Understanding IRS Form 4506-C: A Borrower's Guide

As a borrower, navigating the world of mortgage lending can be overwhelming, especially when it comes to tax-related documentation. One crucial form that often raises questions is the IRS Consent Form 4506-C. In this article, we'll delve into the details of this form, its purpose, and what it means for borrowers.

What is IRS Form 4506-C?

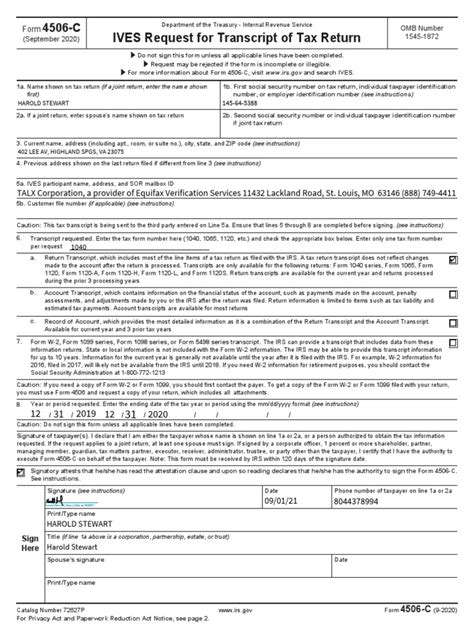

The IRS Consent Form 4506-C, also known as the IVES (Income Verification Express Service) Request for Transcript of Tax Return, is a document used by lenders to verify a borrower's income and employment status. This form is typically required for mortgage loan applications, refinancing, or other financial transactions that involve tax-related information.

Why is IRS Form 4506-C necessary?

Lenders need to verify a borrower's income and employment status to assess their creditworthiness and determine the loan amount. By using the 4506-C form, lenders can request tax transcripts directly from the IRS, ensuring that the information provided by the borrower is accurate and reliable.

What information is required on IRS Form 4506-C?

To complete the IRS Consent Form 4506-C, borrowers need to provide the following information:

- Name and address

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Tax year(s) for which transcripts are being requested

- Type of transcript requested (e.g., tax return, account transcript, or wage and income transcript)

- Borrower's signature, authorizing the lender to request the tax transcripts

How does the lender use the information from IRS Form 4506-C?

Once the lender receives the tax transcripts, they will use the information to verify the borrower's income, employment status, and other relevant details. This information is then used to:

- Calculate the borrower's debt-to-income ratio

- Determine the loan amount and interest rate

- Assess the borrower's creditworthiness

- Make an informed decision about loan approval

Benefits of using IRS Form 4506-C

Using the IRS Consent Form 4506-C provides several benefits, including:

- Faster loan processing: By using the 4506-C form, lenders can quickly verify tax information, reducing the time it takes to process the loan application.

- Increased accuracy: Directly requesting tax transcripts from the IRS ensures that the information is accurate and reliable.

- Reduced risk: By verifying tax information, lenders can reduce the risk of loan defaults and foreclosures.

Common mistakes to avoid when completing IRS Form 4506-C

To avoid delays or rejection of the loan application, borrowers should be aware of the following common mistakes:

- Incomplete or inaccurate information

- Failure to sign the form

- Incorrect tax year or type of transcript requested

- Not submitting the form in a timely manner

Best practices for borrowers completing IRS Form 4506-C

To ensure a smooth loan application process, borrowers should:

- Carefully review the form for accuracy and completeness

- Provide all required information and signatures

- Submit the form in a timely manner

- Ensure that the lender has the necessary documentation to process the loan application

Conclusion: Understanding IRS Form 4506-C

In conclusion, the IRS Consent Form 4506-C is an essential document in the mortgage lending process. By understanding the purpose and requirements of this form, borrowers can ensure a smooth loan application process and avoid potential delays or rejection.

As a borrower, it's essential to carefully review and complete the 4506-C form accurately, providing all required information and signatures. By doing so, you can help the lender verify your tax information, reducing the risk of loan defaults and foreclosures.

We hope this article has provided you with a comprehensive understanding of the IRS Consent Form 4506-C. If you have any questions or concerns, please don't hesitate to ask.

FAQ Section

What is the purpose of IRS Form 4506-C?

+The IRS Consent Form 4506-C is used by lenders to verify a borrower's income and employment status by requesting tax transcripts directly from the IRS.

What information is required on IRS Form 4506-C?

+Borrowers need to provide their name and address, Social Security number or ITIN, tax year(s) for which transcripts are being requested, type of transcript requested, and signature.

Why is it essential to complete IRS Form 4506-C accurately?

+Completing the form accurately and providing all required information ensures a smooth loan application process and reduces the risk of loan defaults and foreclosures.