As a trusted financial institution, TIAA (Teachers Insurance and Annuity Association) provides its customers with a range of financial products and services, including retirement accounts, life insurance, and investment management. One of the essential tools that TIAA offers is the Power of Attorney (POA) form, which allows account holders to appoint a trusted individual to manage their financial affairs on their behalf. In this article, we will explore the five ways to use the TIAA Power of Attorney form, its benefits, and how to complete the form.

Understanding the TIAA Power of Attorney Form

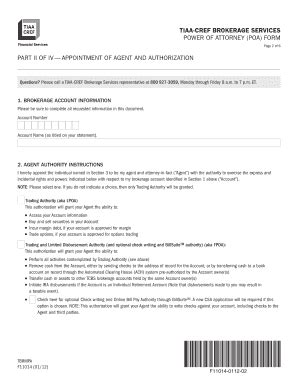

The TIAA Power of Attorney form is a legal document that grants a designated individual, known as the attorney-in-fact or agent, the authority to manage the account holder's financial affairs. This form is essential for account holders who want to ensure that their financial matters are taken care of in case they become incapacitated or are unable to manage their accounts themselves.

Benefits of Using the TIAA Power of Attorney Form

The TIAA Power of Attorney form offers several benefits to account holders, including:

- Ensures continuity of financial management: By appointing an attorney-in-fact, account holders can ensure that their financial affairs are managed continuously, even if they are unable to do so themselves.

- Provides peace of mind: Knowing that someone trusted is managing their financial affairs can give account holders peace of mind and reduce stress.

- Simplifies financial management: The attorney-in-fact can manage the account holder's financial affairs, including paying bills, managing investments, and making financial decisions.

5 Ways to Use the TIAA Power of Attorney Form

The TIAA Power of Attorney form can be used in the following ways:

1. Appointing an Attorney-in-Fact

The primary purpose of the TIAA Power of Attorney form is to appoint an attorney-in-fact to manage the account holder's financial affairs. This can be a trusted family member, friend, or financial advisor.

2. Managing Retirement Accounts

The attorney-in-fact can manage the account holder's retirement accounts, including making investment decisions, withdrawing funds, and managing account beneficiaries.

3. Handling Life Insurance Policies

The attorney-in-fact can manage the account holder's life insurance policies, including making premium payments, changing beneficiaries, and filing claims.

4. Making Investment Decisions

The attorney-in-fact can make investment decisions on behalf of the account holder, including buying and selling securities, managing investment portfolios, and making investment recommendations.

5. Managing Estate Planning

The attorney-in-fact can manage the account holder's estate planning, including creating a will, establishing trusts, and managing estate taxes.

How to Complete the TIAA Power of Attorney Form

To complete the TIAA Power of Attorney form, account holders should follow these steps:

- Download the form from the TIAA website or obtain a copy from a TIAA representative.

- Read the form carefully and understand the terms and conditions.

- Appoint an attorney-in-fact by providing their name, address, and contact information.

- Specify the powers granted to the attorney-in-fact, including managing retirement accounts, handling life insurance policies, making investment decisions, and managing estate planning.

- Sign and date the form in the presence of a notary public.

Conclusion

The TIAA Power of Attorney form is an essential tool for account holders who want to ensure that their financial affairs are managed continuously, even if they are unable to do so themselves. By understanding the benefits and uses of the form, account holders can make informed decisions about their financial management.

We encourage you to share your thoughts and experiences with the TIAA Power of Attorney form in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of the TIAA Power of Attorney form?

+The purpose of the TIAA Power of Attorney form is to grant a designated individual, known as the attorney-in-fact or agent, the authority to manage the account holder's financial affairs.

Who can be appointed as an attorney-in-fact?

+An attorney-in-fact can be a trusted family member, friend, or financial advisor.

What powers can be granted to the attorney-in-fact?

+The powers granted to the attorney-in-fact can include managing retirement accounts, handling life insurance policies, making investment decisions, and managing estate planning.