As a resident of Georgia, it's essential to understand the state's tax laws and requirements to avoid any penalties or fines. One crucial aspect of Georgia's tax laws is the estimated tax payment system, which is reported using Form 500-ES. In this article, we'll delve into the world of Georgia Form 500-ES, exploring its purpose, benefits, and step-by-step guide on how to file.

What is Georgia Form 500-ES?

Georgia Form 500-ES is a quarterly payment voucher used to report and pay estimated taxes for individuals and businesses in the state of Georgia. The form is designed to help taxpayers estimate their tax liability and make timely payments throughout the year, rather than paying a large sum at the end of the tax year.

Who Needs to File Georgia Form 500-ES?

Not everyone is required to file Georgia Form 500-ES. The following individuals and businesses are typically required to make estimated tax payments:

- Self-employed individuals with a net earnings from self-employment of $400 or more

- Individuals with income that is not subject to withholding, such as rental income, dividends, or interest

- Businesses, including corporations, partnerships, and S corporations

- Estates and trusts

Benefits of Filing Georgia Form 500-ES

Filing Georgia Form 500-ES offers several benefits, including:

- Avoiding penalties and fines for underpayment of taxes

- Reducing the amount of taxes owed at the end of the tax year

- Making timely payments to avoid interest on unpaid taxes

- Helping to budget and plan for tax payments throughout the year

How to File Georgia Form 500-ES

Filing Georgia Form 500-ES is a relatively straightforward process. Here's a step-by-step guide:

- Determine Your Estimated Tax Liability: Calculate your estimated tax liability using Form 500-ES or consult with a tax professional.

- Gather Required Information: Collect your business's financial records, including income statements and balance sheets.

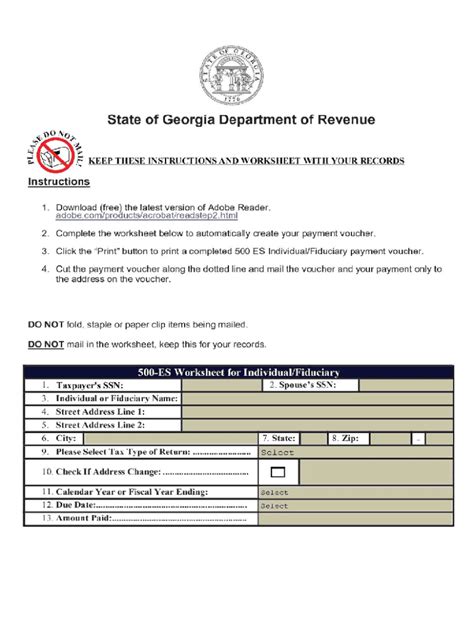

- Complete Form 500-ES: Fill out Form 500-ES, which includes:

- Business name and address

- Taxpayer identification number (EIN or SSN)

- Estimated tax liability

- Payment information (check or electronic payment)

- Submit Form 500-ES: File Form 500-ES with the Georgia Department of Revenue by the due date (April 15th for Q1, June 15th for Q2, September 15th for Q3, and January 15th of the following year for Q4).

- Make Timely Payments: Make timely payments using the voucher or online payment system.

Electronic Filing Options

Georgia offers electronic filing options for Form 500-ES, including:

- Georgia Tax Center: File and pay online through the Georgia Tax Center.

- EFTPS: Make electronic payments through the Electronic Federal Tax Payment System (EFTPS).

Common Mistakes to Avoid

When filing Georgia Form 500-ES, it's essential to avoid common mistakes, including:

- Late Payments: Missing payment deadlines can result in penalties and fines.

- Incorrect Information: Providing incorrect information can lead to delays or rejection of the form.

- Insufficient Payments: Underestimating tax liability can result in penalties and interest.

Conclusion

Filing Georgia Form 500-ES is a crucial step in managing your tax liability and avoiding penalties. By understanding the purpose, benefits, and filing process, you can ensure timely and accurate payments. If you're unsure about any aspect of the process, consult with a tax professional or contact the Georgia Department of Revenue for assistance.

We encourage you to share your experiences or ask questions about Georgia Form 500-ES in the comments below. Additionally, please share this article with others who may benefit from this information.

Who is required to file Georgia Form 500-ES?

+Self-employed individuals with a net earnings from self-employment of $400 or more, individuals with income that is not subject to withholding, businesses, estates, and trusts are typically required to file Georgia Form 500-ES.

What are the benefits of filing Georgia Form 500-ES?

+The benefits of filing Georgia Form 500-ES include avoiding penalties and fines, reducing the amount of taxes owed at the end of the tax year, making timely payments to avoid interest on unpaid taxes, and helping to budget and plan for tax payments throughout the year.

How do I file Georgia Form 500-ES?

+To file Georgia Form 500-ES, determine your estimated tax liability, gather required information, complete Form 500-ES, and submit it with the Georgia Department of Revenue by the due date. You can also file electronically using the Georgia Tax Center or EFTPS.