Filling out a W-9 form is a crucial step for creators on Onlyfans who want to receive payments from the platform. The W-9 form is used to certify your identity and provide your taxpayer identification number to Onlyfans, which is required by the IRS. In this article, we will guide you through the process of filling out a W-9 form for Onlyfans, step by step.

Why Do I Need to Fill Out a W-9 Form for Onlyfans?

As a creator on Onlyfans, you are considered an independent contractor, and Onlyfans is required to report your earnings to the IRS. The W-9 form is used to provide your taxpayer identification number and certify your identity, which is necessary for Onlyfans to comply with IRS regulations.

What Do I Need to Fill Out a W-9 Form?

To fill out a W-9 form for Onlyfans, you will need the following information:

- Your name and address

- Your taxpayer identification number (TIN) or Social Security Number (SSN)

- Your business name and address (if different from your personal name and address)

- Your business type (individual, sole proprietor, partnership, corporation, etc.)

Step-by-Step Guide to Filling Out a W-9 Form for Onlyfans

Here is a step-by-step guide to filling out a W-9 form for Onlyfans:

Step 1: Download the W-9 Form

You can download the W-9 form from the IRS website or obtain it from Onlyfans. Make sure to use the most recent version of the form.

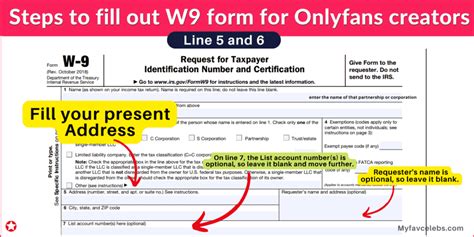

Step 2: Fill Out Your Name and Address

In the first section of the form, fill out your name and address. Make sure to use your full name and address as it appears on your tax return.

Step 3: Fill Out Your Business Name and Address (If Different)

If your business name and address are different from your personal name and address, fill them out in the second section of the form.

Step 4: Fill Out Your Taxpayer Identification Number (TIN) or Social Security Number (SSN)

In the third section of the form, fill out your TIN or SSN. This is a required field, and you must provide a valid TIN or SSN to complete the form.

Step 5: Fill Out Your Business Type

In the fourth section of the form, fill out your business type. As an Onlyfans creator, you are likely an individual or sole proprietor.

Step 6: Sign and Date the Form

Finally, sign and date the form. Make sure to sign the form in the presence of a notary public if required.

What to Do After Filling Out the W-9 Form

After filling out the W-9 form, you will need to submit it to Onlyfans. You can do this by uploading the form to your Onlyfans account or by mailing it to Onlyfans. Make sure to keep a copy of the form for your records.

Common Mistakes to Avoid When Filling Out a W-9 Form

Here are some common mistakes to avoid when filling out a W-9 form:

- Using an incorrect or outdated version of the form

- Failing to provide a valid TIN or SSN

- Failing to sign and date the form

- Failing to submit the form to Onlyfans

Tips for Filling Out a W-9 Form

Here are some tips for filling out a W-9 form:

- Make sure to use your full name and address as it appears on your tax return

- Use a valid TIN or SSN

- Sign and date the form in the presence of a notary public if required

- Keep a copy of the form for your records

Conclusion

Filling out a W-9 form for Onlyfans is a straightforward process that requires some basic information and attention to detail. By following the steps outlined in this article, you can complete the form quickly and easily. Remember to submit the form to Onlyfans and keep a copy for your records.

Frequently Asked Questions

What is a W-9 form?

+A W-9 form is a certification form used by the IRS to verify an individual's or business's identity and taxpayer identification number.

Why do I need to fill out a W-9 form for Onlyfans?

+You need to fill out a W-9 form for Onlyfans to provide your taxpayer identification number and certify your identity, which is required by the IRS.

What information do I need to fill out a W-9 form?

+You will need your name and address, taxpayer identification number or Social Security Number, business name and address (if different), and business type.