Are you facing a financial emergency and need to access your retirement funds? If you have a Merrill Lynch account, you may be eligible for a hardship withdrawal. In this article, we will provide a step-by-step guide on how to complete a Merrill Lynch hardship withdrawal form, as well as explain the rules and regulations surrounding this type of withdrawal.

What is a Hardship Withdrawal?

A hardship withdrawal is a type of withdrawal from a retirement account, such as a 401(k) or IRA, that is allowed due to a financial emergency or hardship. The rules and regulations surrounding hardship withdrawals are governed by the IRS, and the specific requirements may vary depending on the type of account you have.

Eligibility for a Hardship Withdrawal

To be eligible for a hardship withdrawal, you must meet certain requirements, including:

- You must have an immediate and heavy financial need, such as:

- Unreimbursed medical expenses

- Funeral expenses

- Tuition or education expenses

- Payments to prevent foreclosure or eviction

- Repair costs for primary residence

- You must have exhausted all other financial resources, including:

- Liquidating other assets

- Taking out a loan

- Reducing expenses

- You must not have taken a hardship withdrawal in the past 12 months

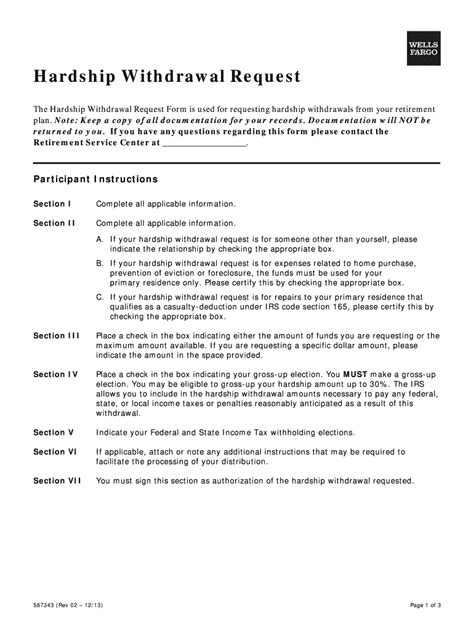

How to Complete a Merrill Lynch Hardship Withdrawal Form

If you meet the eligibility requirements, you can complete a Merrill Lynch hardship withdrawal form to request a withdrawal from your account. Here is a step-by-step guide to completing the form:

- Log in to your Merrill Lynch account online or contact a representative to request a hardship withdrawal form.

- Review the form carefully and ensure you meet the eligibility requirements.

- Complete the form with the required information, including:

- Your account number and name

- The amount of the withdrawal

- The reason for the withdrawal (select one of the eligible reasons)

- Your signature and date

- Attach supporting documentation, such as:

- Medical bills or receipts

- Funeral expenses or receipts

- Tuition or education expenses

- Proof of foreclosure or eviction

- Submit the completed form and supporting documentation to Merrill Lynch.

Rules and Regulations

It's essential to understand the rules and regulations surrounding hardship withdrawals. Some key points to keep in mind:

- Hardship withdrawals are subject to a 10% penalty tax if you are under age 59 1/2.

- You will also be required to pay income tax on the withdrawal.

- The withdrawal amount will be reported to the IRS.

- You may be required to take a withdrawal of a minimum amount (typically $1,000).

Alternatives to Hardship Withdrawal

Before completing a hardship withdrawal form, consider alternative options, such as:

- Taking out a loan from your retirement account (if available)

- Reducing expenses or creating a budget

- Liquidating other assets

- Seeking financial assistance from non-profit organizations or government agencies

Tips and Reminders

- Keep in mind that hardship withdrawals should be used as a last resort, as they can impact your long-term retirement savings.

- Consider consulting with a financial advisor before completing a hardship withdrawal form.

- Ensure you understand the tax implications and potential penalties associated with hardship withdrawals.

Next Steps

If you have completed a Merrill Lynch hardship withdrawal form and submitted it to the company, here's what to expect next:

- Merrill Lynch will review your request and verify the information.

- If approved, the withdrawal amount will be processed and sent to you.

- You will receive a confirmation letter and a tax document (Form 1099-R) for your records.

By following these steps and understanding the rules and regulations surrounding hardship withdrawals, you can ensure a smooth and efficient process. Remember to consider alternative options and seek financial guidance before making a decision.

What is a hardship withdrawal?

+A hardship withdrawal is a type of withdrawal from a retirement account that is allowed due to a financial emergency or hardship.

How do I complete a Merrill Lynch hardship withdrawal form?

+Complete the form with the required information, including your account number, name, and reason for the withdrawal. Attach supporting documentation and submit the form to Merrill Lynch.

What are the tax implications of a hardship withdrawal?

+Hardship withdrawals are subject to a 10% penalty tax if you are under age 59 1/2 and income tax. The withdrawal amount will be reported to the IRS.