Filing Form 8453-EMP, the Employer's Annual Federal Tax Return, is a crucial task for many businesses. The form is used to report employment taxes, including Social Security and Medicare taxes, federal income tax withholding, and federal unemployment tax. Filing this form correctly is essential to avoid penalties, interest, and other compliance issues. In this article, we will provide five tips for filing Form 8453-EMP correctly.

Understanding Form 8453-EMP

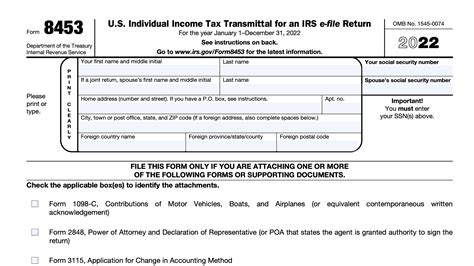

Before we dive into the tips, it's essential to understand the basics of Form 8453-EMP. The form is used by employers to report employment taxes and is typically filed annually. The form includes information such as the employer's identification number, business name and address, total wages and taxes withheld, and tax deposits made during the year.

Tip 1: Gather All Required Information

To file Form 8453-EMP correctly, you need to gather all the required information. This includes:

- Employer's identification number (EIN)

- Business name and address

- Total wages and taxes withheld for the year

- Tax deposits made during the year

- Number of employees and their Social Security numbers

- Federal unemployment tax (FUTA) liability

- State unemployment tax (SUTA) liability

Make sure you have all the necessary documents and records before starting to fill out the form.

What to Do If You're Missing Information

If you're missing any information, don't panic. You can:

- Contact the IRS to request an extension of time to file

- Use the IRS's online tools to retrieve missing information

- Consult with a tax professional or accountant

Tip 2: Use the Correct Filing Status

When filing Form 8453-EMP, you need to use the correct filing status. The filing status determines the tax rates and credits you're eligible for. The most common filing statuses for Form 8453-EMP are:

- Monthly depositor

- Semi-weekly depositor

- Annual depositor

Choose the correct filing status based on your business's tax deposit schedule.

Consequences of Incorrect Filing Status

If you use the incorrect filing status, you may face:

- Penalties and interest on unpaid taxes

- Delayed refunds

- Compliance issues

Tip 3: Report All Employment Taxes

Form 8453-EMP requires you to report all employment taxes, including:

- Social Security taxes

- Medicare taxes

- Federal income tax withholding

- Federal unemployment tax (FUTA)

- State unemployment tax (SUTA)

Make sure you report all employment taxes accurately and on time.

What to Do If You've Underreported Employment Taxes

If you've underreported employment taxes, you can:

- File an amended return (Form 8453-EMP-A)

- Pay any additional taxes due

- Consult with a tax professional or accountant

Tip 4: Take Advantage of Credits and Deductions

Form 8453-EMP allows you to claim credits and deductions that can reduce your tax liability. Some common credits and deductions include:

- Work Opportunity Tax Credit (WOTC)

- Empowerment Zone Employment Credit

- Indian Employment Tax Credit

- Federal unemployment tax (FUTA) credit

Make sure you claim all eligible credits and deductions to minimize your tax liability.

How to Claim Credits and Deductions

To claim credits and deductions, you need to:

- Complete the relevant sections of Form 8453-EMP

- Attach supporting documentation

- Keep accurate records

Tip 5: File Electronically

The IRS encourages employers to file Form 8453-EMP electronically. Electronic filing offers several benefits, including:

- Faster processing

- Reduced errors

- Increased accuracy

- Environmentally friendly

You can file electronically through the IRS's Electronic Federal Tax Payment System (EFTPS) or through a tax professional or accountant.

What to Do If You Need Help with Electronic Filing

If you need help with electronic filing, you can:

- Contact the IRS for assistance

- Consult with a tax professional or accountant

- Use the IRS's online resources and tutorials

By following these five tips, you can ensure that you file Form 8453-EMP correctly and avoid any compliance issues. Remember to gather all required information, use the correct filing status, report all employment taxes, take advantage of credits and deductions, and file electronically.

What is Form 8453-EMP?

+Form 8453-EMP is the Employer's Annual Federal Tax Return, used to report employment taxes, including Social Security and Medicare taxes, federal income tax withholding, and federal unemployment tax.

What is the deadline for filing Form 8453-EMP?

+The deadline for filing Form 8453-EMP is typically January 31st of each year, but it may vary depending on the filing status and tax deposit schedule.

Can I file Form 8453-EMP electronically?

+Yes, the IRS encourages employers to file Form 8453-EMP electronically through the Electronic Federal Tax Payment System (EFTPS) or through a tax professional or accountant.