In the realm of real estate and property law, there are various tools and documents that couples can use to manage their assets and protect their interests. One such tool is an interspousal transfer deed form, which allows spouses to transfer property ownership between each other. This document can be incredibly useful in a variety of situations, providing a convenient and efficient way to reorganize property holdings and achieve specific financial or estate planning goals.

One of the primary reasons couples may consider using an interspousal transfer deed form is to simplify their financial situation and reduce complexity. By consolidating property ownership under one spouse's name, couples can streamline their financial affairs and make it easier to manage their assets. This can be particularly beneficial for couples who are approaching retirement or who are seeking to minimize their tax liability.

In addition to simplifying financial matters, an interspousal transfer deed form can also provide a range of other benefits. For example, it can be used to protect assets from creditors, reduce the risk of property disputes, and even help couples to qualify for certain types of government benefits. By transferring property ownership, couples can also take advantage of tax benefits and exemptions that may not be available to them otherwise.

5 Ways to Use an Interspousal Transfer Deed Form

1. Simplify Financial Affairs

One of the most common reasons couples use an interspousal transfer deed form is to simplify their financial situation. By consolidating property ownership under one spouse's name, couples can reduce complexity and make it easier to manage their assets. This can be particularly beneficial for couples who are approaching retirement or who are seeking to minimize their tax liability.

For example, let's say a couple owns a home together, but one spouse has a significant amount of debt. By transferring the property to the other spouse's name, the couple can protect the property from creditors and ensure that it remains a secure asset.

2. Protect Assets from Creditors

An interspousal transfer deed form can also be used to protect assets from creditors. By transferring property ownership to one spouse's name, couples can shield the property from creditors and ensure that it remains a secure asset. This can be particularly beneficial for couples who have significant assets and are seeking to protect them from potential creditors.

For example, let's say a couple owns a valuable piece of real estate, but one spouse has a business that is at risk of being sued. By transferring the property to the other spouse's name, the couple can protect the property from creditors and ensure that it remains a secure asset.

3. Reduce the Risk of Property Disputes

An interspousal transfer deed form can also be used to reduce the risk of property disputes. By consolidating property ownership under one spouse's name, couples can avoid potential disputes and ensure that the property is managed in a clear and consistent manner.

For example, let's say a couple owns a vacation home together, but they have different ideas about how it should be managed. By transferring the property to one spouse's name, the couple can avoid potential disputes and ensure that the property is managed in a clear and consistent manner.

4. Qualify for Government Benefits

An interspousal transfer deed form can also be used to help couples qualify for certain types of government benefits. By transferring property ownership, couples can take advantage of tax benefits and exemptions that may not be available to them otherwise.

For example, let's say a couple owns a home together, but one spouse is seeking to qualify for Medicaid. By transferring the property to the other spouse's name, the couple can reduce their assets and qualify for Medicaid benefits.

5. Take Advantage of Tax Benefits

Finally, an interspousal transfer deed form can be used to take advantage of tax benefits and exemptions. By transferring property ownership, couples can reduce their tax liability and take advantage of tax benefits that may not be available to them otherwise.

For example, let's say a couple owns a piece of real estate that has increased significantly in value. By transferring the property to one spouse's name, the couple can take advantage of tax benefits and exemptions that may not be available to them otherwise.

How to Use an Interspousal Transfer Deed Form

Using an interspousal transfer deed form is a relatively straightforward process. Here are the steps you'll need to follow:

- Determine the purpose of the transfer: Before you begin, it's essential to determine the purpose of the transfer. Are you seeking to simplify your financial affairs, protect assets from creditors, or take advantage of tax benefits? Understanding the purpose of the transfer will help you to ensure that you use the correct type of deed.

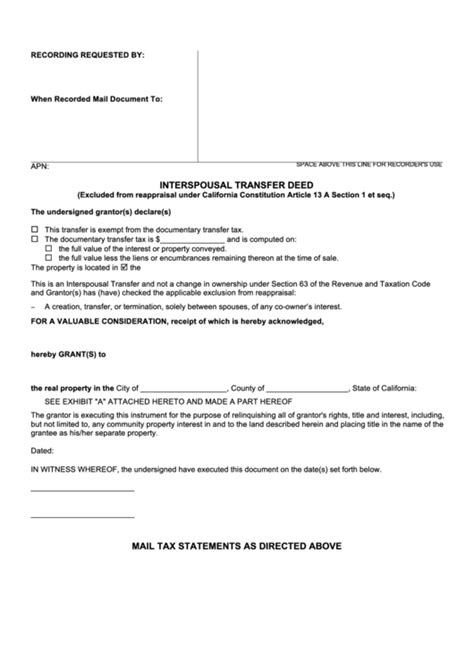

- Choose the correct type of deed: There are several types of deeds that can be used for an interspousal transfer, including a grant deed, quitclaim deed, and warranty deed. The type of deed you choose will depend on the purpose of the transfer and the laws of your state.

- Prepare the deed: Once you've chosen the correct type of deed, you'll need to prepare the document. This will involve filling out a form and signing it in the presence of a notary public.

- Record the deed: After the deed has been prepared and signed, it will need to be recorded with the county recorder's office. This will provide public notice of the transfer and help to ensure that the property is transferred correctly.

Conclusion

An interspousal transfer deed form is a powerful tool that can be used to simplify financial affairs, protect assets from creditors, reduce the risk of property disputes, qualify for government benefits, and take advantage of tax benefits. By understanding how to use an interspousal transfer deed form, couples can take control of their assets and achieve their financial goals.

We hope this article has provided you with a comprehensive understanding of interspousal transfer deed forms and how they can be used. If you have any questions or need further guidance, please don't hesitate to reach out.

FAQ Section

What is an interspousal transfer deed form?

+An interspousal transfer deed form is a document that allows spouses to transfer property ownership between each other.

Why would I use an interspousal transfer deed form?

+You may use an interspousal transfer deed form to simplify your financial affairs, protect assets from creditors, reduce the risk of property disputes, qualify for government benefits, or take advantage of tax benefits.

How do I use an interspousal transfer deed form?

+To use an interspousal transfer deed form, you'll need to determine the purpose of the transfer, choose the correct type of deed, prepare the deed, and record the deed with the county recorder's office.