As a business owner in Georgia, navigating the complex world of taxes can be overwhelming. However, understanding the various tax exemptions available can help you save money and reduce your tax liability. One such exemption is the Georgia Form NRW-Exemption, which is designed for non-resident withholding tax exemptions. In this article, we will delve into the details of the Georgia Form NRW-Exemption, its benefits, and the steps to claim it.

What is the Georgia Form NRW-Exemption?

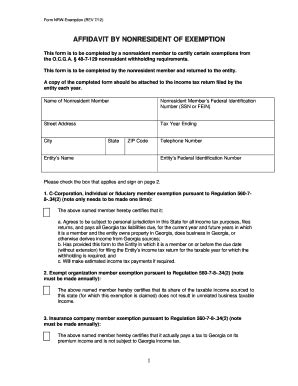

The Georgia Form NRW-Exemption is a tax exemption form designed for non-resident individuals and businesses that are not subject to Georgia state income tax. The form is used to claim an exemption from non-resident withholding tax, which is typically withheld by payers on certain types of income, such as rent, interest, and dividends.

Benefits of the Georgia Form NRW-Exemption

The Georgia Form NRW-Exemption offers several benefits to non-resident individuals and businesses, including:

- Reduced tax liability: By claiming the exemption, non-resident individuals and businesses can reduce their tax liability and avoid overpayment of taxes.

- Increased cash flow: With reduced tax withholding, non-resident individuals and businesses can retain more of their income, resulting in increased cash flow.

- Simplified tax compliance: The exemption form simplifies the tax compliance process for non-resident individuals and businesses, reducing the administrative burden associated with tax filings.

Who is Eligible for the Georgia Form NRW-Exemption?

To be eligible for the Georgia Form NRW-Exemption, non-resident individuals and businesses must meet certain requirements, including:

- Not being a resident of Georgia for tax purposes

- Not having a permanent establishment in Georgia

- Not being subject to Georgia state income tax

How to Claim the Georgia Form NRW-Exemption

Claiming the Georgia Form NRW-Exemption involves several steps, including:

- Obtaining the necessary forms: Non-resident individuals and businesses can obtain the Georgia Form NRW-Exemption from the Georgia Department of Revenue or online.

- Completing the form: The form must be completed accurately and thoroughly, including providing all required documentation and information.

- Submitting the form: The completed form must be submitted to the payer or withholding agent, who will then verify the exemption and adjust the withholding accordingly.

Common Errors to Avoid

When claiming the Georgia Form NRW-Exemption, it is essential to avoid common errors, including:

- Failing to provide required documentation

- Inaccurately completing the form

- Failing to submit the form on time

Georgia Form NRW-Exemption vs. Other Tax Exemptions

The Georgia Form NRW-Exemption is just one of several tax exemptions available in Georgia. Other exemptions include:

- Georgia Form IT-511: This form is used to claim a exemption from Georgia state income tax for resident individuals and businesses.

- Georgia Form G-4: This form is used to claim a exemption from Georgia state withholding tax for non-resident individuals and businesses.

Frequently Asked Questions

Q: Who is eligible for the Georgia Form NRW-Exemption? A: Non-resident individuals and businesses who are not subject to Georgia state income tax are eligible for the exemption.

Q: How do I claim the Georgia Form NRW-Exemption? A: Claiming the exemption involves obtaining the necessary forms, completing the form accurately, and submitting it to the payer or withholding agent.

Q: What are the benefits of the Georgia Form NRW-Exemption? A: The exemption offers reduced tax liability, increased cash flow, and simplified tax compliance.

Conclusion

In conclusion, the Georgia Form NRW-Exemption is a valuable tax exemption for non-resident individuals and businesses. By understanding the benefits and requirements of the exemption, non-resident individuals and businesses can reduce their tax liability and simplify their tax compliance. If you are a non-resident individual or business, consider consulting with a tax professional to determine if you are eligible for the Georgia Form NRW-Exemption.

What is the Georgia Form NRW-Exemption?

+The Georgia Form NRW-Exemption is a tax exemption form designed for non-resident individuals and businesses that are not subject to Georgia state income tax.

Who is eligible for the Georgia Form NRW-Exemption?

+Non-resident individuals and businesses who are not subject to Georgia state income tax are eligible for the exemption.

How do I claim the Georgia Form NRW-Exemption?

+Claiming the exemption involves obtaining the necessary forms, completing the form accurately, and submitting it to the payer or withholding agent.