The state of Hawaii requires individuals and businesses to file various tax forms to report their income, claim deductions, and pay taxes owed. One of the essential tax forms for Hawaii residents and non-residents is the N-342 form. In this article, we will provide a comprehensive guide to help you understand the N-342 form, its purpose, and how to file it correctly.

What is the N-342 Form?

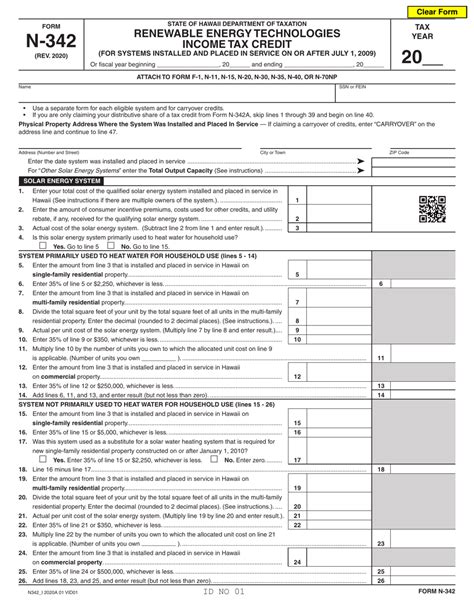

The N-342 form, also known as the "Hawaii Income Tax Declaration for Electronic Filing," is a tax form used by individuals and businesses to report their income and claim deductions for Hawaii state taxes. The form is required for taxpayers who are filing electronically, and it serves as a declaration of the accuracy of the information reported on the tax return.

Who Needs to File the N-342 Form?

The N-342 form is required for the following taxpayers:

- Individuals who are filing a Hawaii state income tax return (Form N-11)

- Businesses that are filing a Hawaii state income tax return (Form G-45)

- Estates and trusts that are filing a Hawaii state income tax return (Form N-40)

What Information is Required on the N-342 Form?

The N-342 form requires taxpayers to provide the following information:

- Name and address

- Social Security number or Federal Employer Identification Number (FEIN)

- Hawaii tax identification number (if applicable)

- Type of tax return being filed (individual, business, estate, or trust)

- Tax year being reported

- Signature and date

How to Fill Out the N-342 Form

To fill out the N-342 form, follow these steps:

- Download the N-342 form from the Hawaii Department of Taxation website or obtain a copy from a local tax office.

- Read the instructions carefully and ensure you have all the necessary information and documents.

- Fill out the form accurately and completely, using black ink and printing or typing the information.

- Sign and date the form.

How to File the N-342 Form

The N-342 form can be filed electronically or by mail. To file electronically, taxpayers can use the Hawaii Department of Taxation's online filing system. To file by mail, taxpayers should send the completed form to the address listed on the form.

Electronic Filing

To file electronically, follow these steps:

- Go to the Hawaii Department of Taxation website and click on the "File Online" button.

- Create an account or log in to your existing account.

- Select the tax year and type of return you are filing.

- Upload the required documents and information.

- Review and submit your return.

Mailing the N-342 Form

To file by mail, follow these steps:

- Complete the N-342 form accurately and sign it.

- Attach the required documents and information.

- Mail the form to the address listed on the form.

Deadlines and Penalties

The deadline for filing the N-342 form is April 20th for individual taxpayers and March 15th for businesses and estates. Failure to file the form by the deadline may result in penalties and interest.

Penalties

The Hawaii Department of Taxation imposes penalties for late filing and payment of taxes. The penalties are as follows:

- 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25% for failure to file

Conclusion

Filing the N-342 form is a crucial step in the Hawaii state tax filing process. By following the instructions and guidelines outlined in this article, taxpayers can ensure accurate and timely filing of their tax returns. Remember to file electronically or by mail, and avoid penalties by meeting the deadline.

We hope this article has provided you with a comprehensive guide to filing the N-342 form. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the purpose of the N-342 form?

+The N-342 form is a declaration of the accuracy of the information reported on the tax return.

Who needs to file the N-342 form?

+Individuals, businesses, estates, and trusts that are filing a Hawaii state income tax return.

How do I file the N-342 form?

+You can file the N-342 form electronically or by mail.