In today's digital age, managing finances efficiently is crucial for individuals and businesses alike. One of the most convenient ways to receive funds is through direct deposit. For MCU ( Municipal Credit Union) members, setting up a direct deposit is a straightforward process that can save time and reduce the risk of lost or stolen checks. In this article, we will delve into the world of MCU direct deposit forms, exploring their benefits, setup process, and management.

Benefits of MCU Direct Deposit

MCU direct deposit offers numerous benefits to its members. Some of the most significant advantages include:

- Convenience: Direct deposit eliminates the need to physically visit a bank branch or ATM to deposit funds. This saves time and reduces the risk of lost or stolen checks.

- Security: Direct deposit reduces the risk of check fraud and ensures that funds are deposited directly into the recipient's account.

- Timeliness: Direct deposit ensures that funds are available in the recipient's account on the designated payment date.

- Cost-effectiveness: Direct deposit eliminates the need for paper checks, reducing costs associated with check printing, mailing, and processing.

Setting Up MCU Direct Deposit

Setting up MCU direct deposit is a simple process that can be completed in a few steps:

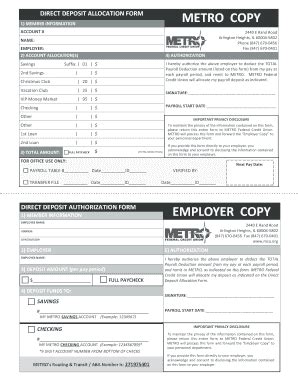

- Gather required information: Members will need to provide their MCU account number, routing number, and deposit information.

- Obtain a direct deposit form: Members can obtain a direct deposit form from the MCU website, a branch location, or by contacting the MCU customer service department.

- Complete the form: Members will need to complete the direct deposit form, providing the required information and signing the form.

- Submit the form: Members can submit the completed form to the MCU via mail, fax, or in-person at a branch location.

Managing MCU Direct Deposit

Once MCU direct deposit is set up, members can manage their direct deposit accounts easily. Here are some tips for managing MCU direct deposit:

- Verify deposit information: Members should verify their deposit information to ensure that funds are being deposited correctly.

- Monitor account activity: Members should regularly monitor their account activity to detect any suspicious transactions.

- Update deposit information: Members should update their deposit information if there are any changes to their account or deposit information.

- Contact MCU customer service: Members can contact the MCU customer service department if they have any questions or concerns about their direct deposit account.

Common Issues with MCU Direct Deposit

While MCU direct deposit is a reliable and efficient way to receive funds, there may be instances where issues arise. Here are some common issues with MCU direct deposit:

- Incorrect deposit information: Incorrect deposit information can result in delayed or rejected deposits.

- Insufficient funds: Insufficient funds in the payer's account can result in rejected deposits.

- Technical issues: Technical issues with the MCU system or the payer's system can result in delayed or rejected deposits.

Troubleshooting MCU Direct Deposit Issues

If members experience issues with their MCU direct deposit, there are several steps they can take to troubleshoot the issue:

- Verify deposit information: Members should verify their deposit information to ensure that it is accurate.

- Contact the payer: Members should contact the payer to verify that the deposit was sent correctly.

- Contact MCU customer service: Members can contact the MCU customer service department for assistance with resolving the issue.

Conclusion: Simplify Your Finances with MCU Direct Deposit

MCU direct deposit is a convenient, secure, and cost-effective way to receive funds. By setting up MCU direct deposit, members can simplify their finances and reduce the risk of lost or stolen checks. If you're an MCU member, consider setting up direct deposit today and take advantage of the benefits it has to offer.

We hope this article has provided you with valuable information about MCU direct deposit. If you have any questions or concerns, please don't hesitate to comment below.

What is MCU direct deposit?

+MCU direct deposit is a service that allows members to receive funds directly into their account.

How do I set up MCU direct deposit?

+To set up MCU direct deposit, members will need to provide their account number, routing number, and deposit information, and complete a direct deposit form.

What are the benefits of MCU direct deposit?

+The benefits of MCU direct deposit include convenience, security, timeliness, and cost-effectiveness.