Navigating the world of annuities can be a daunting task, especially when it comes to withdrawing funds. Athene annuities, in particular, have gained popularity due to their flexibility and potential for growth. However, understanding the withdrawal process can be overwhelming, especially for those who are new to annuities. In this article, we will delve into the Athene annuity withdrawal form, providing a step-by-step guide to help you navigate the process with ease.

The Importance of Understanding Annuity Withdrawals

Annuities are designed to provide a steady income stream in retirement, but there may be times when you need to access your funds earlier. Whether you're facing unexpected expenses or simply need to supplement your income, understanding the withdrawal process is crucial. Failure to follow the correct procedures can result in penalties, fees, or even tax implications. By grasping the Athene annuity withdrawal form, you'll be empowered to make informed decisions about your financial future.

What is an Athene Annuity Withdrawal Form?

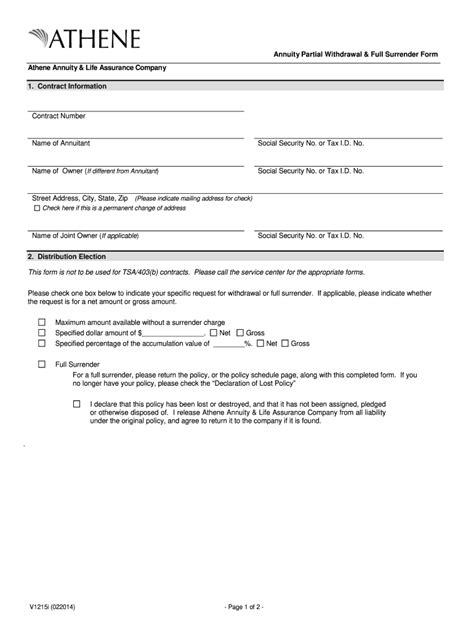

The Athene annuity withdrawal form is a document that allows you to request withdrawals from your Athene annuity account. This form is typically used when you need to access your funds for a specific purpose, such as supplementing your income or covering unexpected expenses. The form will require you to provide personal and account information, as well as specify the amount you wish to withdraw.

Types of Withdrawals

Before we dive into the withdrawal form, it's essential to understand the types of withdrawals available. Athene annuities offer several withdrawal options, including:

- Free Withdrawal: This option allows you to withdraw a portion of your account value without incurring surrender charges.

- Systematic Withdrawal: This option enables you to receive regular payments from your annuity, providing a steady income stream.

- Lump Sum Withdrawal: This option allows you to withdraw a single lump sum from your account.

Step-by-Step Guide to Completing the Athene Annuity Withdrawal Form

Completing the Athene annuity withdrawal form is a straightforward process. Here's a step-by-step guide to help you navigate the form:

- Gather Required Information: Before starting the form, ensure you have the following information readily available:

- Your Athene annuity account number

- Your name and address

- Your social security number or tax identification number

- The type of withdrawal you wish to make (free withdrawal, systematic withdrawal, or lump sum withdrawal)

- Download and Print the Form: You can obtain the Athene annuity withdrawal form from the Athene website or by contacting their customer service department. Print the form and review it carefully.

- Complete Section 1: Account Information: Fill in your account number, name, and address. Ensure this information matches the information on file with Athene.

- Complete Section 2: Withdrawal Request: Specify the type of withdrawal you wish to make and the amount you wish to withdraw. If you're requesting a systematic withdrawal, you'll need to provide the payment frequency and duration.

- Complete Section 3: Tax Information: Provide your social security number or tax identification number. This information is required for tax reporting purposes.

- Sign and Date the Form: Sign and date the form, ensuring you've reviewed and understood the terms and conditions.

- Submit the Form: Submit the completed form to Athene via mail or fax. Be sure to keep a copy of the form for your records.

Tips and Considerations

When completing the Athene annuity withdrawal form, keep the following tips and considerations in mind:

- Review the Form Carefully: Ensure you've completed the form accurately and thoroughly. Incomplete or inaccurate forms may result in delays or rejection.

- Understand the Fees and Charges: Familiarize yourself with any fees or charges associated with withdrawals. These may include surrender charges, administrative fees, or tax implications.

- Consider the Tax Implications: Withdrawals from an annuity may be subject to tax. Consult with a tax professional to understand the tax implications of your withdrawal.

- Seek Professional Advice: If you're unsure about the withdrawal process or have complex financial situations, consider consulting with a financial advisor.

Conclusion

Withdrawing from an Athene annuity can be a straightforward process, but it's essential to understand the withdrawal form and procedures. By following the step-by-step guide outlined in this article, you'll be empowered to make informed decisions about your financial future. Remember to review the form carefully, understand the fees and charges, and consider the tax implications. If you're unsure about any aspect of the withdrawal process, don't hesitate to seek professional advice.

What is the minimum withdrawal amount from an Athene annuity?

+The minimum withdrawal amount from an Athene annuity varies depending on the specific product and contract terms. Typically, the minimum withdrawal amount is $500.

Are there any fees associated with withdrawing from an Athene annuity?

+Yes, there may be fees associated with withdrawing from an Athene annuity, such as surrender charges, administrative fees, or tax implications. These fees vary depending on the specific product and contract terms.

Can I withdraw from my Athene annuity at any time?

+Yes, you can withdraw from your Athene annuity at any time, but there may be restrictions or penalties depending on the specific product and contract terms. It's essential to review your contract and understand the terms and conditions before making a withdrawal.