Filing The Maryland Mw507 Form: A Step-By-Step Guide

As a business owner in Maryland, it's essential to understand the state's tax requirements to avoid any penalties or fines. One of the crucial forms you'll need to file is the Maryland MW507 form, also known as the Employer's Quarterly Return of Income Tax Withheld. In this article, we'll provide a step-by-step guide on how to file the Maryland MW507 form, including the necessary information, deadlines, and calculations.

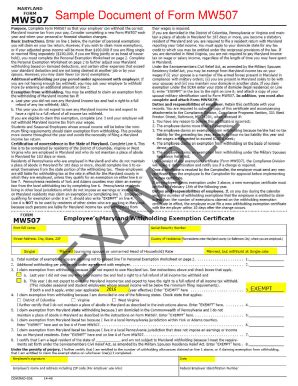

What is the Maryland MW507 Form?

The Maryland MW507 form is a quarterly return that employers must file to report the income tax withheld from their employees' wages. The form is used to calculate the amount of tax owed to the state of Maryland and to make payments for the quarter. Employers must file the MW507 form even if they have no tax to report or if they have made no payments for the quarter.

Who Needs to File the Maryland MW507 Form?

All employers in Maryland who withhold income tax from their employees' wages must file the MW507 form. This includes:

- Businesses with employees who are Maryland residents

- Businesses with employees who work in Maryland, even if they are not residents

- Businesses that withhold Maryland income tax from employees' wages

When is the Maryland MW507 Form Due?

The Maryland MW507 form is due on the last day of the month following the end of each quarter. The due dates are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st of the following year for the fourth quarter (October 1 - December 31)

Step-by-Step Guide to Filing the Maryland MW507 Form

To file the Maryland MW507 form, follow these steps:

Step 1: Gather Necessary Information

Before you start filing the MW507 form, gather the necessary information, including:

- Your business's federal employer identification number (FEIN)

- Your business's Maryland tax account number

- The total amount of income tax withheld from employees' wages for the quarter

- The total amount of wages paid to employees for the quarter

- The amount of tax owed to the state of Maryland

Step 2: Calculate the Tax Owed

To calculate the tax owed, you'll need to multiply the total amount of income tax withheld by the applicable tax rate. The tax rate for Maryland is 5.2% for 2022.

Step 3: Complete the MW507 Form

Complete the MW507 form, making sure to include all the necessary information. You can file the form online through the Maryland Comptroller's website or by mail.

Step 4: Make Payments

Make payments for the tax owed by the due date to avoid penalties and interest. You can make payments online, by phone, or by mail.

Calculating the Maryland Income Tax Withheld

To calculate the Maryland income tax withheld, you'll need to follow these steps:

- Determine the total amount of wages paid to employees for the quarter

- Determine the amount of income tax withheld from employees' wages for the quarter

- Multiply the amount of income tax withheld by the applicable tax rate (5.2% for 2022)

Example:

Let's say you paid $100,000 in wages to your employees for the quarter and withheld $5,200 in income tax.

- Total wages paid: $100,000

- Income tax withheld: $5,200

- Tax rate: 5.2%

- Tax owed: $5,200 x 5.2% = $270.40

Common Mistakes to Avoid When Filing the Maryland MW507 Form

To avoid penalties and fines, make sure to avoid the following common mistakes when filing the Maryland MW507 form:

- Filing the form late or not at all

- Not making payments for the tax owed

- Not reporting the correct amount of income tax withheld

- Not reporting the correct amount of wages paid to employees

Conclusion

Filing the Maryland MW507 form is a crucial step in meeting your business's tax obligations in the state of Maryland. By following the step-by-step guide outlined in this article, you can ensure that you're filing the form correctly and avoiding any penalties or fines. Remember to gather all the necessary information, calculate the tax owed, and make payments by the due date.

We encourage you to share your experiences or ask questions about filing the Maryland MW507 form in the comments below. You can also share this article with others who may find it helpful.

What is the deadline for filing the Maryland MW507 form?

+The deadline for filing the Maryland MW507 form is the last day of the month following the end of each quarter.

Who needs to file the Maryland MW507 form?

+All employers in Maryland who withhold income tax from their employees' wages must file the MW507 form.

What is the tax rate for Maryland income tax withheld?

+The tax rate for Maryland income tax withheld is 5.2% for 2022.