As a nonresident of Kentucky, you may be wondering if you need to file a tax return in the Bluegrass State. The answer is yes, if you have income sourced from Kentucky, you are required to file a nonresident tax return. In this article, we will delve into the world of Form 740-NP, the nonresident tax filing form in Kentucky, and explain everything you need to know.

Kentucky is one of the many states that require nonresidents to file a tax return if they have income sourced from within the state. This includes income from employment, self-employment, investments, and other sources. The Kentucky Department of Revenue requires nonresidents to file Form 740-NP, which is used to report income earned in Kentucky.

Who Needs to File Form 740-NP?

Not everyone who earns income in Kentucky needs to file Form 740-NP. To determine if you need to file, you should ask yourself the following questions:

- Did you earn income from a Kentucky source?

- Are you a nonresident of Kentucky?

- Do you have a tax liability in Kentucky?

If you answered yes to these questions, you will likely need to file Form 740-NP.

Types of Income That Require Filing

There are several types of income that require nonresidents to file Form 740-NP. These include:

- Wages and salaries earned from a Kentucky employer

- Self-employment income earned from a Kentucky business

- Rental income from a Kentucky property

- Investment income from a Kentucky source

- Other types of income earned in Kentucky

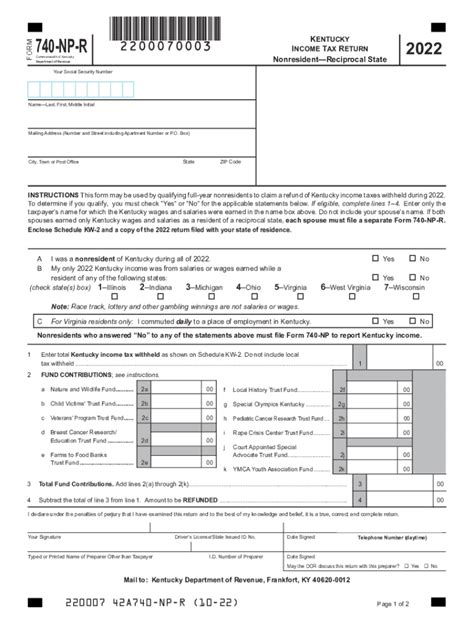

How to File Form 740-NP

Filing Form 740-NP is a relatively straightforward process. Here are the steps you need to follow:

- Gather all necessary documents, including your W-2 forms, 1099 forms, and other income statements.

- Download and complete Form 740-NP from the Kentucky Department of Revenue website.

- Calculate your tax liability using the tax tables or tax calculator provided by the Kentucky Department of Revenue.

- Pay any tax due by the filing deadline.

- File your completed Form 740-NP with the Kentucky Department of Revenue.

Deadlines and Penalties

The deadline for filing Form 740-NP is typically April 15th of each year. However, if you need more time to file, you can request an extension by submitting Form 740EXT. If you fail to file or pay your tax liability by the deadline, you may be subject to penalties and interest.

Benefits of Filing Form 740-NP

Filing Form 740-NP may seem like a hassle, but there are several benefits to doing so. Here are a few:

- Avoid penalties and interest by filing on time.

- Ensure you are in compliance with Kentucky tax laws.

- Take advantage of any tax credits or deductions you may be eligible for.

- Receive a refund if you overpaid your taxes.

Common Mistakes to Avoid

When filing Form 740-NP, there are several common mistakes to avoid. These include:

- Failing to report all income earned in Kentucky.

- Not claiming all eligible tax credits and deductions.

- Not paying tax due by the filing deadline.

- Not keeping accurate records of income and expenses.

Conclusion

In conclusion, filing Form 740-NP is an important part of being a nonresident with income sourced from Kentucky. By understanding who needs to file, how to file, and the benefits of filing, you can ensure you are in compliance with Kentucky tax laws and avoid any penalties or interest. Remember to file on time, claim all eligible tax credits and deductions, and keep accurate records of income and expenses.

Additional Resources

If you need additional help or resources, here are a few:

- Kentucky Department of Revenue website:

- IRS website:

- Tax professional or accountant

We hope this article has provided you with a comprehensive understanding of Form 740-NP and nonresident tax filing in Kentucky. If you have any questions or comments, please feel free to share them below.

Who needs to file Form 740-NP?

+Nonresidents who earn income from a Kentucky source need to file Form 740-NP.

What types of income require filing Form 740-NP?

+Types of income that require filing include wages and salaries, self-employment income, rental income, investment income, and other types of income earned in Kentucky.

What is the deadline for filing Form 740-NP?

+The deadline for filing Form 740-NP is typically April 15th of each year.