As a homeowner, you're likely no stranger to the numerous tax credits and deductions available to you. One such credit is the Residential Energy Efficient Property Credit, which is reported on Form 5695. This credit can be a game-changer for homeowners who have made energy-efficient improvements to their primary residence. However, navigating the complexities of Form 5695 can be overwhelming, especially for those who are new to tax credits. In this article, we'll delve into the world of Form 5695 and provide you with 5 valuable tips to help you master it.

Understanding Form 5695

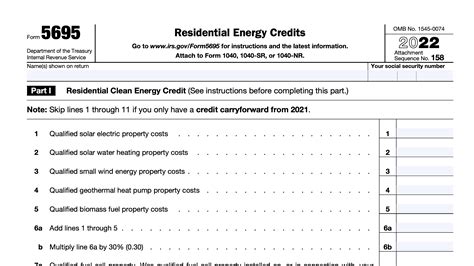

Form 5695 is used to claim the Residential Energy Efficient Property Credit, which is a non-refundable credit that can be claimed for energy-efficient improvements made to a primary residence. The credit is equal to 30% of the cost of the qualified property, including labor costs. To qualify for the credit, the improvements must meet specific energy efficiency standards and be installed in the taxpayer's primary residence.

Tips to Master Mo Form 5695

Tip 1: Identify Qualified Property

To claim the credit, you must first identify the qualified property that is eligible for the credit. Qualified property includes:

- Solar water heaters

- Solar panels

- Fuel cells

- Wind turbines

- Geothermal heat pumps

It's essential to ensure that the property you're claiming is qualified and meets the energy efficiency standards set by the manufacturer and the government.

Tip 2: Gather Required Documents

To claim the credit, you'll need to gather specific documents, including:

- Manufacturer certification statements

- Receipts for the qualified property

- Invoices for labor costs

- Proof of installation

It's crucial to keep accurate records of these documents, as the IRS may request them during an audit.

Tip 3: Calculate the Credit

To calculate the credit, you'll need to multiply the cost of the qualified property, including labor costs, by 30%. For example, if the total cost of the solar panels and installation is $10,000, the credit would be $3,000.

Tip 4: Claim the Credit on the Correct Form

The credit is claimed on Form 5695, which is attached to your tax return (Form 1040). You'll need to complete Part I of the form, which includes the calculation of the credit.

Tip 5: Consult a Tax Professional

Navigating the complexities of Form 5695 can be challenging, especially if you're new to tax credits. Consulting a tax professional can help ensure that you're claiming the credit correctly and avoiding any potential errors.

Additional Resources

For more information on Form 5695 and the Residential Energy Efficient Property Credit, you can visit the IRS website or consult with a tax professional.

What is the Residential Energy Efficient Property Credit?

+The Residential Energy Efficient Property Credit is a non-refundable credit that can be claimed for energy-efficient improvements made to a primary residence.

What types of property qualify for the credit?

+Qualified property includes solar water heaters, solar panels, fuel cells, wind turbines, and geothermal heat pumps.

How do I claim the credit?

+The credit is claimed on Form 5695, which is attached to your tax return (Form 1040).

In conclusion, mastering Form 5695 requires a solid understanding of the qualified property, required documents, credit calculation, and correct form. By following these 5 valuable tips, you can ensure that you're claiming the Residential Energy Efficient Property Credit correctly and maximizing your tax savings. Don't hesitate to reach out to a tax professional if you need additional guidance. Share your experiences with Form 5695 in the comments below!