Filing taxes can be a daunting task, especially for those who are new to the process or are unsure about the requirements. In New Jersey, businesses and individuals are required to file taxes using the NJ Form 1065, which is used to report partnership income, deductions, and credits. In this article, we will guide you through the 5 easy steps to fill out NJ Form 1065, making the process less overwhelming and more manageable.

Why is NJ Form 1065 Important?

Before we dive into the steps, it's essential to understand the importance of NJ Form 1065. This form is used by partnerships, limited liability companies (LLCs), and S corporations to report their income, deductions, and credits to the state of New Jersey. The form is used to calculate the amount of taxes owed by the business or individual, and it's also used to claim any credits or deductions that may be available.

Step 1: Gather Necessary Information and Documents

Before starting to fill out NJ Form 1065, gather all the necessary information and documents. This includes:

- Partnership or LLC agreement

- Financial statements (balance sheet and income statement)

- Federal Form 1065 (if applicable)

- New Jersey tax return from the previous year (if applicable)

- Any other relevant tax documents

Having all the necessary information and documents will make it easier to complete the form accurately and efficiently.

Step 2: Identify the Type of Filer

NJ Form 1065 is used by different types of filers, including partnerships, LLCs, and S corporations. Identify the type of filer you are, as this will determine which sections of the form you need to complete.

- Partnership: Complete Sections 1-5 and Schedule K-1

- LLC: Complete Sections 1-5 and Schedule K-1 (if the LLC is treated as a partnership)

- S Corporation: Complete Sections 1-5 and Schedule K-1 (if the S corporation is treated as a partnership)

Step 3: Complete Sections 1-5

Sections 1-5 of NJ Form 1065 require information about the partnership or LLC, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Tax year and accounting method

- Type of business and industry code

- Income and deductions

Complete these sections accurately and thoroughly, as this information will be used to calculate the amount of taxes owed.

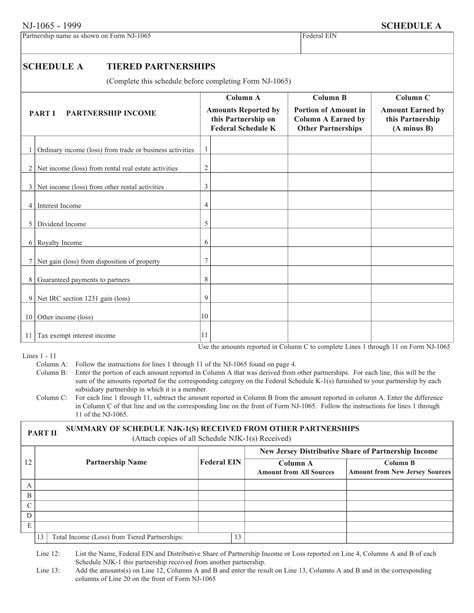

Step 4: Complete Schedule K-1

Schedule K-1 is used to report the partner's or member's share of income, deductions, and credits. Complete this schedule for each partner or member, including:

- Partner's or member's name and address

- Partner's or member's share of income and deductions

- Partner's or member's share of credits

This schedule is used to calculate the amount of taxes owed by each partner or member.

Step 5: Review and Submit the Form

Review NJ Form 1065 and Schedule K-1 carefully to ensure accuracy and completeness. Make sure to sign and date the form, as this is required for submission.

Submit the form to the New Jersey Division of Taxation, either electronically or by mail, depending on the filing method you choose.

Tips and Reminders

- Make sure to file NJ Form 1065 on time to avoid penalties and interest.

- Use the correct form and schedules for your type of business or income.

- Keep accurate and complete records, as this will make it easier to complete the form and avoid audits.

- Consider consulting a tax professional or accountant if you're unsure about any part of the process.

By following these 5 easy steps, you can fill out NJ Form 1065 with confidence and accuracy. Remember to review and submit the form carefully, and don't hesitate to seek help if you need it.

What is the deadline for filing NJ Form 1065?

+The deadline for filing NJ Form 1065 is typically April 15th for calendar-year filers, and the 15th day of the fourth month after the end of the fiscal year for fiscal-year filers.

Can I file NJ Form 1065 electronically?

+Yes, you can file NJ Form 1065 electronically through the New Jersey Division of Taxation's website or through a tax software provider.

Do I need to attach any schedules or forms to NJ Form 1065?

+Yes, you may need to attach schedules or forms, such as Schedule K-1, to NJ Form 1065, depending on your type of business or income.