The world of tax exemptions can be a complex and daunting one, especially for those who are new to the game. However, understanding the E595 tax exempt form is crucial for businesses and organizations that want to take advantage of the tax exemptions available to them. In this article, we will break down the E595 tax exempt form into five manageable sections, making it easier for you to comprehend and navigate.

What is the E595 Tax Exempt Form?

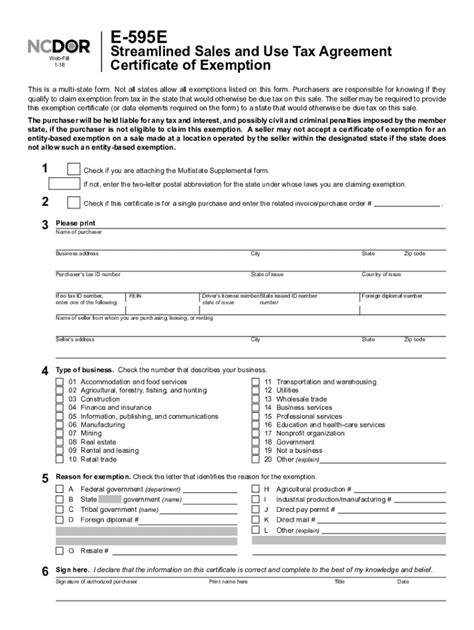

The E595 tax exempt form is a document used by the North Carolina Department of Revenue to determine whether a business or organization is eligible for a tax exemption. The form is used to collect information about the business or organization, including its purpose, activities, and financial information.

Why is the E595 Tax Exempt Form Important?

The E595 tax exempt form is important because it allows businesses and organizations to claim tax exemptions that they may be eligible for. By completing the form, businesses and organizations can demonstrate their eligibility for tax exemptions and avoid paying unnecessary taxes.

Who is Eligible for a Tax Exemption?

To be eligible for a tax exemption, a business or organization must meet certain criteria. These criteria include:

- Being a non-profit organization

- Being a charitable organization

- Being a educational organization

- Being a governmental organization

- Being a religious organization

Additionally, the business or organization must also meet certain financial criteria, such as having a certain amount of annual revenue.

How to Complete the E595 Tax Exempt Form

Completing the E595 tax exempt form can seem like a daunting task, but it's actually quite straightforward. Here are the steps to follow:

- Download the E595 tax exempt form from the North Carolina Department of Revenue website.

- Read the instructions carefully and make sure you understand what information is required.

- Fill out the form completely and accurately, making sure to include all required documentation.

- Sign and date the form.

- Submit the form to the North Carolina Department of Revenue.

What Happens After Submitting the E595 Tax Exempt Form?

After submitting the E595 tax exempt form, the North Carolina Department of Revenue will review the application to determine whether the business or organization is eligible for a tax exemption. If the application is approved, the business or organization will receive a tax exemption certificate, which must be renewed annually.

Renewing the Tax Exemption Certificate

To renew the tax exemption certificate, businesses and organizations must submit a renewal application to the North Carolina Department of Revenue. The renewal application must be submitted annually, and it must include updated financial information and other documentation.

Tips for Filling Out the E595 Tax Exempt Form

Here are some tips for filling out the E595 tax exempt form:

- Make sure to read the instructions carefully and understand what information is required.

- Fill out the form completely and accurately, making sure to include all required documentation.

- Use a secure online connection to submit the form, and make sure to keep a copy of the form for your records.

- If you have any questions or concerns, don't hesitate to contact the North Carolina Department of Revenue.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the E595 tax exempt form:

- Failing to include required documentation

- Failing to sign and date the form

- Failing to submit the form on time

- Providing inaccurate or incomplete information

Conclusion

Understanding the E595 tax exempt form can seem like a daunting task, but it's actually quite straightforward. By following the steps outlined in this article, businesses and organizations can complete the form and take advantage of the tax exemptions available to them. Remember to read the instructions carefully, fill out the form completely and accurately, and submit it on time.

What is the E595 tax exempt form used for?

+The E595 tax exempt form is used to determine whether a business or organization is eligible for a tax exemption.

Who is eligible for a tax exemption?

+Non-profit organizations, charitable organizations, educational organizations, governmental organizations, and religious organizations are eligible for a tax exemption.

How do I complete the E595 tax exempt form?

+Download the form from the North Carolina Department of Revenue website, read the instructions carefully, fill out the form completely and accurately, and submit it to the North Carolina Department of Revenue.