The First-Time Homebuyer Credit, also known as the Obama stimulus plan, has helped many Americans achieve their dream of owning a home. To claim this credit, taxpayers need to fill out Form 5405, also known as the First-Time Homebuyer Credit and Repayment of the Credit. Filling out this form can be a bit complex, but with the right guidance, you can easily navigate the process using Turbotax. Here are five ways to fill out Turbotax Form 5405:

Understanding the First-Time Homebuyer Credit

Before we dive into the five ways to fill out Turbotax Form 5405, it's essential to understand the First-Time Homebuyer Credit. The credit was introduced in 2008 as part of the Housing and Economic Recovery Act. It provides a tax credit of up to $7,500 to first-time homebuyers who purchased a home between April 9, 2008, and December 31, 2008. The credit is refundable, meaning that even if the taxpayer doesn't owe any taxes, they can still receive the credit as a refund.

Eligibility Requirements

To be eligible for the First-Time Homebuyer Credit, taxpayers must meet the following requirements:

- They must be a first-time homebuyer, meaning they haven't owned a home in the past three years.

- They must have purchased a home between April 9, 2008, and December 31, 2008.

- The home must be their primary residence.

- Their income must be below a certain threshold, which varies based on filing status.

5 Ways to Fill Out Turbotax Form 5405

Now that we've covered the basics of the First-Time Homebuyer Credit, let's dive into the five ways to fill out Turbotax Form 5405:

1. Gathering Required Documents

Before starting the Form 5405, make sure you have all the required documents. These include:

- A copy of the settlement statement (Form HUD-1)

- A copy of the mortgage interest statement (Form 1098)

- A copy of the property tax statement

- Your social security number or individual taxpayer identification number (ITIN)

2. Entering Homebuyer Information

Once you have all the required documents, you can start entering the homebuyer information in Turbotax. This includes:

- The address of the home

- The date of purchase

- The purchase price of the home

- The amount of the mortgage

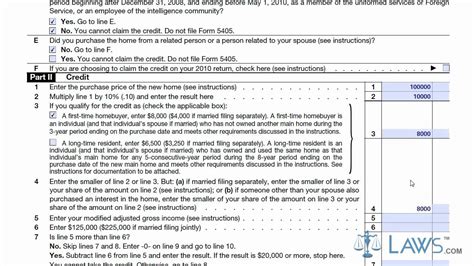

3. Calculating the Credit

After entering the homebuyer information, Turbotax will calculate the credit amount. The credit is equal to 10% of the purchase price of the home, up to a maximum of $7,500.

4. Reporting the Credit on Your Tax Return

Once the credit is calculated, you'll need to report it on your tax return. This involves entering the credit amount on Form 5405 and attaching it to your tax return (Form 1040).

5. Repaying the Credit (If Necessary)

If you received the First-Time Homebuyer Credit in 2008, you may need to repay some or all of the credit over a 15-year period, starting in 2010. Turbotax will help you calculate the repayment amount and report it on your tax return.

Tips and Reminders

Here are a few tips and reminders to keep in mind when filling out Turbotax Form 5405:

- Make sure to keep all required documents, including the settlement statement and mortgage interest statement.

- Double-check your math to ensure accuracy.

- If you're unsure about any part of the process, consider consulting a tax professional.

- Don't forget to report the credit on your tax return and attach Form 5405.

Common Mistakes to Avoid

When filling out Turbotax Form 5405, there are a few common mistakes to avoid:

- Incorrectly calculating the credit amount

- Failing to report the credit on your tax return

- Not attaching Form 5405 to your tax return

- Not keeping required documents

By avoiding these common mistakes, you can ensure that you accurately fill out Turbotax Form 5405 and receive the First-Time Homebuyer Credit.

Conclusion

Filling out Turbotax Form 5405 can seem daunting, but with the right guidance, you can easily navigate the process. By following these five ways to fill out the form, you can ensure that you accurately claim the First-Time Homebuyer Credit and receive the refund you deserve. Remember to keep all required documents, double-check your math, and seek help if you're unsure about any part of the process.

Share Your Experience

Have you filled out Turbotax Form 5405 before? Share your experience in the comments below. If you have any questions or need help with the process, feel free to ask.

What is the First-Time Homebuyer Credit?

+The First-Time Homebuyer Credit is a tax credit of up to $7,500 for first-time homebuyers who purchased a home between April 9, 2008, and December 31, 2008.

How do I qualify for the First-Time Homebuyer Credit?

+To qualify for the First-Time Homebuyer Credit, you must be a first-time homebuyer, meaning you haven't owned a home in the past three years. You must also have purchased a home between April 9, 2008, and December 31, 2008, and meet certain income requirements.

How do I report the First-Time Homebuyer Credit on my tax return?

+To report the First-Time Homebuyer Credit on your tax return, you'll need to complete Form 5405 and attach it to your tax return (Form 1040).