The state of Michigan requires businesses and individuals to collect and remit sales tax on certain transactions. However, there are certain exemptions available for qualifying entities. To take advantage of these exemptions, a Michigan Sales Tax Exemption Certificate Form 3372 must be completed and submitted to the seller. In this article, we will guide you through the process of completing and using the Form 3372, as well as provide information on the types of exemptions available and the requirements for eligibility.

Understanding the Michigan Sales Tax Exemption Certificate Form 3372

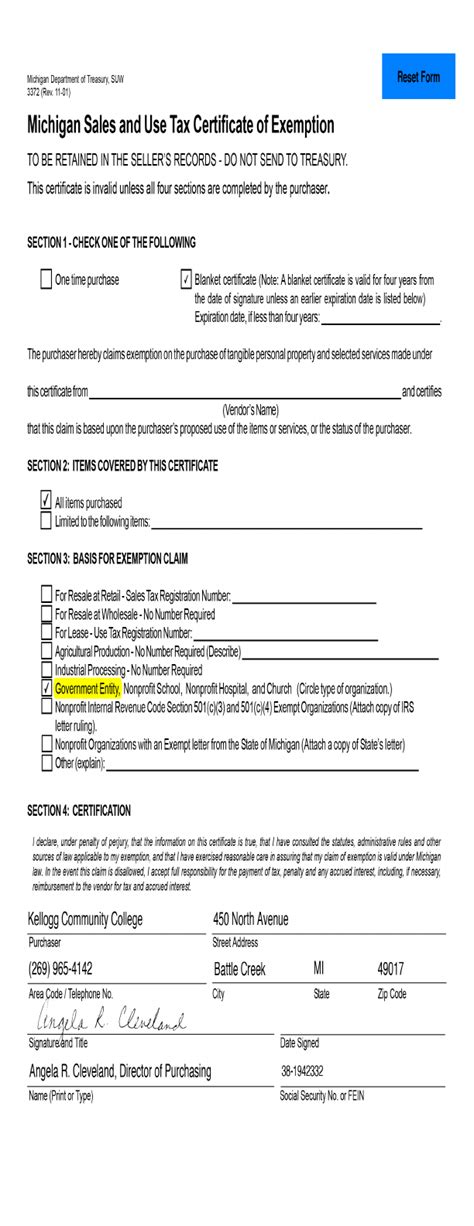

The Michigan Sales Tax Exemption Certificate Form 3372 is a document used by buyers to certify that they are exempt from paying sales tax on certain purchases. The form is typically used by businesses, non-profit organizations, and government agencies that are exempt from paying sales tax under Michigan law.

Types of Exemptions Available

There are several types of exemptions available in Michigan, including:

- Business exemption: Available to businesses that purchase goods or services for resale or use in the production of tangible personal property.

- Non-profit exemption: Available to non-profit organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code.

- Government exemption: Available to government agencies and instrumentalities that are exempt from paying sales tax under Michigan law.

- Veterans exemption: Available to veterans who are exempt from paying sales tax on certain purchases.

Completing the Michigan Sales Tax Exemption Certificate Form 3372

To complete the Form 3372, you will need to provide the following information:

- Buyer's name and address: The name and address of the buyer claiming the exemption.

- Seller's name and address: The name and address of the seller.

- Exemption type: The type of exemption being claimed (business, non-profit, government, etc.).

- Exemption certificate number: The exemption certificate number issued by the Michigan Department of Treasury (if applicable).

- Description of goods or services: A description of the goods or services being purchased.

- Signature and date: The signature and date of the buyer claiming the exemption.

Requirements for Eligibility

To be eligible for a sales tax exemption in Michigan, the buyer must meet certain requirements, including:

- Registration with the Michigan Department of Treasury: The buyer must be registered with the Michigan Department of Treasury and have an exemption certificate number.

- Qualifying purchases: The buyer must make qualifying purchases that are exempt from sales tax under Michigan law.

- Completion of Form 3372: The buyer must complete and submit the Form 3372 to the seller.

Using the Michigan Sales Tax Exemption Certificate Form 3372

Once the Form 3372 is completed and signed, it should be submitted to the seller. The seller will then verify the exemption and exempt the purchase from sales tax.

Record Keeping Requirements

Buyers and sellers must keep records of the Form 3372, including the exemption certificate number and the description of the goods or services purchased. These records must be kept for at least four years and made available for audit by the Michigan Department of Treasury.

Common Mistakes to Avoid

When completing and using the Form 3372, there are several common mistakes to avoid, including:

- Incomplete or inaccurate information: Ensure that all information on the form is complete and accurate.

- Failure to register with the Michigan Department of Treasury: Ensure that the buyer is registered with the Michigan Department of Treasury and has an exemption certificate number.

- Failure to verify the exemption: Ensure that the seller verifies the exemption and exempts the purchase from sales tax.

Penalties for Non-Compliance

Failure to comply with the requirements for the Form 3372 can result in penalties, including fines and interest on unpaid sales tax.

Conclusion

The Michigan Sales Tax Exemption Certificate Form 3372 is an important document used by buyers to certify that they are exempt from paying sales tax on certain purchases. To take advantage of the exemptions available in Michigan, buyers must complete and submit the Form 3372 to the seller. By understanding the requirements for eligibility and the process for completing and using the Form 3372, buyers can ensure that they are in compliance with Michigan law and avoid penalties for non-compliance.

What is the Michigan Sales Tax Exemption Certificate Form 3372?

+The Michigan Sales Tax Exemption Certificate Form 3372 is a document used by buyers to certify that they are exempt from paying sales tax on certain purchases.

Who is eligible for a sales tax exemption in Michigan?

+Businesses, non-profit organizations, and government agencies that are exempt from paying sales tax under Michigan law are eligible for a sales tax exemption.

How do I complete the Michigan Sales Tax Exemption Certificate Form 3372?

+To complete the Form 3372, you will need to provide the buyer's name and address, seller's name and address, exemption type, exemption certificate number, description of goods or services, and signature and date.