The world of retirement savings can be complex and overwhelming, especially when it comes to managing multiple accounts and navigating the intricacies of rollovers. However, with the right guidance, it's possible to simplify the process and make informed decisions about your financial future. In this article, we'll delve into the Equitable 403b rollover form, a crucial document for individuals looking to consolidate their retirement savings.

The importance of retirement savings cannot be overstated. With the rising cost of living and increasing life expectancy, it's essential to plan carefully for the golden years. One of the most effective ways to do this is by participating in a 403b plan, a type of retirement savings plan offered by certain employers, such as schools and non-profit organizations. However, as individuals change jobs or retire, they may need to navigate the rollover process to consolidate their savings and ensure a smooth transition.

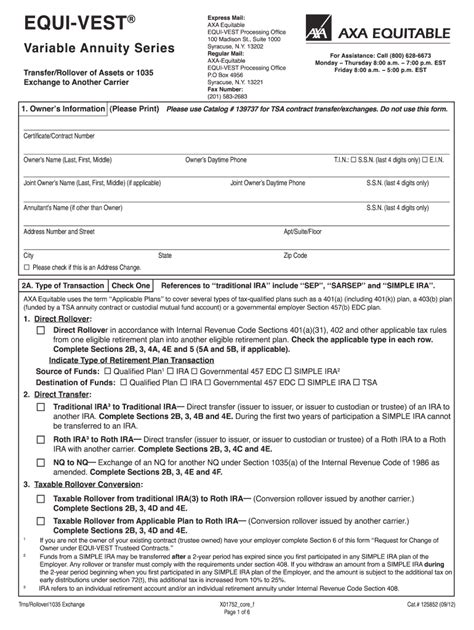

Understanding the Equitable 403b Rollover Form

The Equitable 403b rollover form is a document used to initiate the transfer of funds from an existing 403b account to a new account, such as an IRA or another 403b plan. This form is typically provided by the plan administrator or financial institution managing the account. The purpose of the form is to ensure that the transfer is done correctly and in accordance with IRS regulations.

Key Components of the Equitable 403b Rollover Form

The Equitable 403b rollover form typically includes the following key components:

- Account information: This section requires individuals to provide details about the existing 403b account, including the account number and plan name.

- Transfer information: Here, individuals specify the type of transfer they want to make, such as a direct rollover or indirect rollover.

- Distribution information: This section requires individuals to indicate how they want to receive the transferred funds, such as a lump sum or periodic payments.

- Tax withholding: Individuals must decide whether to have taxes withheld from the transferred amount or pay taxes later.

Benefits of Using the Equitable 403b Rollover Form

Using the Equitable 403b rollover form can provide several benefits, including:

- Simplified transfer process: The form ensures that the transfer is done correctly and efficiently, minimizing the risk of errors or delays.

- Tax efficiency: By using the form, individuals can avoid unnecessary taxes and penalties associated with incorrect transfers.

- Consolidation of accounts: The form enables individuals to consolidate their retirement savings into a single account, making it easier to manage and track their funds.

Common Mistakes to Avoid When Using the Equitable 403b Rollover Form

While the Equitable 403b rollover form is designed to simplify the transfer process, there are common mistakes to avoid:

- Incorrect account information: Double-check that the account numbers and plan names are accurate to avoid delays or errors.

- Insufficient tax withholding: Failing to withhold sufficient taxes can result in penalties and interest.

- Incomplete documentation: Ensure that all required documentation is included to avoid delays or rejection of the transfer.

Best Practices for Completing the Equitable 403b Rollover Form

To ensure a smooth transfer process, follow these best practices when completing the Equitable 403b rollover form:

- Read the instructions carefully: Take the time to review the form and instructions to ensure you understand the requirements.

- Verify account information: Double-check that the account numbers and plan names are accurate.

- Seek professional advice: If you're unsure about any aspect of the transfer process, consult a financial advisor or tax professional.

Common Questions About the Equitable 403b Rollover Form

Here are some common questions about the Equitable 403b rollover form:

- Q: What is the deadline for submitting the Equitable 403b rollover form? A: The deadline varies depending on the plan administrator and IRS regulations. It's essential to check with the plan administrator for specific deadlines.

- Q: Can I use the Equitable 403b rollover form for multiple transfers? A: Yes, you can use the form for multiple transfers, but you must complete a separate form for each transfer.

Conclusion

The Equitable 403b rollover form is a crucial document for individuals looking to consolidate their retirement savings. By understanding the key components of the form, benefits, and best practices for completion, you can ensure a smooth transfer process and avoid common mistakes. Remember to seek professional advice if you're unsure about any aspect of the transfer process. Take control of your retirement savings today and secure a brighter financial future.

Now that you've read this comprehensive guide, take the next step by sharing your thoughts and experiences with the Equitable 403b rollover form in the comments section below. Have you used the form before? What challenges did you face, and how did you overcome them? Your input can help others navigate the rollover process with confidence.

What is the Equitable 403b rollover form used for?

+The Equitable 403b rollover form is used to initiate the transfer of funds from an existing 403b account to a new account, such as an IRA or another 403b plan.

What are the key components of the Equitable 403b rollover form?

+The key components of the form include account information, transfer information, distribution information, and tax withholding.

What are the benefits of using the Equitable 403b rollover form?

+The benefits include a simplified transfer process, tax efficiency, and consolidation of accounts.