As the tax filing deadline approaches, many individuals and businesses find themselves scrambling to complete their tax returns on time. However, unexpected circumstances can arise, making it impossible to meet the deadline. This is where the IRS Form 8868 comes into play, providing a lifeline for those who need more time to file their tax returns.

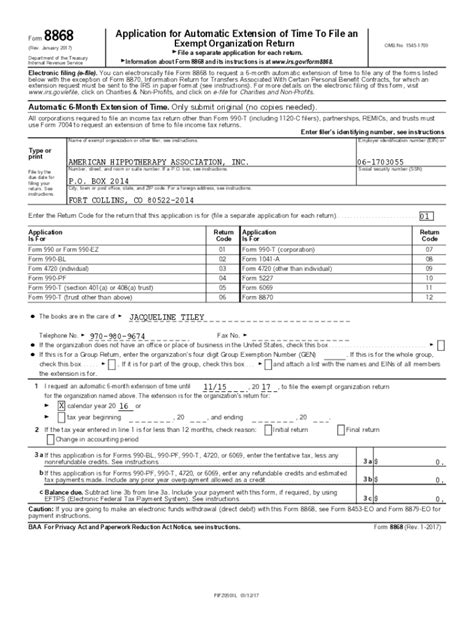

The IRS Form 8868, also known as the Application for Automatic Extension of Time To File an Exempt Organization Return, is a simple yet powerful tool that allows exempt organizations, including charities, non-profits, and other tax-exempt entities, to request an automatic six-month extension to file their tax returns. In this article, we will delve into the world of Form 8868, exploring its benefits, working mechanisms, and step-by-step filing process.

Benefits of Filing Form 8868

Filing Form 8868 offers numerous benefits to exempt organizations, including:

- Automatic Extension: The most significant advantage of filing Form 8868 is the automatic six-month extension to file tax returns. This allows organizations to take their time, gather necessary documents, and ensure accuracy in their tax returns.

- Reduced Penalties: By filing Form 8868, organizations can avoid late-filing penalties and interest on unpaid taxes. This can result in significant cost savings, especially for organizations with complex tax returns.

- Increased Flexibility: The automatic extension provided by Form 8868 gives organizations the flexibility to manage their tax filing process, allowing them to prioritize other critical tasks and projects.

Eligibility Criteria for Form 8868

To be eligible to file Form 8868, organizations must meet the following criteria:

- Exempt Organization: Only exempt organizations, including charities, non-profits, and other tax-exempt entities, are eligible to file Form 8868.

- Tax Return Filing Requirements: Organizations must have a tax return filing requirement, such as Form 990, Form 990-EZ, or Form 990-PF.

- Original Filing Deadline: The original filing deadline for the tax return must have passed, and the organization must not have previously filed for an extension.

Step-by-Step Filing Process for Form 8868

Filing Form 8868 is a straightforward process that can be completed in a few easy steps:

- Gather Required Information: Organizations will need to gather their Employer Identification Number (EIN), tax return type, and original filing deadline.

- Access the Form: Form 8868 can be accessed on the IRS website or through tax software providers.

- Complete the Form: Fill out the form, ensuring accuracy and completeness. Organizations will need to provide their EIN, tax return type, and original filing deadline.

- Submit the Form: Submit the completed form to the IRS, either electronically or by mail.

Common Mistakes to Avoid When Filing Form 8868

While filing Form 8868 is a relatively simple process, there are common mistakes that organizations should avoid:

- Inaccurate Information: Ensure accuracy and completeness when filling out the form, as errors can lead to delays or rejection.

- Late Filing: Submit the form before the original filing deadline to avoid late-filing penalties and interest.

- Insufficient Documentation: Keep records of the form submission, including proof of mailing or electronic submission confirmation.

Additional Tips and Reminders for Form 8868 Filers

In addition to the step-by-step filing process, the following tips and reminders can help organizations navigate the Form 8868 filing process:

- Electronic Filing: The IRS encourages electronic filing, which can result in faster processing and reduced errors.

- Filing Deadline: The extended filing deadline is typically six months from the original deadline. However, this deadline can vary depending on the tax return type and original filing deadline.

- Multiple Extensions: Organizations can file multiple extensions, but each extension request must be submitted separately.

Conclusion

The IRS Form 8868 is a valuable tool for exempt organizations, providing an automatic six-month extension to file tax returns. By understanding the benefits, eligibility criteria, and step-by-step filing process, organizations can navigate the Form 8868 filing process with ease. Remember to avoid common mistakes, take advantage of electronic filing, and keep records of the form submission. If you have any questions or concerns about Form 8868, we encourage you to share them in the comments below.

What is the purpose of IRS Form 8868?

+IRS Form 8868 is an application for automatic extension of time to file an exempt organization return.

Who is eligible to file Form 8868?

+Exempt organizations, including charities, non-profits, and other tax-exempt entities, are eligible to file Form 8868.

How do I file Form 8868?

+Form 8868 can be filed electronically or by mail, and the process typically involves gathering required information, accessing the form, completing the form, and submitting it to the IRS.