As a business owner or individual with depreciation expenses, understanding how to properly file Federal Form 4562 is crucial for accurate tax reporting and maximizing your deductions. The Form 4562, also known as the Depreciation and Amortization form, is used to report depreciation and amortization expenses on your tax return. Here are five tips to help you navigate the process and ensure you're taking advantage of the deductions you're eligible for.

Understanding the Purpose of Form 4562

The primary purpose of Form 4562 is to report the depreciation and amortization of assets used in your business or for the production of income. This includes property such as buildings, equipment, vehicles, and intangible assets like patents and copyrights. The form is used to calculate the depreciation and amortization expenses that can be deducted on your tax return.

Tip 1: Identify Eligible Assets

To accurately complete Form 4562, you must first identify the assets that are eligible for depreciation and amortization. These include:

- Tangible assets: buildings, machinery, equipment, and vehicles

- Intangible assets: patents, copyrights, and goodwill

- Listed property: assets used for both business and personal purposes, such as cars and cell phones

It's essential to keep accurate records of your assets, including the date acquired, cost, and estimated useful life. This information will be used to calculate the depreciation and amortization expenses.

Calculating Depreciation and Amortization

Once you've identified your eligible assets, you'll need to calculate the depreciation and amortization expenses. There are several methods to choose from, including:

- Modified Accelerated Cost Recovery System (MACRS): the most common method, which uses a predetermined schedule to calculate depreciation

- Alternative Depreciation System (ADS): a less common method that uses a straight-line approach to calculate depreciation

- Section 179 deduction: allows businesses to deduct the full cost of eligible assets in the first year

The calculation method you choose will depend on the type of asset and your business needs. It's essential to consult with a tax professional to ensure you're using the correct method.

Tip 2: Keep Accurate Records

Accurate records are crucial for completing Form 4562. You'll need to keep track of:

- Asset acquisition dates and costs

- Estimated useful lives of assets

- Depreciation and amortization expenses

- Dispositions of assets

Maintaining accurate records will help you ensure that you're calculating the correct depreciation and amortization expenses and taking advantage of the deductions you're eligible for.

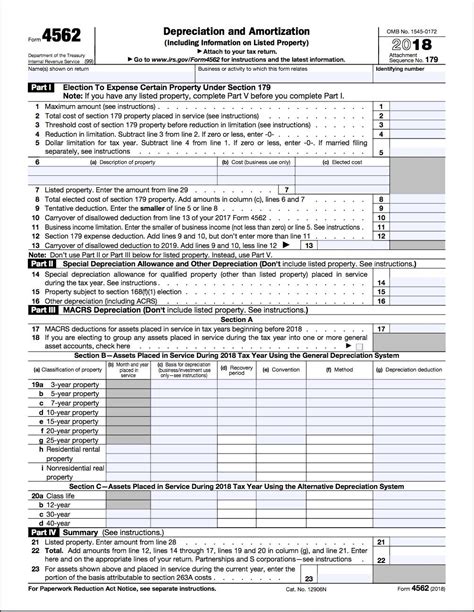

Reporting Depreciation and Amortization on Form 4562

Once you've calculated your depreciation and amortization expenses, you'll need to report them on Form 4562. The form is divided into several sections, including:

- Part I: Depreciation and Amortization

- Part II: Amortization of Intangible Assets

- Part III: Depreciation on Certain Property

- Part IV: Summary

You'll need to complete the relevant sections based on the type of assets you're reporting and the calculation method you're using.

Tip 3: Avoid Common Mistakes

Common mistakes on Form 4562 can lead to delays in processing your tax return and even result in penalties. Some common mistakes to avoid include:

- Incorrectly calculating depreciation and amortization expenses

- Failing to report all eligible assets

- Using the wrong calculation method

- Not keeping accurate records

To avoid these mistakes, it's essential to carefully review your calculations and ensure that you're reporting all eligible assets.

Additional Tips for Filing Form 4562

In addition to the tips above, here are a few more things to keep in mind when filing Form 4562:

-

Tip 4: Consult with a Tax Professional

Filing Form 4562 can be complex, especially if you have multiple assets or are using a combination of calculation methods. Consulting with a tax professional can help ensure that you're accurately reporting your depreciation and amortization expenses.

-

Tip 5: Keep Records for Audits

In the event of an audit, having accurate records of your assets and depreciation and amortization expenses can help support your tax return. Keep all relevant documentation, including receipts, invoices, and asset records.

By following these tips, you can ensure that you're accurately reporting your depreciation and amortization expenses on Form 4562 and taking advantage of the deductions you're eligible for.

What is the purpose of Form 4562?

+The purpose of Form 4562 is to report depreciation and amortization expenses on your tax return.

What types of assets are eligible for depreciation and amortization?

+Eligible assets include tangible assets, intangible assets, and listed property.

What calculation methods can I use for depreciation and amortization?

+You can use the Modified Accelerated Cost Recovery System (MACRS), Alternative Depreciation System (ADS), or Section 179 deduction.