The Pt 61 Transfer Tax Form is a crucial document in the process of buying or selling a property in Thailand. As a buyer or seller, understanding the intricacies of this form is essential to ensure a smooth and hassle-free transaction. In this comprehensive guide, we will delve into the world of Pt 61 Transfer Tax Form, exploring its purpose, benefits, and the steps involved in filling it out.

The Importance of Pt 61 Transfer Tax Form

In Thailand, the Pt 61 Transfer Tax Form is a mandatory document required for the transfer of property ownership. This form is used to calculate and pay the transfer tax, which is a significant cost associated with buying or selling a property. The transfer tax is typically paid by the buyer, but it can be negotiated between the parties involved.

The Pt 61 Transfer Tax Form serves several purposes:

- It helps to determine the transfer tax payable on the property.

- It provides a record of the property transfer, which is essential for future reference.

- It ensures compliance with Thai tax laws and regulations.

Benefits of Pt 61 Transfer Tax Form

The Pt 61 Transfer Tax Form offers several benefits to buyers and sellers:

- It provides a clear and transparent way of calculating the transfer tax.

- It helps to avoid disputes and misunderstandings between the parties involved.

- It ensures that the property transfer is done in accordance with Thai laws and regulations.

How to Fill Out Pt 61 Transfer Tax Form

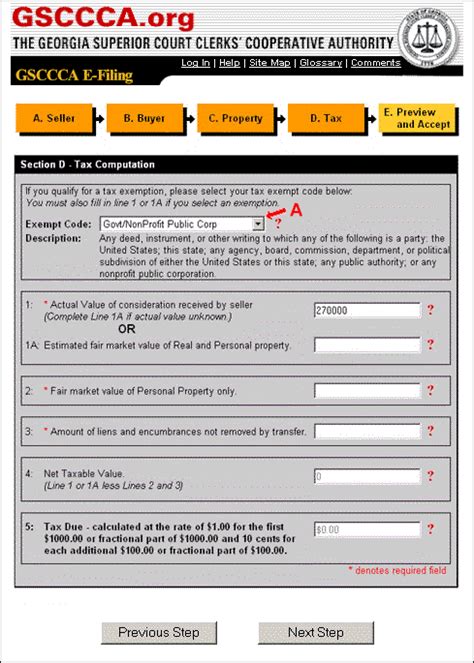

Filling out the Pt 61 Transfer Tax Form can be a complex process, requiring careful attention to detail. Here are the steps involved:

- Gather required documents: Before filling out the form, ensure that you have all the necessary documents, including the property deed, identification documents, and proof of payment.

- Determine the transfer tax: Calculate the transfer tax payable on the property using the formula: Transfer Tax = (Property Value x Transfer Tax Rate).

- Fill out the form: Complete the Pt 61 Transfer Tax Form, ensuring that all the required information is accurate and up-to-date.

- Sign and stamp: Sign and stamp the form, as required by Thai law.

Types of Transfer Tax

There are two types of transfer tax in Thailand:

- Transfer tax on property value: This is the most common type of transfer tax, calculated as a percentage of the property value.

- Transfer tax on registered capital: This type of transfer tax is applicable to companies and is calculated as a percentage of the registered capital.

Transfer Tax Rates

The transfer tax rates in Thailand vary depending on the type of property and the location. Here are the current transfer tax rates:

- Residential property: 2% of the property value.

- Commercial property: 3% of the property value.

- Agricultural land: 5% of the property value.

Exemptions and Reductions

There are certain exemptions and reductions available for transfer tax in Thailand:

- Exemption for first-time buyers: First-time buyers may be exempt from paying transfer tax.

- Reduction for low-income earners: Low-income earners may be eligible for a reduction in transfer tax.

Tips for Buyers and Sellers

Here are some tips for buyers and sellers when dealing with the Pt 61 Transfer Tax Form:

- Seek professional advice: Consult with a lawyer or tax expert to ensure that the form is filled out correctly.

- Understand the transfer tax: Familiarize yourself with the transfer tax rates and exemptions to avoid any surprises.

- Negotiate the transfer tax: Negotiate the transfer tax with the other party to ensure a fair deal.

Challenges and Solutions

Here are some common challenges and solutions when dealing with the Pt 61 Transfer Tax Form:

- Language barrier: If you are not fluent in Thai, consider hiring a translator or seeking assistance from a lawyer.

- Complexity: If you are unsure about the form, seek professional advice from a lawyer or tax expert.

In conclusion, the Pt 61 Transfer Tax Form is a critical document in the process of buying or selling a property in Thailand. By understanding the purpose, benefits, and steps involved in filling out the form, buyers and sellers can ensure a smooth and hassle-free transaction.

We hope this comprehensive guide has provided you with valuable insights into the world of Pt 61 Transfer Tax Form. If you have any questions or comments, please feel free to share them below.

FAQ Section:

What is the purpose of the Pt 61 Transfer Tax Form?

+The Pt 61 Transfer Tax Form is used to calculate and pay the transfer tax, which is a significant cost associated with buying or selling a property in Thailand.

Who is responsible for paying the transfer tax?

+The transfer tax is typically paid by the buyer, but it can be negotiated between the parties involved.

What are the transfer tax rates in Thailand?

+The transfer tax rates in Thailand vary depending on the type of property and the location, ranging from 2% to 5% of the property value.