Filing taxes can be a daunting task, especially when dealing with specific forms like the Form 8915-F. This form is used by the Internal Revenue Service (IRS) to report qualified 2020 disaster retirement plan distributions and repayments. If you're struggling to navigate this form, you're not alone. In this article, we'll break down the process into 5 easy steps to help you complete Form 8915-F with confidence.

The Form 8915-F is an essential document for individuals who have taken distributions from their retirement plans due to a qualified disaster. It's crucial to complete this form accurately to avoid any penalties or delays in processing your tax return. Before we dive into the steps, let's understand the purpose of this form and who needs to file it.

Who Needs to File Form 8915-F?

You'll need to file Form 8915-F if you received a qualified 2020 disaster retirement plan distribution and you're repaying the distribution or reporting the repayment. Qualified disasters include hurricanes, wildfires, floods, and other disasters declared by the President. If you're unsure whether you qualify, consult with a tax professional or the IRS website for guidance.

What is a Qualified Disaster Retirement Plan Distribution?

A qualified disaster retirement plan distribution is a distribution from a retirement plan made on or after the first day of the disaster and before June 25, 2021. This distribution is exempt from the 10% early withdrawal penalty, and you may have the option to repay the distribution within three years.

Now that we've covered the basics, let's move on to the 5 easy steps to complete Form 8915-F.

Step 1: Gather Required Information

Before you start filling out the form, gather all the necessary information and documents. You'll need:

- Your social security number or individual taxpayer identification number (ITIN)

- The name and address of the retirement plan administrator

- The account number and type of retirement plan (e.g., 401(k), IRA, etc.)

- The date and amount of the qualified disaster retirement plan distribution

- The amount of the distribution you're repaying, if applicable

Step 2: Complete Part I - Recipient Information

Part I of Form 8915-F requires you to provide your personal and contact information. Fill in the following:

- Your name, social security number or ITIN, and address

- The name and address of the retirement plan administrator

- The account number and type of retirement plan

Tips and Reminders

- Make sure to use the correct social security number or ITIN.

- Verify the retirement plan administrator's information with your plan documents or contact them directly.

- Double-check the account number and type of retirement plan.

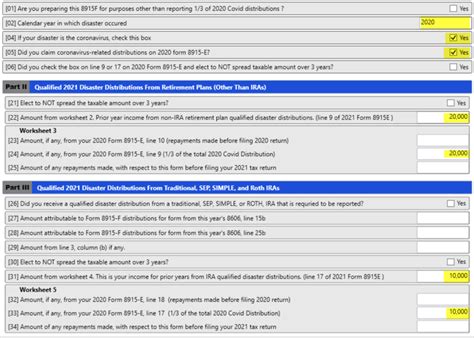

Step 3: Complete Part II - Qualified Disaster Retirement Plan Distribution

In Part II, you'll report the qualified disaster retirement plan distribution. Fill in the following:

- The date of the distribution

- The amount of the distribution

- The type of retirement plan (e.g., 401(k), IRA, etc.)

Important Notes

- Make sure to use the correct date of the distribution.

- Report the total amount of the distribution, even if you're only repaying a portion of it.

- Verify the type of retirement plan with your plan documents or contact the plan administrator.

Step 4: Complete Part III - Repayment of Qualified Disaster Retirement Plan Distribution

If you're repaying the qualified disaster retirement plan distribution, complete Part III. Fill in the following:

- The amount of the distribution you're repaying

- The date of the repayment

- The type of repayment (e.g., lump sum, installment, etc.)

Repayment Options

- You can repay the distribution within three years.

- You may repay the distribution in a lump sum or installments.

- Consult with a tax professional to determine the best repayment option for your situation.

Step 5: Review and Submit the Form

Once you've completed all the necessary sections, review the form for accuracy and completeness. Make sure to sign and date the form. You can submit the form with your tax return or separately, depending on your situation.

Submission Options

- You can submit the form electronically or by mail.

- If you're submitting the form with your tax return, attach it to the front of your return.

- Consult with a tax professional or the IRS website for guidance on submission options.

By following these 5 easy steps, you'll be able to complete Form 8915-F with confidence. Remember to gather all necessary information, complete each section accurately, and review the form before submission. If you're unsure about any part of the process, consult with a tax professional or the IRS website for guidance.

What is the purpose of Form 8915-F?

+Form 8915-F is used to report qualified 2020 disaster retirement plan distributions and repayments.

Who needs to file Form 8915-F?

+You'll need to file Form 8915-F if you received a qualified 2020 disaster retirement plan distribution and you're repaying the distribution or reporting the repayment.

What is a qualified disaster retirement plan distribution?

+A qualified disaster retirement plan distribution is a distribution from a retirement plan made on or after the first day of the disaster and before June 25, 2021.

We hope this article has helped you navigate the process of completing Form 8915-F. If you have any questions or concerns, feel free to ask in the comments below. Don't forget to share this article with others who may be struggling with this form.