Many employers offer Dependent Care Flexible Spending Accounts (FSAs) as a benefit to their employees, allowing them to set aside pre-tax dollars for childcare or adult care expenses. Optum is a popular administrator of these accounts, and understanding how to use the Optum Dependent Care FSA form is crucial for easy reimbursement. In this article, we will delve into the world of Dependent Care FSAs, explain how the Optum Dependent Care FSA form works, and provide a step-by-step guide on how to file for reimbursement.

What is a Dependent Care FSA?

A Dependent Care FSA is a type of flexible spending account that allows employees to set aside a portion of their income on a pre-tax basis to pay for dependent care expenses. These expenses can include childcare costs for children under the age of 13, as well as adult care expenses for disabled or elderly dependents. By contributing to a Dependent Care FSA, employees can reduce their taxable income, resulting in lower federal income taxes.

How Does the Optum Dependent Care FSA Form Work?

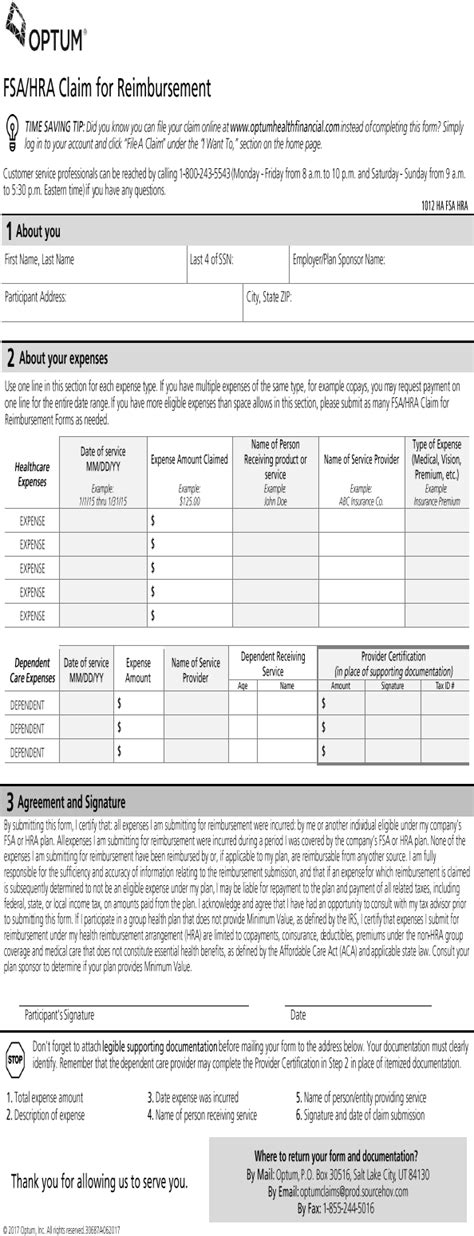

The Optum Dependent Care FSA form is used to request reimbursement for eligible dependent care expenses. The form requires employees to provide documentation, such as receipts or invoices, to support their expense claims. Here's a breakdown of the key sections of the Optum Dependent Care FSA form:

- Section 1: Participant Information: This section requires employees to provide their personal details, including their name, address, and social security number.

- Section 2: Dependent Information: This section requires employees to provide information about their dependents, including their names, dates of birth, and relationships to the employee.

- Section 3: Expense Information: This section requires employees to provide details about the expenses they are claiming, including the dates of service, types of care, and amounts paid.

- Section 4: Supporting Documentation: This section requires employees to attach supporting documentation, such as receipts or invoices, to substantiate their expense claims.

Step-by-Step Guide to Filing for Reimbursement

Filing for reimbursement using the Optum Dependent Care FSA form is a straightforward process. Here's a step-by-step guide:

- Gather Supporting Documentation: Collect receipts or invoices for the dependent care expenses you wish to claim.

- Complete the Optum Dependent Care FSA Form: Fill out the form, ensuring that you provide all required information and attach supporting documentation.

- Submit the Form: Submit the completed form to Optum, either online or by mail, depending on your employer's specific instructions.

- Wait for Reimbursement: Optum will review your claim and reimburse you for eligible expenses.

Tips for Easy Reimbursement

To ensure easy reimbursement, follow these tips:

- Keep Accurate Records: Keep receipts and invoices for all dependent care expenses, as you will need these to support your claims.

- Submit Claims Promptly: Submit your claims as soon as possible after incurring expenses to avoid missing deadlines.

- Verify Eligible Expenses: Ensure that the expenses you are claiming are eligible under your Dependent Care FSA plan.

Common Mistakes to Avoid

When filing for reimbursement using the Optum Dependent Care FSA form, avoid these common mistakes:

- Insufficient Documentation: Failing to provide sufficient supporting documentation can result in delayed or denied reimbursement.

- Ineligible Expenses: Claiming ineligible expenses can result in denied reimbursement and potential penalties.

Conclusion

In conclusion, understanding how to use the Optum Dependent Care FSA form is crucial for easy reimbursement. By following the step-by-step guide and tips outlined in this article, you can ensure that you receive reimbursement for eligible dependent care expenses. Remember to keep accurate records, submit claims promptly, and verify eligible expenses to avoid common mistakes.

Take Action Today!

If you have any questions or concerns about the Optum Dependent Care FSA form or reimbursement process, don't hesitate to reach out to your employer or Optum directly. Take control of your dependent care expenses and start saving today!

FAQ Section:

What is the deadline for submitting claims?

+The deadline for submitting claims varies depending on your employer's plan. Typically, claims must be submitted within 90 days of the end of the plan year.

Can I use my Dependent Care FSA for adult care expenses?

+Yes, you can use your Dependent Care FSA for adult care expenses, including expenses for disabled or elderly dependents.

How do I check the status of my claim?

+You can check the status of your claim by logging into your Optum account online or by contacting Optum directly.