As a business owner, there may come a time when you need to dissolve your company. Whether it's due to financial difficulties, changes in the market, or personal reasons, dissolving a business can be a complex process. One of the key steps in dissolving a business is filing Form 966 with the Internal Revenue Service (IRS). In this article, we will explore the five ways to file Form 966 for business dissolution.

What is Form 966?

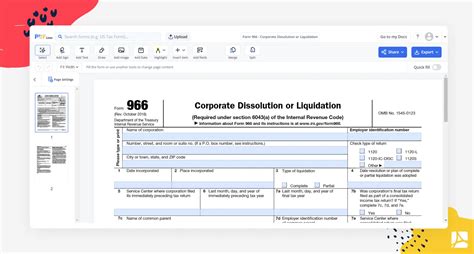

Form 966, also known as the "Corporate Dissolution or Liquidation," is a form used by corporations to notify the IRS of their intention to dissolve or liquidate. This form is required by the IRS and must be filed within 30 days of the corporation's dissolution or liquidation.

Why is Form 966 Important?

Filing Form 966 is crucial for several reasons:

- It notifies the IRS of the corporation's intention to dissolve or liquidate, which helps to avoid any potential penalties or fines.

- It provides the IRS with the necessary information to update its records and remove the corporation from its database.

- It helps to ensure that the corporation's tax obligations are settled and that any outstanding taxes are paid.

5 Ways to File Form 966

There are five ways to file Form 966, and we will explore each of them in detail:

1. Electronic Filing

The IRS offers an electronic filing option for Form 966 through its website. To file electronically, you will need to:

- Go to the IRS website and log in to your account.

- Select the "File" option and choose Form 966.

- Fill out the form and attach any required documentation.

- Submit the form and receive a confirmation number.

2. Mail Filing

You can also file Form 966 by mail. To do so, you will need to:

- Download and print Form 966 from the IRS website.

- Fill out the form and attach any required documentation.

- Mail the form to the IRS address listed on the form.

3. Fax Filing

The IRS also accepts faxed copies of Form 966. To file by fax, you will need to:

- Download and print Form 966 from the IRS website.

- Fill out the form and attach any required documentation.

- Fax the form to the IRS fax number listed on the form.

4. Third-Party Filing

You can also hire a third-party service to file Form 966 on your behalf. These services typically offer a range of options, including electronic and mail filing. To use a third-party service, you will need to:

- Research and select a reputable service.

- Provide the service with the necessary information and documentation.

- Pay the service fee.

5. Professional Assistance

Finally, you can also seek the assistance of a tax professional, such as a certified public accountant (CPA) or an enrolled agent (EA). These professionals can help you prepare and file Form 966, as well as provide guidance on any other tax-related issues.

Tips and Reminders

When filing Form 966, there are several tips and reminders to keep in mind:

- Make sure to file the form within 30 days of the corporation's dissolution or liquidation.

- Ensure that all required documentation is attached to the form.

- Keep a copy of the filed form for your records.

Conclusion

Filing Form 966 is an important step in the business dissolution process. By understanding the five ways to file Form 966, you can ensure that your corporation's tax obligations are settled and that any outstanding taxes are paid. Remember to file the form within the required timeframe and to seek professional assistance if needed.

What is the deadline for filing Form 966?

+The deadline for filing Form 966 is within 30 days of the corporation's dissolution or liquidation.

Can I file Form 966 electronically?

+Yes, the IRS offers an electronic filing option for Form 966 through its website.

What documentation is required to file Form 966?

+The required documentation may vary depending on the specific circumstances of the corporation's dissolution or liquidation. It's best to consult with a tax professional or the IRS to determine what documentation is required.