The world of online content creation has opened up new avenues for individuals to monetize their passions and connect with their audience. Platforms like Onlyfans have made it possible for creators to earn a living by sharing exclusive content with their fans. However, as with any income-generating activity, there are tax implications to consider. One of the essential steps in managing your taxes as an Onlyfans creator is filling out a W-9 form. In this article, we will break down the 7 easy steps to fill out a W-9 for Onlyfans, ensuring you comply with the IRS requirements and avoid any potential issues.

Understanding the Purpose of a W-9 Form

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the IRS to collect information from independent contractors and freelancers. As an Onlyfans creator, you are considered a self-employed individual, and therefore, you need to provide your taxpayer identification number to Onlyfans. This information is used to report your income to the IRS and to ensure you are paying the correct amount of taxes.

Why Do You Need to Fill Out a W-9 Form for Onlyfans?

Onlyfans requires all creators to fill out a W-9 form to comply with IRS regulations. By providing your taxpayer identification number, you are certifying that you are a U.S. person (including a resident alien) and that you are not subject to backup withholding. If you fail to provide a completed W-9 form, Onlyfans may be required to withhold taxes from your earnings, which could result in a significant reduction in your take-home pay.

Step 1: Download and Print the W-9 Form

You can download the W-9 form from the IRS website or obtain a copy from Onlyfans. Make sure to use the most recent version of the form, as it may be updated periodically.

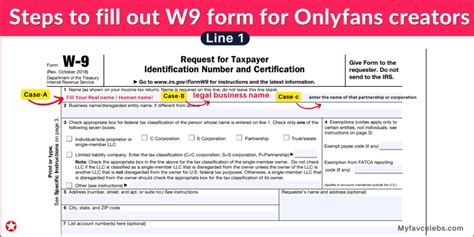

Step 2: Fill Out Your Name and Business Name

In the first section of the W-9 form, you will need to provide your name and business name (if applicable). Make sure to use the same name that you use on your tax returns.

- Name: Enter your full name as it appears on your tax returns.

- Business name: If you have a business name, enter it here. This is optional, but it may be required if you have a registered business.

Step 3: Provide Your Taxpayer Identification Number

In this section, you will need to provide your taxpayer identification number. This can be either your Social Security number (SSN) or your Employer Identification Number (EIN).

- Social Security number (SSN): If you are an individual, enter your SSN here.

- Employer Identification Number (EIN): If you have a registered business, enter your EIN here.

Step 4: Certify Your Taxpayer Identification Number

In this section, you will need to certify that the taxpayer identification number you provided is correct. You will also need to certify that you are not subject to backup withholding.

- Certification: Check the box to certify that the information you provided is accurate.

- Backup withholding: Check the box to certify that you are not subject to backup withholding.

Step 5: Sign and Date the W-9 Form

Once you have completed the W-9 form, you will need to sign and date it. Make sure to sign the form in ink, as digital signatures are not accepted.

Step 6: Submit the W-9 Form to Onlyfans

Once you have completed and signed the W-9 form, you will need to submit it to Onlyfans. You can do this by uploading the form to your Onlyfans account or by mailing it to Onlyfans.

Step 7: Keep a Copy of the W-9 Form for Your Records

It is essential to keep a copy of the W-9 form for your records. This will help you to ensure that you have completed the form correctly and that you have submitted it to Onlyfans.

By following these 7 easy steps, you can ensure that you have completed the W-9 form correctly and that you have submitted it to Onlyfans. Remember to keep a copy of the form for your records, and do not hesitate to reach out to Onlyfans if you have any questions or concerns.

What is the purpose of a W-9 form?

+A W-9 form is used by the IRS to collect information from independent contractors and freelancers. It is used to report income to the IRS and to ensure that the correct amount of taxes is paid.

Why do I need to fill out a W-9 form for Onlyfans?

+Onlyfans requires all creators to fill out a W-9 form to comply with IRS regulations. By providing your taxpayer identification number, you are certifying that you are a U.S. person and that you are not subject to backup withholding.

What happens if I don't fill out a W-9 form for Onlyfans?

+If you fail to provide a completed W-9 form, Onlyfans may be required to withhold taxes from your earnings. This could result in a significant reduction in your take-home pay.