As a resident of California, filing your taxes can seem like a daunting task, especially when dealing with the California Tax Form 540 2EZ. However, with a clear understanding of the form and the filing process, you can navigate through it with ease. In this comprehensive guide, we will walk you through the ins and outs of the California Tax Form 540 2EZ, making it simpler for you to file your taxes accurately and on time.

Understanding the California Tax Form 540 2EZ

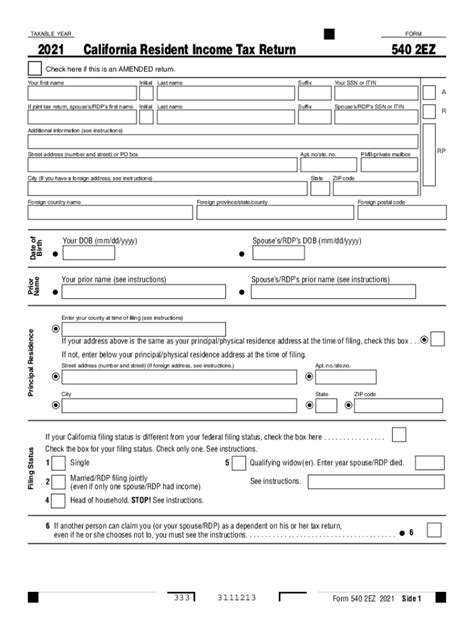

The California Tax Form 540 2EZ is a simplified version of the standard Form 540, designed for taxpayers with straightforward tax situations. This form is ideal for individuals who:

- Have only one source of income, such as a job or retirement account

- Do not have any dependents

- Do not itemize deductions

- Do not have any self-employment income

If you meet these criteria, the California Tax Form 540 2EZ is the perfect option for you. It's a concise and user-friendly form that simplifies the tax filing process.

Benefits of Filing the California Tax Form 540 2EZ

Filing the California Tax Form 540 2EZ offers several benefits, including:

- Simplified tax filing process

- Reduced paperwork and documentation

- Faster processing and refund times

- Lower risk of errors and audits

Who Can File the California Tax Form 540 2EZ?

To be eligible to file the California Tax Form 540 2EZ, you must meet the following requirements:

- Be a California resident

- Have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- Have only one source of income

- Not have any dependents

- Not itemize deductions

- Not have any self-employment income

If you meet these requirements, you can proceed to file the California Tax Form 540 2EZ.

What You'll Need to File the California Tax Form 540 2EZ

To file the California Tax Form 540 2EZ, you'll need the following documents and information:

- Your Social Security number or ITIN

- Your W-2 forms from your employer(s)

- Your 1099 forms for any retirement or interest income

- Your California driver's license or state ID

- Your checking account information for direct deposit (if applicable)

Filing the California Tax Form 540 2EZ

Filing the California Tax Form 540 2EZ is a straightforward process. Here's a step-by-step guide to help you get started:

- Gather all the required documents and information.

- Fill out the form accurately and completely.

- Review and sign the form.

- Submit the form by mail or e-file through the California Franchise Tax Board (FTB) website.

California Tax Form 540 2EZ Deadline

The deadline for filing the California Tax Form 540 2EZ is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by submitting Form 3519.

Tips and Tricks for Filing the California Tax Form 540 2EZ

Here are some tips and tricks to help you file the California Tax Form 540 2EZ accurately and efficiently:

- Double-check your math and calculations.

- Make sure to sign and date the form.

- Use black ink and write legibly.

- Keep a copy of the form for your records.

- Consider e-filing for faster processing and refund times.

Common Errors to Avoid When Filing the California Tax Form 540 2EZ

To avoid delays and potential audits, make sure to avoid the following common errors when filing the California Tax Form 540 2EZ:

- Inaccurate or incomplete information

- Math errors or incorrect calculations

- Failure to sign or date the form

- Incorrect or missing documentation

What to Do If You Need Help with the California Tax Form 540 2EZ

If you need help with the California Tax Form 540 2EZ, don't hesitate to reach out to the California Franchise Tax Board (FTB) or a tax professional. You can also visit the FTB website for additional resources and guidance.

Conclusion

Filing the California Tax Form 540 2EZ is a relatively simple process, but it requires attention to detail and accuracy. By following the tips and tricks outlined in this guide, you can ensure a smooth and efficient tax filing experience. Remember to review and understand the form carefully, and don't hesitate to seek help if you need it. Happy filing!

Now that you've finished reading this comprehensive guide, take the next step and file your California Tax Form 540 2EZ with confidence. If you have any questions or comments, please feel free to share them below.

What is the California Tax Form 540 2EZ?

+The California Tax Form 540 2EZ is a simplified version of the standard Form 540, designed for taxpayers with straightforward tax situations.

Who can file the California Tax Form 540 2EZ?

+To be eligible to file the California Tax Form 540 2EZ, you must meet the following requirements: be a California resident, have a valid Social Security number or Individual Taxpayer Identification Number (ITIN), have only one source of income, not have any dependents, not itemize deductions, and not have any self-employment income.

What is the deadline for filing the California Tax Form 540 2EZ?

+The deadline for filing the California Tax Form 540 2EZ is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by submitting Form 3519.