In the world of business and finance, compliance with regulatory requirements is crucial for maintaining a smooth operation. One such requirement is the filing of the OGE Form 278, a document that plays a significant role in the ethics and compliance landscape of the United States. In this article, we will delve into the details of the OGE Form 278, its purpose, and the requirements surrounding its filing.

Understanding the OGE Form 278

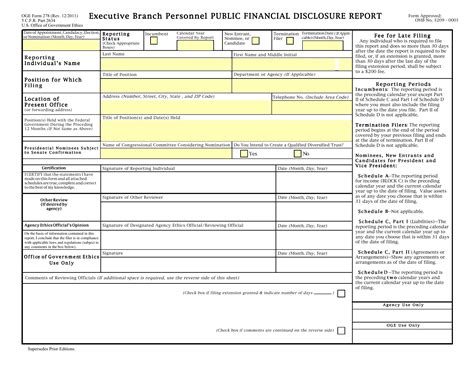

The OGE Form 278, also known as the Executive Branch Personnel Public Financial Disclosure Report, is a document that certain individuals in the executive branch of the U.S. government are required to file. The form is designed to provide transparency and accountability by disclosing the financial interests and holdings of these individuals. The Office of Government Ethics (OGE) is responsible for administering the filing requirements and ensuring compliance.

Who Needs to File the OGE Form 278?

Not everyone in the executive branch is required to file the OGE Form 278. The filing requirement applies to certain individuals who hold positions that are classified as "public filers." These individuals include:

- Presidential appointees who are confirmed by the Senate

- High-ranking officials in the executive branch, including those in the Senior Executive Service (SES)

- Officers and employees in the executive branch who have access to confidential or sensitive information

- Other individuals who are designated by the head of their agency as public filers

Filing Requirements and Deadlines

Public filers are required to file the OGE Form 278 on an annual basis, as well as when they enter or leave government service. The form must be filed within a specified timeframe, which varies depending on the individual's circumstances. For example:

- New entrants to the executive branch must file the form within 30 days of assuming their position

- Annual filers must submit the form by May 15th of each year

- Termination filers must file the form within 30 days of leaving government service

Consequences of Non-Compliance

Failure to file the OGE Form 278 or filing an incomplete or inaccurate form can result in serious consequences, including:

- Disciplinary action, up to and including termination

- Civil penalties, including fines and damages

- Damage to one's professional reputation

What to Report on the OGE Form 278

The OGE Form 278 requires public filers to disclose a wide range of financial information, including:

- Income and investments

- Real estate holdings

- Liabilities and debts

- Gifts and reimbursements

- Positions held in outside organizations

Confidential Filings

In certain circumstances, public filers may be eligible to file a confidential version of the OGE Form 278. This is typically the case for individuals who are in sensitive or high-risk positions, such as those involved in national security or law enforcement. Confidential filers are required to disclose the same financial information as public filers, but their forms are not made publicly available.

Amendments and Updates

Public filers are required to update their OGE Form 278 whenever their financial situation changes. This includes reporting any new income, investments, or liabilities, as well as any changes to their outside positions or affiliations.

Electronic Filing

The OGE offers an electronic filing system for the OGE Form 278, which allows public filers to submit their forms online. This system provides a secure and efficient way to file the form and reduces the risk of errors or omissions.

Conclusion

In conclusion, the OGE Form 278 is a critical component of the ethics and compliance framework in the executive branch of the U.S. government. Public filers are required to disclose their financial interests and holdings, and failure to comply can result in serious consequences. By understanding the filing requirements and deadlines, as well as what to report on the form, public filers can ensure that they are in compliance with the regulations and avoid any potential penalties.

We encourage you to share your thoughts and questions about the OGE Form 278 in the comments section below. If you have any specific questions or concerns about the filing requirements, please don't hesitate to reach out to us.

Who is required to file the OGE Form 278?

+Public filers, including presidential appointees, high-ranking officials, and certain officers and employees in the executive branch, are required to file the OGE Form 278.

What is the deadline for filing the OGE Form 278?

+The deadline for filing the OGE Form 278 varies depending on the individual's circumstances, but annual filers must submit the form by May 15th of each year.

What happens if I fail to file the OGE Form 278?

+Failure to file the OGE Form 278 or filing an incomplete or inaccurate form can result in serious consequences, including disciplinary action, civil penalties, and damage to one's professional reputation.