Missouri is a state with a diverse economy, rich history, and stunning natural beauty. As a business owner in Missouri, understanding the state's sales tax laws and regulations is crucial for compliance and avoiding penalties. One of the essential forms for businesses in Missouri is the Sales Tax Form 53-1. In this article, we will delve into the world of Missouri Sales Tax Form 53-1, explaining its purpose, benefits, and providing a step-by-step guide on how to file it accurately.

What is Missouri Sales Tax Form 53-1?

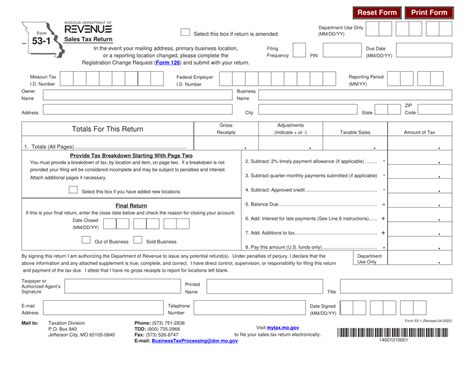

Missouri Sales Tax Form 53-1, also known as the Sales Tax Return, is a document required by the Missouri Department of Revenue for businesses to report and pay sales tax on their transactions. The form is used to calculate the total sales tax due, and it provides essential information to the state about a business's sales and tax liability.

Benefits of Filing Missouri Sales Tax Form 53-1

Filing Missouri Sales Tax Form 53-1 offers several benefits for businesses, including:

- Compliance with state regulations: Filing the form ensures that businesses are meeting their sales tax obligations, avoiding penalties and fines.

- Accurate tax calculation: The form helps businesses calculate their sales tax liability accurately, ensuring they pay the correct amount.

- Simplified audit process: Filing the form provides a clear record of sales tax transactions, making it easier for businesses to navigate audits and resolve any discrepancies.

Step-by-Step Guide to Filing Missouri Sales Tax Form 53-1

Filing Missouri Sales Tax Form 53-1 can seem daunting, but breaking it down into steps makes it more manageable. Here's a step-by-step guide to help businesses file the form accurately:

Step 1: Gather Required Information

Before starting the filing process, businesses need to gather essential information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Missouri Sales Tax License Number

- Gross sales and exempt sales data

- Sales tax rates and local option use taxes

Step 2: Determine the Filing Frequency

Missouri businesses must determine their filing frequency, which depends on their annual sales tax liability. The filing frequencies are:

- Monthly: Businesses with an annual sales tax liability of $1,000 or more

- Quarterly: Businesses with an annual sales tax liability of $100 to $999

- Annually: Businesses with an annual sales tax liability of less than $100

Step 3: Calculate Sales Tax Liability

Using the gathered information, businesses must calculate their sales tax liability. This involves:

- Calculating gross sales and exempt sales

- Applying the sales tax rate and local option use taxes

- Determining the total sales tax due

Step 4: Complete the Form

With the calculated sales tax liability, businesses can complete Missouri Sales Tax Form 53-1. The form requires:

- Business information and FEIN

- Gross sales and exempt sales data

- Sales tax rates and local option use taxes

- Total sales tax due

Step 5: File the Form and Pay Sales Tax

Once the form is complete, businesses must file it with the Missouri Department of Revenue and pay the total sales tax due. Filing can be done:

- Online: Through the Missouri Department of Revenue's website

- Mail: By sending the completed form and payment to the department's address

- In-person: By visiting a local department office

Common Mistakes to Avoid When Filing Missouri Sales Tax Form 53-1

To avoid penalties and fines, businesses must be aware of common mistakes when filing Missouri Sales Tax Form 53-1:

- Inaccurate business information

- Incorrect sales tax rates or local option use taxes

- Failure to report exempt sales

- Late filing or payment

Conclusion

Filing Missouri Sales Tax Form 53-1 is a crucial task for businesses in the state. By understanding the purpose and benefits of the form, following the step-by-step guide, and avoiding common mistakes, businesses can ensure compliance and avoid penalties. Remember to stay informed about changes in sales tax laws and regulations to maintain accurate filing practices.

Call to Action

If you're a business owner in Missouri, don't wait until the last minute to file your sales tax return. Stay ahead of the game by:

- Registering for a sales tax permit

- Keeping accurate records of sales and exempt sales

- Filing Missouri Sales Tax Form 53-1 on time

- Staying informed about changes in sales tax laws and regulations

Share your experiences and tips for filing Missouri Sales Tax Form 53-1 in the comments below!

What is the due date for filing Missouri Sales Tax Form 53-1?

+The due date for filing Missouri Sales Tax Form 53-1 depends on the filing frequency. For monthly filers, the due date is the 20th day of the month following the reporting period. For quarterly filers, the due date is the 20th day of the month following the reporting period. For annual filers, the due date is January 20th of the following year.

Can I file Missouri Sales Tax Form 53-1 electronically?

+Yes, you can file Missouri Sales Tax Form 53-1 electronically through the Missouri Department of Revenue's website. Electronic filing is available for monthly, quarterly, and annual filers.

What is the penalty for late filing or payment of Missouri Sales Tax Form 53-1?

+The penalty for late filing or payment of Missouri Sales Tax Form 53-1 is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%. Additionally, a late payment penalty of 1% of the unpaid tax per month or part of a month may be assessed.