Editing a Public Service Loan Forgiveness (PSLF) form can be a daunting task, especially with the numerous requirements and documentation needed. However, it's crucial to get it right to ensure your eligibility for loan forgiveness. In this article, we'll guide you through the process, highlighting the essential steps to edit your PSLF form correctly.

As a borrower, it's essential to understand the PSLF program's requirements and the importance of accurate documentation. The PSLF program is designed to forgive the remaining balance on your Direct Loans after you've made 120 qualifying payments while working full-time for a qualifying employer. To take advantage of this program, you'll need to submit a PSLF form, which requires precise editing to avoid errors.

Understanding the PSLF Form

Before we dive into the editing process, it's crucial to understand the PSLF form's components. The form typically consists of several sections, including:

- Borrower information

- Employment information

- Loan information

- Payment history

- Certification

Each section requires specific documentation and information, which we'll discuss in detail later.

5 Ways to Edit PSLF Form Correctly

1. Verify Borrower Information

The first step in editing your PSLF form is to verify your borrower information. This includes your name, date of birth, Social Security number, and contact information. Ensure that all the information is accurate and matches your loan documents.

- Check your loan statements and identification documents to confirm your borrower information.

- Update your information if there have been any changes since your last loan application.

2. Confirm Employment Information

To qualify for PSLF, you must work full-time for a qualifying employer. When editing your PSLF form, ensure that your employment information is accurate and complete.

- Verify your employer's name, address, and tax ID number.

- Confirm your employment dates, job title, and hours worked per week.

- Ensure that your employer is a qualifying employer, such as a government agency, 501(c)(3) organization, or private non-profit organization.

3. Review Loan Information

Your loan information is critical to the PSLF application process. When editing your form, ensure that your loan information is accurate and up-to-date.

- Verify your loan account numbers, loan types, and loan balances.

- Confirm your loan servicer's information and contact details.

- Ensure that you've included all eligible loans, such as Direct Loans and Federal Family Education Loans (FFEL).

4. Track Payment History

To qualify for PSLF, you must make 120 qualifying payments while working full-time for a qualifying employer. When editing your PSLF form, ensure that your payment history is accurate and complete.

- Verify your payment dates, amounts, and payment methods.

- Confirm that you've made 120 qualifying payments.

- Ensure that you've included any payment records, such as payment statements or cancelled checks.

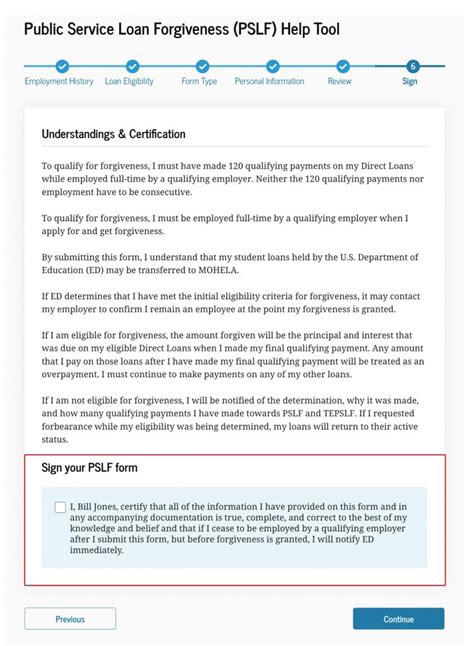

5. Certify Your Application

The final step in editing your PSLF form is to certify your application. This involves signing and dating the form, as well as providing any required documentation.

- Sign and date the form in the presence of a notary public, if required.

- Attach any required documentation, such as employment certification or payment records.

- Ensure that you've included all required information and documentation.

Common Mistakes to Avoid

When editing your PSLF form, it's essential to avoid common mistakes that can delay or reject your application. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Missing documentation or signatures

- Failure to certify the application

- Ineligible loans or employment

- Insufficient payment history

By avoiding these common mistakes, you can ensure that your PSLF application is processed smoothly and efficiently.

Conclusion

Editing a PSLF form requires attention to detail and accuracy. By following these 5 steps and avoiding common mistakes, you can ensure that your application is complete and eligible for loan forgiveness. Remember to verify your borrower information, confirm your employment information, review your loan information, track your payment history, and certify your application.

What is the PSLF program?

+The Public Service Loan Forgiveness (PSLF) program is a federal program that forgives the remaining balance on your Direct Loans after you've made 120 qualifying payments while working full-time for a qualifying employer.

Who is eligible for PSLF?

+To be eligible for PSLF, you must work full-time for a qualifying employer, such as a government agency, 501(c)(3) organization, or private non-profit organization, and make 120 qualifying payments on your Direct Loans.

How do I apply for PSLF?

+To apply for PSLF, you'll need to submit a PSLF form, which requires documentation and information about your employment, loans, and payment history. You can submit the form online or by mail.