The IRS Form 941 is a crucial document for employers, as it reports their quarterly federal income tax withholding and Federal Insurance Contributions Act (FICA) taxes. Filling out the form correctly is essential to avoid penalties, fines, and potential audits. In this article, we will guide you through the process of filling out the MO 941 form correctly, highlighting key sections, and providing valuable tips to ensure accuracy.

Understanding the Importance of Accurate Reporting

Before diving into the tips, it's essential to understand the significance of accurate reporting on the MO 941 form. The IRS uses this form to track employer tax obligations, and any errors or discrepancies can lead to costly consequences. Employers who fail to report taxes correctly may face penalties, fines, and even interest on underpaid taxes.

Tip 1: Gather Necessary Information

To fill out the MO 941 form correctly, you'll need to gather necessary information, including:

- Employer Identification Number (EIN)

- Quarterly wages and tips

- Federal income tax withheld

- FICA taxes withheld (Social Security and Medicare)

- Number of employees who received wages and tips

- Any adjustments or corrections to prior quarter reports

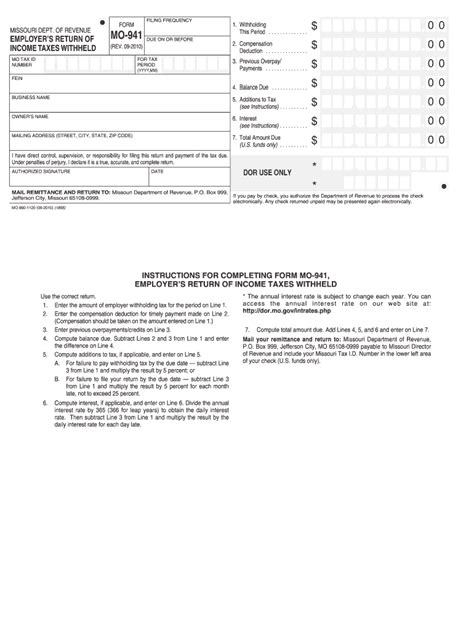

Tip 2: Complete Form 941 Section 1

Section 1 of the MO 941 form requires employers to report their quarterly wages and tips, as well as the federal income tax withheld. This section is divided into several parts:

- Line 1: Report the total wages and tips paid to employees during the quarter.

- Line 2: Report the total federal income tax withheld from employee wages and tips.

- Line 3: Calculate the total FICA taxes withheld (Social Security and Medicare).

Tip 3: Complete Form 941 Section 2

Section 2 of the MO 941 form requires employers to report their FICA taxes withheld and calculate their tax liability. This section includes:

- Line 4: Report the total FICA taxes withheld (Social Security and Medicare).

- Line 5: Calculate the employer's share of FICA taxes.

- Line 6: Calculate the total tax liability.

Tip 4: Report Adjustments and Corrections

Employers may need to report adjustments or corrections to prior quarter reports. This can include:

- Correcting errors or discrepancies in prior reports

- Reporting changes in employee wages or tips

- Adjusting FICA taxes withheld

Tip 5: Review and Verify

Before submitting the MO 941 form, it's essential to review and verify the information for accuracy. Employers should:

- Review calculations and math

- Verify employee information and wages

- Ensure all necessary sections are completed

By following these 5 tips, employers can ensure accurate reporting on the MO 941 form and avoid costly penalties and fines. Remember to gather necessary information, complete all sections accurately, report adjustments and corrections, and review and verify the form before submission.

Additional Tips and Reminders

- File the MO 941 form on time to avoid penalties and fines.

- Use the correct EIN and report accurate wages and tips.

- Keep accurate records of employee information and wages.

- Seek professional help if you're unsure about any part of the form.

Take Action Today

Don't wait until the last minute to fill out the MO 941 form. Gather necessary information, complete the form accurately, and review and verify the information to ensure accuracy. By taking these steps, you can avoid costly penalties and fines and maintain compliance with IRS regulations.

Share Your Thoughts

Have you ever struggled with filling out the MO 941 form? Share your experiences and tips in the comments below. Help others by sharing this article on social media and spreading the word about the importance of accurate reporting.

What is the purpose of the MO 941 form?

+The MO 941 form is used to report quarterly federal income tax withholding and FICA taxes.

What information do I need to gather to fill out the MO 941 form?

+You'll need to gather your EIN, quarterly wages and tips, federal income tax withheld, FICA taxes withheld, and number of employees who received wages and tips.

How do I report adjustments or corrections to prior quarter reports?

+You can report adjustments or corrections on the MO 941 form by completing the necessary sections and attaching a statement explaining the changes.