The Internal Revenue Service (IRS) requires farmers and landlords to report farm rental income on a specific form, known as IRS Form 4835. This form is used to calculate the taxable income from farm rentals, which can be a complex process. In this article, we will break down the components of Form 4835, explain how to complete it, and provide examples to help you understand the process.

What is IRS Form 4835?

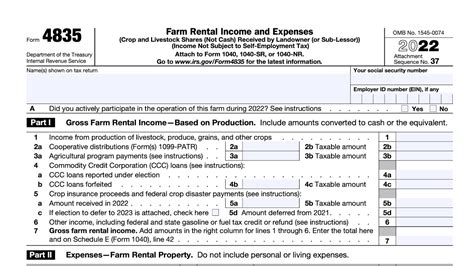

IRS Form 4835, also known as the Farm Rental Income and Expenses form, is used to report the income and expenses related to farm rentals. This form is used by farmers and landlords who rent out their farmland to others. The form is used to calculate the taxable income from farm rentals, which is then reported on the taxpayer's tax return.

Who Needs to File Form 4835?

Form 4835 is required for farmers and landlords who rent out their farmland to others. This includes:

- Farmers who rent out their land to other farmers or agricultural businesses

- Landlords who rent out their land to farmers or agricultural businesses

- Estates and trusts that own farmland and rent it out to others

Components of Form 4835

Form 4835 consists of several sections that require you to report your farm rental income and expenses. The main components of the form are:

- Part I: Farm Rental Income

- This section requires you to report the total farm rental income you received during the tax year.

- You will need to report the income from each farm rental agreement separately.

- Part II: Farm Rental Expenses

- This section requires you to report the expenses related to your farm rental income.

- You will need to report expenses such as property taxes, insurance, and maintenance costs.

- Part III: Net Farm Rental Income

- This section requires you to calculate your net farm rental income by subtracting your farm rental expenses from your farm rental income.

How to Complete Form 4835

To complete Form 4835, you will need to follow these steps:

- Gather your farm rental income and expense records

- Make sure you have all the necessary records, including rental agreements, invoices, and receipts.

- Complete Part I: Farm Rental Income

- Report the total farm rental income you received during the tax year.

- Report the income from each farm rental agreement separately.

- Complete Part II: Farm Rental Expenses

- Report the expenses related to your farm rental income.

- Make sure to report expenses such as property taxes, insurance, and maintenance costs.

- Complete Part III: Net Farm Rental Income

- Calculate your net farm rental income by subtracting your farm rental expenses from your farm rental income.

Examples of Completing Form 4835

Let's say you are a farmer who rented out your land to another farmer for $10,000 per year. You also incurred expenses of $2,000 for property taxes and $1,000 for insurance. Here's how you would complete Form 4835:

- Part I: Farm Rental Income

- Total farm rental income: $10,000

- Part II: Farm Rental Expenses

- Property taxes: $2,000

- Insurance: $1,000

- Total farm rental expenses: $3,000

- Part III: Net Farm Rental Income

- Net farm rental income: $7,000 ($10,000 - $3,000)

Tips for Completing Form 4835

Here are some tips to keep in mind when completing Form 4835:

- Keep accurate records: Make sure to keep accurate records of your farm rental income and expenses.

- Report all income and expenses: Make sure to report all income and expenses related to your farm rentals.

- Consult a tax professional: If you are unsure about how to complete Form 4835, consider consulting a tax professional.

Conclusion

IRS Form 4835 is an important form for farmers and landlords who rent out their farmland to others. By understanding how to complete the form, you can ensure that you are reporting your farm rental income and expenses accurately. Remember to keep accurate records, report all income and expenses, and consult a tax professional if you are unsure about how to complete the form.

Additional Resources

- IRS Publication 225: This publication provides more information on farm rental income and expenses.

- IRS Form 1040: This form is used to report your tax return, which will include your farm rental income and expenses.

- IRS Form 4562: This form is used to report depreciation and amortization expenses related to your farm rentals.

We hope this article has helped you understand how to complete IRS Form 4835. If you have any further questions or need additional guidance, please don't hesitate to ask.

FAQ Section

What is IRS Form 4835 used for?

+IRS Form 4835 is used to report farm rental income and expenses.

Who needs to file Form 4835?

+Farmers and landlords who rent out their farmland to others need to file Form 4835.

What are the main components of Form 4835?

+The main components of Form 4835 include Part I: Farm Rental Income, Part II: Farm Rental Expenses, and Part III: Net Farm Rental Income.