Filing taxes can be a daunting task, especially for business owners who need to navigate the complexities of sales and use tax. The North Carolina Sales and Use Tax Form E-500 is a critical document for businesses operating in the state, as it helps to report and remit sales and use tax to the North Carolina Department of Revenue. In this article, we will delve into the world of NC sales and use tax, providing a comprehensive guide to the Form E-500 and its requirements.

Understanding the Basics of NC Sales and Use Tax

Before we dive into the specifics of the Form E-500, it's essential to understand the basics of NC sales and use tax. Sales tax is a type of consumption tax levied on the sale of goods and services, while use tax is a type of tax levied on the use or consumption of goods and services. In North Carolina, businesses are required to collect sales tax on taxable sales and remit it to the state.

Who Needs to File Form E-500?

Form E-500 is required for businesses that are registered to collect and remit sales and use tax in North Carolina. This includes:

- Retailers who sell taxable goods and services

- Wholesalers who sell taxable goods and services

- Service providers who provide taxable services

- Businesses that lease or rent tangible personal property

Completing Form E-500

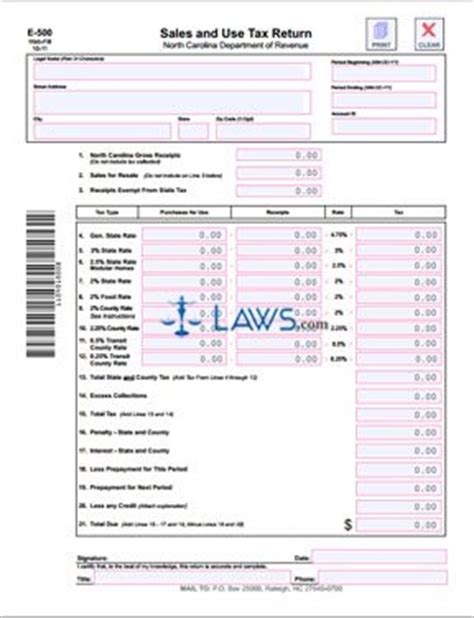

Form E-500 is a relatively straightforward document, but it does require careful attention to detail. The form consists of several sections, including:

- Business information: This section requires businesses to provide their name, address, and tax identification number.

- Sales and use tax liability: This section requires businesses to report their total sales and use tax liability for the reporting period.

- Taxable sales: This section requires businesses to report their total taxable sales for the reporting period.

- Use tax: This section requires businesses to report their total use tax liability for the reporting period.

Tips for Completing Form E-500

- Make sure to complete all sections of the form accurately and thoroughly.

- Use the correct tax rates and exemptions.

- Keep accurate records of sales and use tax transactions.

- File Form E-500 on time to avoid penalties and interest.

Filing Form E-500

Form E-500 can be filed electronically or by mail. The North Carolina Department of Revenue encourages businesses to file electronically, as it is faster and more secure. Businesses can file Form E-500 through the NC Department of Revenue's website or through a third-party filing service.

Due Dates and Penalties

Form E-500 is due on the 20th day of the month following the end of the reporting period. For example, if the reporting period is January 1 - January 31, the Form E-500 is due on February 20. Businesses that fail to file Form E-500 on time may be subject to penalties and interest.

Amending Form E-500

If a business needs to make changes to a previously filed Form E-500, they can file an amended return. The amended return must include all the necessary documentation and explanations for the changes.

Reasons for Amending Form E-500

- Error in reporting sales and use tax liability

- Error in reporting taxable sales

- Error in reporting use tax liability

- Change in business information

Conclusion and Next Steps

Filing NC sales and use tax Form E-500 is a critical responsibility for businesses operating in North Carolina. By following the guidelines and tips outlined in this article, businesses can ensure they are in compliance with state tax laws and regulations. If you have any questions or concerns about Form E-500, don't hesitate to reach out to the North Carolina Department of Revenue or a qualified tax professional.

We hope this guide has been informative and helpful. Take a moment to share your thoughts and experiences with NC sales and use tax Form E-500 in the comments below.

What is the purpose of Form E-500?

+Form E-500 is used to report and remit sales and use tax to the North Carolina Department of Revenue.

Who needs to file Form E-500?

+Businesses that are registered to collect and remit sales and use tax in North Carolina need to file Form E-500.

What is the due date for Form E-500?

+Form E-500 is due on the 20th day of the month following the end of the reporting period.