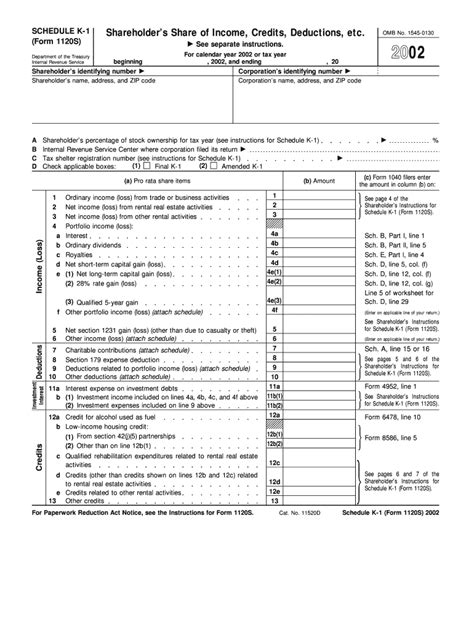

As a business owner, filing taxes can be a daunting task, especially when it comes to complex forms like the Form 1120S Schedule K-1. This form is used to report the income, deductions, and credits of a Subchapter S corporation, also known as an S corp. The Schedule K-1 is a crucial part of the tax return, as it breaks down the business income and expenses among the shareholders. In this article, we will explore the 5 ways to fill out Form 1120S Schedule K-1, providing you with a comprehensive guide to help you navigate this complex process.

Understanding the Purpose of Form 1120S Schedule K-1

Before we dive into the 5 ways to fill out the form, it's essential to understand the purpose of the Schedule K-1. The main objective of this form is to report the business income and expenses to the shareholders, who will then use this information to complete their personal tax returns. The Schedule K-1 provides a detailed breakdown of the business income, deductions, and credits, which helps the shareholders determine their share of the business income and expenses.

Way 1: Gather Necessary Information

The first step in filling out the Form 1120S Schedule K-1 is to gather all the necessary information. This includes:

- Business income and expenses

- Depreciation and amortization

- Interest and dividends

- Capital gains and losses

- Tax credits and deductions

It's essential to have all the financial records and statements readily available to ensure accuracy and completeness. You may need to consult with your accountant or bookkeeper to gather all the necessary information.

Way 2: Complete the Entity Information

The next step is to complete the entity information section of the Schedule K-1. This includes:

- Business name and address

- Employer Identification Number (EIN)

- Tax year and accounting method

It's crucial to ensure that this information is accurate and matches the information reported on the Form 1120S.

Way 3: Calculate the Business Income and Expenses

The third step is to calculate the business income and expenses. This includes:

- Gross receipts and sales

- Cost of goods sold

- Operating expenses

- Depreciation and amortization

- Interest and dividends

You will need to use the financial records and statements gathered in Step 1 to calculate the business income and expenses.

Way 4: Allocate the Business Income and Expenses to Shareholders

The fourth step is to allocate the business income and expenses to the shareholders. This includes:

- Allocating the business income and expenses to each shareholder based on their ownership percentage

- Calculating the shareholder's share of the business income and expenses

You will need to use the information calculated in Step 3 to allocate the business income and expenses to each shareholder.

Way 5: Review and Sign the Schedule K-1

The final step is to review and sign the Schedule K-1. This includes:

- Reviewing the information reported on the Schedule K-1 for accuracy and completeness

- Signing the Schedule K-1 as the authorized representative of the business

It's essential to ensure that the information reported on the Schedule K-1 is accurate and complete to avoid any potential penalties or fines.

Take Action

Filling out the Form 1120S Schedule K-1 can be a complex and time-consuming process. However, by following the 5 ways outlined in this article, you can ensure that you complete the form accurately and efficiently. Remember to gather all the necessary information, complete the entity information, calculate the business income and expenses, allocate the business income and expenses to shareholders, and review and sign the Schedule K-1.

If you have any questions or concerns about filling out the Form 1120S Schedule K-1, please don't hesitate to comment below. We would be happy to help you navigate this complex process.

What is the purpose of the Schedule K-1?

+The main objective of the Schedule K-1 is to report the business income and expenses to the shareholders, who will then use this information to complete their personal tax returns.

What information do I need to gather to fill out the Schedule K-1?

+You will need to gather all the financial records and statements, including business income and expenses, depreciation and amortization, interest and dividends, capital gains and losses, and tax credits and deductions.

How do I allocate the business income and expenses to shareholders?

+You will need to allocate the business income and expenses to each shareholder based on their ownership percentage, and calculate the shareholder's share of the business income and expenses.