The IRS Form 8857 is a crucial document for individuals who need to request an Innocent Spouse Relief. This form allows taxpayers to separate their tax liability from their spouse's or former spouse's, providing a way to avoid being held responsible for errors or omissions made by the other spouse on their joint tax return. In this article, we will delve into the details of the IRS Form 8857, its printable version, and provide a comprehensive filing guide to help you navigate the process.

Understanding the Importance of IRS Form 8857

When filing a joint tax return, both spouses are equally responsible for the accuracy and completeness of the return. However, there may be situations where one spouse is unaware of the other's actions or errors on the return. This is where the IRS Form 8857 comes into play. By filing this form, an individual can request relief from joint and several liability, which means they will not be held responsible for the other spouse's mistakes or omissions.

Who is Eligible for Innocent Spouse Relief?

Not everyone is eligible for innocent spouse relief. To qualify, you must meet certain conditions, including:

- You filed a joint return with your spouse

- There is an understatement of tax on the return due to your spouse's actions

- You did not know, and had no reason to know, about the understatement

- It would be unfair to hold you liable for the understatement

- You and your spouse are no longer married, or you are separated and have not lived together for the past 12 months

How to Download and Print IRS Form 8857

To obtain a printable version of the IRS Form 8857, you can download it from the official IRS website. Here's a step-by-step guide:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab.

- Search for "Form 8857" in the search bar.

- Click on the "Form 8857" link to access the form.

- Click on the "Download" button to save the form to your computer.

- Print the form using a PDF viewer or printer.

Filing Guide for IRS Form 8857

Filing the IRS Form 8857 requires careful attention to detail and accuracy. Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Required Documents

Before filing the form, make sure you have the following documents:

- A copy of your joint tax return (Form 1040)

- A copy of your spouse's tax return (if filed separately)

- Any supporting documentation, such as receipts or bank statements, to prove your innocence

Step 2: Complete Form 8857

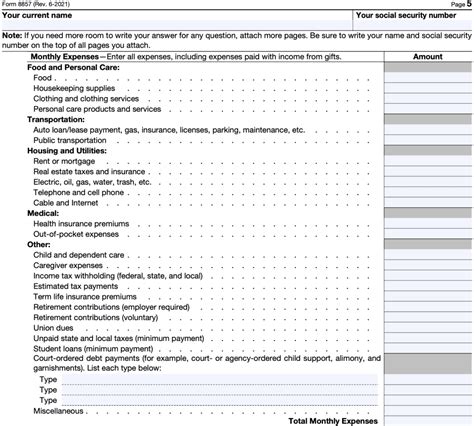

Fill out Form 8857 accurately and completely. Make sure to provide all required information, including:

- Your name and address

- Your spouse's name and address

- The tax year(s) for which you are requesting relief

- The reason for requesting relief

- Any supporting documentation

Step 3: Sign and Date the Form

Sign and date the form in the presence of a notary public or other authorized witness.

Step 4: Attach Supporting Documentation

Attach all supporting documentation to the form, including receipts, bank statements, and any other relevant documents.

Step 5: Submit the Form

Mail the completed form and supporting documentation to the IRS address listed on the form.

What to Expect After Filing

After filing the IRS Form 8857, you can expect the following:

- The IRS will review your application and make a determination within 6-12 months

- You may receive a letter requesting additional information or documentation

- If your application is approved, you will receive a letter stating the amount of relief granted

- If your application is denied, you will receive a letter explaining the reason for the denial

Conclusion

Filing the IRS Form 8857 can be a complex and time-consuming process. However, with the right guidance and support, you can successfully navigate the process and obtain the relief you deserve. Remember to carefully review and complete the form, gather all required documentation, and submit the form and supporting documentation to the IRS. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the IRS directly.

We hope this article has provided you with a comprehensive understanding of the IRS Form 8857 and the filing process. If you have any questions or comments, please feel free to share them below.

What is the purpose of the IRS Form 8857?

+The IRS Form 8857 is used to request innocent spouse relief from joint and several liability on a joint tax return.

Who is eligible for innocent spouse relief?

+To be eligible for innocent spouse relief, you must meet certain conditions, including filing a joint return with your spouse, having an understatement of tax on the return due to your spouse's actions, and not knowing or having reason to know about the understatement.

How long does it take to process the IRS Form 8857?

+The IRS typically takes 6-12 months to process the IRS Form 8857 and make a determination.