Filing tax forms can be a daunting task, especially for those who are new to the process. The Maryland 1099 G form is a specific tax document that requires careful attention to detail to ensure accuracy and compliance with state regulations. In this article, we will explore three ways to file the Maryland 1099 G form correctly, providing you with a comprehensive guide to help you navigate the process with ease.

Understanding the Maryland 1099 G Form

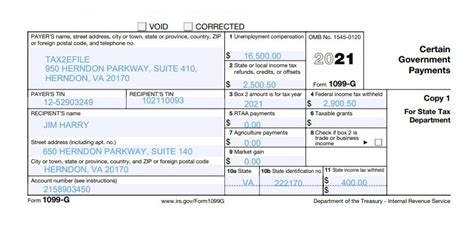

The Maryland 1099 G form is a tax document used to report certain government payments, such as unemployment compensation, state and local income tax refunds, and other government payments. The form is typically filed by the payer, such as the Maryland Department of Labor, Licensing and Regulation, or the Comptroller of Maryland. As a recipient of these payments, it's essential to understand the form and its requirements to ensure accurate filing.

Benefits of Filing the Maryland 1099 G Form Correctly

Filing the Maryland 1099 G form correctly is crucial to avoid any penalties, fines, or delays in receiving your refund. By following the correct procedures, you can:

- Ensure accurate reporting of government payments

- Avoid any potential penalties or fines

- Receive your refund in a timely manner

- Maintain compliance with state regulations

Method 1: E-Filing with the Maryland Comptroller's Office

The Maryland Comptroller's Office offers an e-filing option for the 1099 G form, making it a convenient and efficient way to file. To e-file, you will need to:

- Create an account on the Maryland Comptroller's website

- Gather all required information, including your name, address, and Social Security number

- Fill out the online form accurately and completely

- Submit the form electronically

The Maryland Comptroller's Office will review and process your form, and you will receive confirmation of receipt. This method is ideal for those who are comfortable with technology and want to file quickly and efficiently.

Benefits of E-Filing with the Maryland Comptroller's Office

E-filing with the Maryland Comptroller's Office offers several benefits, including:

- Fast and efficient filing process

- Accurate and secure transmission of data

- Confirmation of receipt and processing

- Environmentally friendly, reducing paper waste

Method 2: Filing by Mail

If you prefer to file by mail, you can obtain a paper copy of the 1099 G form from the Maryland Comptroller's Office or download it from their website. To file by mail, you will need to:

- Complete the form accurately and completely

- Sign and date the form

- Attach any required supporting documentation

- Mail the form to the address listed on the form

The Maryland Comptroller's Office will review and process your form, and you will receive confirmation of receipt. This method is ideal for those who prefer a more traditional approach or do not have access to technology.

Benefits of Filing by Mail

Filing by mail offers several benefits, including:

- No need for technical expertise

- Ability to attach supporting documentation

- Paper trail for record-keeping purposes

Method 3: Using a Tax Professional or Software

If you are unsure about the filing process or need additional guidance, you may consider using a tax professional or software. Tax professionals can provide expert advice and ensure accurate filing, while tax software can guide you through the process and perform calculations. To use a tax professional or software, you will need to:

- Research and select a reputable tax professional or software

- Provide required information and documentation

- Follow the guidance provided by the tax professional or software

This method is ideal for those who want expert guidance or need additional support.

Benefits of Using a Tax Professional or Software

Using a tax professional or software offers several benefits, including:

- Expert guidance and support

- Accurate filing and calculations

- Time-saving and convenient

- Access to additional resources and support

What is the deadline for filing the Maryland 1099 G form?

+The deadline for filing the Maryland 1099 G form is typically January 31st of each year.

Can I file the Maryland 1099 G form electronically?

+Yes, you can file the Maryland 1099 G form electronically through the Maryland Comptroller's Office website.

What happens if I file the Maryland 1099 G form incorrectly?

+If you file the Maryland 1099 G form incorrectly, you may be subject to penalties, fines, or delays in receiving your refund.

By following these three methods, you can ensure accurate and timely filing of the Maryland 1099 G form. Remember to choose the method that best suits your needs and preferences. If you have any questions or concerns, don't hesitate to reach out to the Maryland Comptroller's Office or a tax professional for guidance.