Filing state taxes can be a daunting task, especially for those who are new to the process. In Virginia, the tax form used to report individual income tax is the Virginia Tax Form 760. In this article, we will guide you through the process of filing your Virginia state taxes using Form 760, highlighting the importance of accurate filing, the benefits of timely submission, and the steps involved in completing the form.

For many Virginians, the thought of filing state taxes can be overwhelming, especially with the numerous forms and schedules required. However, understanding the process and the benefits of timely filing can help alleviate some of the stress associated with tax season. By filing your Virginia state taxes on time, you can avoid penalties and interest, and even receive a refund if you have overpaid throughout the year.

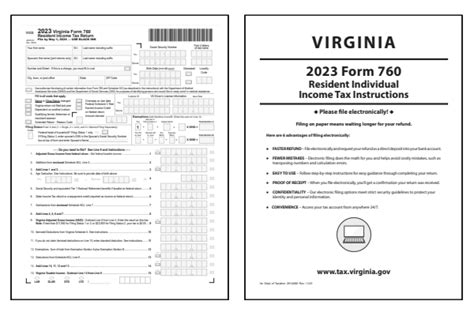

Understanding Virginia Tax Form 760

The Virginia Tax Form 760 is the standard form used by the Virginia Department of Taxation to report individual income tax. The form is used to calculate the amount of state income tax owed, as well as any refund due to the taxpayer. The form requires information about the taxpayer's income, deductions, and credits, and is typically filed by April 15th of each year.

Who Needs to File Form 760?

Not everyone is required to file a Virginia state tax return. Generally, you need to file Form 760 if you are a resident of Virginia and your gross income exceeds the minimum filing threshold. For the 2022 tax year, the minimum filing threshold is $11,950 for single filers and $23,900 for joint filers. However, even if you don't meet the minimum filing threshold, you may still need to file a return if you have self-employment income, unemployment compensation, or other types of income that require reporting.

Benefits of Filing Form 760

Filing your Virginia state taxes on time has several benefits. By filing your return, you can:

- Avoid penalties and interest on unpaid taxes

- Receive a refund if you have overpaid throughout the year

- Claim any eligible credits or deductions

- Meet the requirements for other state programs, such as the Virginia Earned Income Tax Credit (EITC)

How to File Form 760

Filing Form 760 is a relatively straightforward process. Here are the steps involved:

- Gather all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Determine your filing status and complete the corresponding sections of the form.

- Report your income, including wages, salaries, tips, and any other types of income.

- Claim any eligible deductions and credits, such as the standard deduction or the Virginia EITC.

- Calculate your state income tax liability and complete the corresponding sections of the form.

- Sign and date the form, and submit it to the Virginia Department of Taxation by the filing deadline.

Common Mistakes to Avoid When Filing Form 760

When filing Form 760, there are several common mistakes to avoid. These include:

- Failing to report all income, including self-employment income and unemployment compensation

- Claiming ineligible deductions or credits

- Failing to sign and date the form

- Submitting the form after the filing deadline

Penalties and Interest for Late Filing

If you fail to file your Virginia state tax return on time, you may be subject to penalties and interest. The penalty for late filing is 6% of the unpaid tax liability, plus interest at a rate of 1% per month. By filing your return on time, you can avoid these penalties and interest, and ensure that you receive any refund due to you.

Electronic Filing Options

In addition to filing a paper return, the Virginia Department of Taxation offers several electronic filing options. These include:

- e-File: A free online filing option for eligible taxpayers

- Virginia Taxpayer Portal: A secure online portal for filing and managing your state tax account

- Tax preparation software: Several tax preparation software programs, such as TurboTax and H&R Block, offer electronic filing options for Virginia state taxes.

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Faster processing and refund times

- Reduced errors and rejections

- Increased security and confidentiality

Amending a Previously Filed Return

If you need to amend a previously filed return, you can file Form 760-X, Amended Individual Income Tax Return. This form is used to correct errors or report changes to your original return.

Reasons to Amend a Return

You may need to amend a previously filed return if:

- You received additional income or deductions after filing your original return

- You discovered an error or omission on your original return

- You received a notice from the Virginia Department of Taxation indicating a change to your tax liability

Conclusion

Filing your Virginia state taxes using Form 760 is a relatively straightforward process. By understanding the benefits of timely filing, the steps involved in completing the form, and the common mistakes to avoid, you can ensure that you meet the requirements for filing a state tax return. Remember to take advantage of electronic filing options and to amend a previously filed return if necessary. If you have any questions or concerns, contact the Virginia Department of Taxation for assistance.

Who needs to file a Virginia state tax return?

+Generally, you need to file a Virginia state tax return if you are a resident of Virginia and your gross income exceeds the minimum filing threshold.

What is the deadline for filing a Virginia state tax return?

+The deadline for filing a Virginia state tax return is typically April 15th of each year.

Can I file my Virginia state tax return electronically?

+Yes, the Virginia Department of Taxation offers several electronic filing options, including e-File and the Virginia Taxpayer Portal.