The Earned Income Tax Credit (EITC) is a refundable tax credit designed to help low-to-moderate-income working individuals and families. The Advance Earned Income Credit (AEIC) is a provision that allows eligible taxpayers to receive a portion of their EITC in advance, rather than waiting until they file their tax return. To claim the AEIC, taxpayers must complete and submit IRS Form 7205. In this article, we will explore the details of Form 7205, including its purpose, eligibility requirements, and step-by-step instructions for completion.

What is IRS Form 7205?

IRS Form 7205, also known as the Advance Earned Income Credit, is used by taxpayers to claim the AEIC. This form is typically completed by employers, who then use it to calculate the amount of AEIC to be paid to eligible employees. The AEIC is a portion of the EITC that eligible taxpayers can receive in advance, rather than waiting until they file their tax return.

Benefits of the Advance Earned Income Credit

The AEIC provides several benefits to eligible taxpayers, including:

- Reduced financial burden: By receiving a portion of their EITC in advance, taxpayers can reduce their financial burden and better manage their expenses.

- Increased cash flow: The AEIC can provide a much-needed influx of cash for taxpayers who are struggling to make ends meet.

- Simplified tax filing: Taxpayers who receive the AEIC may have a simpler tax filing process, as they will have already received a portion of their EITC.

Eligibility Requirements for Form 7205

To be eligible for the AEIC, taxpayers must meet certain requirements, including:

- Earned income: Taxpayers must have earned income from a job, such as wages, salaries, or tips.

- Income limits: Taxpayers must meet certain income limits, which vary based on filing status and number of qualifying children.

- Qualifying children: Taxpayers must have qualifying children, who are defined as children under the age of 19, or under the age of 24 if a full-time student.

- Residency: Taxpayers must be a U.S. citizen or resident alien, and must have a valid Social Security number.

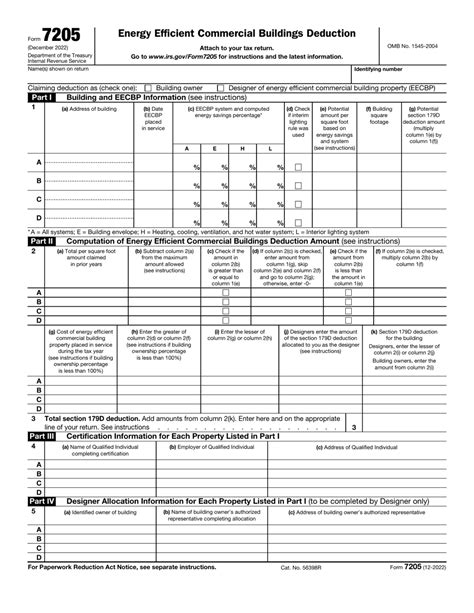

Step-by-Step Instructions for Completing Form 7205

Completing Form 7205 is a relatively straightforward process. Here's a step-by-step guide:

- Determine eligibility: Review the eligibility requirements to ensure you qualify for the AEIC.

- Gather necessary documents: You will need to provide documentation to support your eligibility, such as proof of income and qualifying children.

- Complete Part I: Provide your name, address, and Social Security number.

- Complete Part II: Provide information about your earned income, including your employer's name and address.

- Complete Part III: Provide information about your qualifying children, including their names, ages, and relationship to you.

- Calculate the AEIC: Use the AEIC worksheet to calculate the amount of AEIC you are eligible for.

- Sign and date the form: Sign and date the form, and provide any additional documentation required.

Deadlines and Penalties for Form 7205

There are no specific deadlines for submitting Form 7205, as it is typically completed by employers. However, taxpayers who are eligible for the AEIC should ensure that their employer submits the form on their behalf.

Failure to comply with the requirements for Form 7205 can result in penalties, including:

- Loss of AEIC: Taxpayers who fail to meet the eligibility requirements or provide required documentation may lose their eligibility for the AEIC.

- Tax penalties: Taxpayers who fail to report the AEIC on their tax return may be subject to tax penalties.

Common Errors to Avoid When Completing Form 7205

Here are some common errors to avoid when completing Form 7205:

- Incomplete or inaccurate information: Ensure that all information is complete and accurate, including your name, address, and Social Security number.

- Failure to provide required documentation: Ensure that you provide all required documentation, including proof of income and qualifying children.

- Miscalculation of AEIC: Use the AEIC worksheet to calculate the correct amount of AEIC you are eligible for.

Additional Resources for Form 7205

Here are some additional resources for Form 7205:

- IRS website: The IRS website provides detailed information on Form 7205, including eligibility requirements and step-by-step instructions for completion.

- Tax professional: Consider consulting a tax professional if you have questions or concerns about Form 7205.

- Employer: If you are an employee, consult with your employer to ensure that they are completing Form 7205 on your behalf.

FAQs for Form 7205

Here are some frequently asked questions for Form 7205:

- Q: Who is eligible for the AEIC? A: Taxpayers who meet certain income limits, have qualifying children, and have earned income from a job.

- Q: How do I claim the AEIC? A: Complete Form 7205 and submit it to your employer, who will then calculate the AEIC and pay it to you.

- Q: What is the deadline for submitting Form 7205? A: There is no specific deadline for submitting Form 7205, as it is typically completed by employers.

What is the Advance Earned Income Credit (AEIC)?

+The AEIC is a provision that allows eligible taxpayers to receive a portion of their EITC in advance, rather than waiting until they file their tax return.

Who is eligible for the AEIC?

+Taxpayers who meet certain income limits, have qualifying children, and have earned income from a job.

How do I claim the AEIC?

+Complete Form 7205 and submit it to your employer, who will then calculate the AEIC and pay it to you.

We hope this article has provided you with a comprehensive understanding of Form 7205 and the Advance Earned Income Credit. If you have any further questions or concerns, please don't hesitate to comment below.