The 941x form is a crucial document for employers who need to make adjustments to their quarterly employment tax returns. Filing this form can be a bit complex, but with the right guidance, you can navigate the process with ease. In this article, we will break down the steps to mail a 941x form, ensuring that you comply with the IRS regulations and avoid any potential penalties.

Understanding the 941x Form

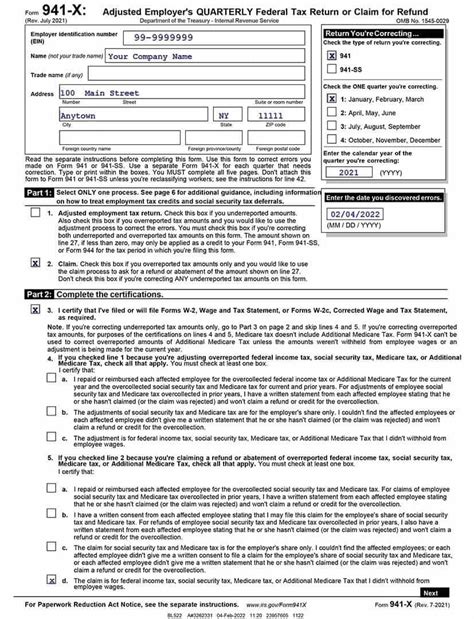

Before we dive into the steps to mail a 941x form, it's essential to understand what this form is and why it's necessary. The 941x form is used to make adjustments to previously filed quarterly employment tax returns, specifically Form 941. This form is typically used to correct errors or report changes in employment taxes, such as correcting Social Security tax withheld or reporting additional tax liability.

Step 1: Prepare the 941x Form

To begin the process, you need to prepare the 941x form. You can download the form from the IRS website or use tax software to generate the form. Ensure that you use the most recent version of the form, as the IRS frequently updates its forms.

When preparing the 941x form, you will need to provide the following information:

- Your employer identification number (EIN)

- The quarter and year for which you are making the adjustment

- The type of adjustment you are making (e.g., correction, additional tax liability)

- The amount of the adjustment

Tips for Preparing the 941x Form

- Use a separate 941x form for each quarter you are adjusting.

- Make sure to sign and date the form.

- Use black ink to sign the form.

- Keep a copy of the form for your records.

Step 2: Attach Supporting Documentation

Depending on the type of adjustment you are making, you may need to attach supporting documentation to the 941x form. This documentation can include:

- A detailed explanation of the adjustment

- A copy of the original Form 941

- A copy of any amended returns (e.g., Form 941-X)

- Documentation to support the adjustment (e.g., payroll records, tax deposits)

Types of Supporting Documentation

- A written explanation of the error or change

- A copy of the original Form 941, if you are correcting an error

- A copy of any amended returns, if you are reporting additional tax liability

- Payroll records, if you are adjusting employment taxes

- Tax deposit records, if you are reporting additional tax liability

Step 3: Mail the 941x Form

Once you have prepared the 941x form and attached any supporting documentation, you can mail the form to the IRS. The mailing address will depend on your location and the type of adjustment you are making.

IRS Mailing Addresses

- If you are filing a correction or reporting additional tax liability, mail the form to: Internal Revenue Service Department of the Treasury Internal Revenue Service Center Austin, TX 73301

- If you are reporting a change in employment taxes, mail the form to: Internal Revenue Service Department of the Treasury Internal Revenue Service Center Cincinnati, OH 45999

Step 4: Verify Receipt and Follow Up

After mailing the 941x form, it's essential to verify that the IRS received it. You can do this by:

- Using a trackable mail service, such as certified mail or FedEx

- Calling the IRS to confirm receipt

- Checking your account online to see if the adjustment has been processed

Following Up with the IRS

- If you don't receive a confirmation within 2-3 weeks, call the IRS to inquire about the status of your form.

- If you need to make additional adjustments, file another 941x form.

- Keep a copy of the form and any supporting documentation for your records.

In conclusion, mailing a 941x form requires careful attention to detail and adherence to IRS regulations. By following these four easy steps, you can ensure that your form is processed correctly and avoid any potential penalties. Remember to verify receipt and follow up with the IRS to ensure that your adjustment is processed promptly.

If you have any questions or concerns about mailing a 941x form, please don't hesitate to comment below. We're here to help!

What is the purpose of the 941x form?

+The 941x form is used to make adjustments to previously filed quarterly employment tax returns, specifically Form 941.

What type of supporting documentation do I need to attach to the 941x form?

+Depending on the type of adjustment, you may need to attach a written explanation, a copy of the original Form 941, payroll records, or tax deposit records.

How do I verify receipt of the 941x form?

+You can verify receipt by using a trackable mail service, calling the IRS, or checking your account online.