a tax professional or contacting the Hawaii Department of Taxation for guidance.

We hope this article has provided you with valuable insights and tips for filing Hawaii Form G-49. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your colleagues and friends who may also benefit from this information.

What is the deadline for filing Hawaii Form G-49?

+The deadline for filing Hawaii Form G-49 is January 31st of each year.

Can I file Hawaii Form G-49 electronically?

+Yes, you can file Hawaii Form G-49 electronically through the Hawaii Department of Taxation's website or through a third-party filing service.

What if I have a tax liability and fail to pay by the deadline?

+If you have a tax liability and fail to pay by the deadline, you may be subject to penalties and interest.