When it comes to managing the distribution of assets after the passing of a loved one, navigating the complexities of beneficiary forms can be overwhelming. For those dealing with Merrill Lynch accounts, understanding the beneficiary distribution form is crucial to ensuring that the deceased's assets are distributed according to their wishes. In this article, we will break down the Merrill Lynch beneficiary distribution form, providing a comprehensive guide to help you through the process.

The importance of beneficiary forms cannot be overstated. These forms ensure that assets are distributed to the intended recipients, avoiding costly probate processes and ensuring that the deceased's wishes are respected. However, the process of filling out these forms can be daunting, especially for those without prior experience with estate planning or financial management.

Merrill Lynch, a well-established financial services company, provides its clients with a beneficiary distribution form to facilitate the transfer of assets to beneficiaries. This form is designed to be user-friendly, but it's essential to understand the intricacies involved to avoid any potential issues or delays in the distribution process.

Understanding the Merrill Lynch Beneficiary Distribution Form

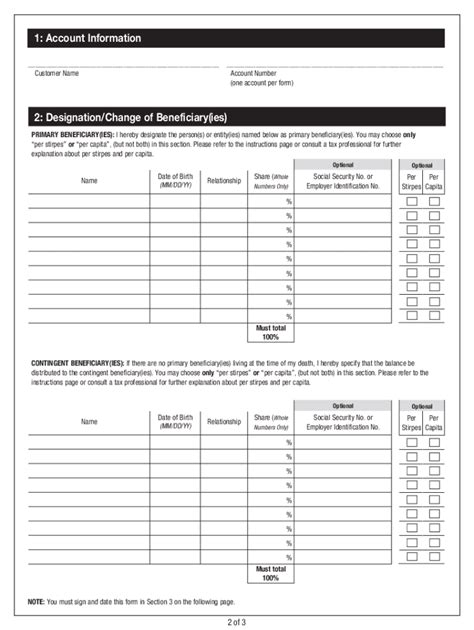

The Merrill Lynch beneficiary distribution form is a multi-page document that requires careful attention to detail. The form typically includes the following sections:

- Account Information: This section requires you to provide details about the account, including the account number, type, and registration.

- Beneficiary Information: Here, you will need to list the beneficiaries, including their names, addresses, and social security numbers or tax identification numbers.

- Distribution Instructions: This section allows you to specify how the assets should be distributed among the beneficiaries. You can choose to distribute the assets equally or according to a specific percentage.

Steps to Complete the Form

To ensure that the form is completed correctly, follow these steps:

- Gather required information: Before starting the form, make sure you have all the necessary information, including the account details, beneficiary information, and distribution instructions.

- Read the instructions carefully: Take the time to read the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately: Complete the form accurately, ensuring that all information is correct and consistent.

- Sign and date the form: Once the form is complete, sign and date it, ensuring that you have followed the instructions provided.

Tips for Completing the Form

To avoid common mistakes and ensure that the form is completed correctly, consider the following tips:

- Use a pen: When filling out the form, use a pen to avoid any potential issues with pencil marks.

- Be concise: Keep your answers concise and to the point, avoiding any unnecessary information.

- Use correct terminology: Ensure that you use the correct terminology, avoiding any ambiguous language.

- Review the form carefully: Before submitting the form, review it carefully to ensure that all information is accurate and complete.

Merrill Lynch Beneficiary Distribution Form FAQs

Still have questions about the Merrill Lynch beneficiary distribution form? Here are some frequently asked questions to help:

- Q: Who should I contact if I have questions about the form? A: You can contact Merrill Lynch customer support or consult with a financial advisor.

- Q: Can I submit the form electronically? A: Yes, you can submit the form electronically, but ensure that you follow the instructions provided.

- Q: How long does it take to process the form? A: The processing time may vary, but it typically takes a few days to a few weeks.

Conclusion

Completing the Merrill Lynch beneficiary distribution form can be a daunting task, but by following these guidelines and tips, you can ensure that the process is smooth and efficient. Remember to take your time, review the form carefully, and seek help if needed. By doing so, you can ensure that the deceased's assets are distributed according to their wishes, bringing peace of mind to the beneficiaries.

We hope this comprehensive guide has been helpful in understanding the Merrill Lynch beneficiary distribution form. If you have any further questions or concerns, please don't hesitate to reach out.

What's your experience with beneficiary forms? Share your thoughts and questions in the comments below!

What is the purpose of a beneficiary distribution form?

+The purpose of a beneficiary distribution form is to ensure that assets are distributed to the intended recipients according to the deceased's wishes.

How do I obtain a Merrill Lynch beneficiary distribution form?

+You can obtain a Merrill Lynch beneficiary distribution form by contacting Merrill Lynch customer support or logging into your online account.

Can I change the beneficiaries on my account?

+Yes, you can change the beneficiaries on your account by completing a new beneficiary distribution form and submitting it to Merrill Lynch.