Understanding tax forms can be a daunting task, especially when it comes to forms that are specific to certain states or regions. The Maryland 1099-G form is one such document that is used to report unemployment benefits, as well as other types of income, to the state of Maryland. In this article, we will delve into the intricacies of the Maryland 1099-G form, exploring its purpose, who needs to file it, and how to navigate its various sections.

What is the Maryland 1099-G Form?

The Maryland 1099-G form is a tax document that is used to report various types of income, including unemployment benefits, state and local income tax refunds, and certain types of gambling winnings. The form is typically issued by the Maryland Department of Labor, Licensing and Regulation, and is used to provide information to the recipient about the amount of income they received during the tax year.

Who Needs to File the Maryland 1099-G Form?

The Maryland 1099-G form is typically issued to individuals who have received unemployment benefits, as well as those who have received state and local income tax refunds. Additionally, individuals who have received certain types of gambling winnings may also receive a 1099-G form.

In order to determine whether or not you need to file the Maryland 1099-G form, you will need to review the information contained on the form. If you have received income that is reported on the form, you will need to report that income on your tax return.

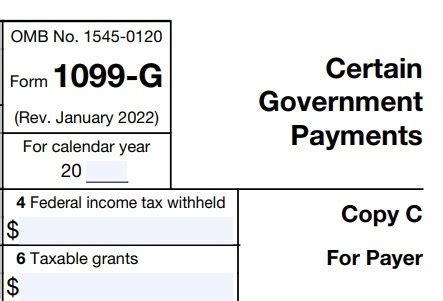

Understanding the Sections of the Maryland 1099-G Form

The Maryland 1099-G form is divided into several sections, each of which contains specific information about the income reported on the form. The sections of the form include:

- Box 1: Unemployment Benefits: This section reports the amount of unemployment benefits you received during the tax year.

- Box 2: State and Local Income Tax Refunds: This section reports the amount of state and local income tax refunds you received during the tax year.

- Box 3: Gambling Winnings: This section reports the amount of certain types of gambling winnings you received during the tax year.

- Box 4: Federal Income Tax Withheld: This section reports the amount of federal income tax that was withheld from your unemployment benefits or other income reported on the form.

- Box 5: State and Local Income Tax Withheld: This section reports the amount of state and local income tax that was withheld from your unemployment benefits or other income reported on the form.

How to Report Income from the Maryland 1099-G Form on Your Tax Return

In order to report income from the Maryland 1099-G form on your tax return, you will need to follow these steps:

- Review the form: Carefully review the information contained on the 1099-G form to ensure that it is accurate.

- Report unemployment benefits: Report the amount of unemployment benefits you received during the tax year on Schedule 1 of your tax return.

- Report state and local income tax refunds: Report the amount of state and local income tax refunds you received during the tax year on Schedule 1 of your tax return.

- Report gambling winnings: Report the amount of certain types of gambling winnings you received during the tax year on Schedule 1 of your tax return.

- Claim withholding credits: Claim any withholding credits you are eligible for on Schedule 3 of your tax return.

Tips for Navigating the Maryland 1099-G Form

Here are some tips for navigating the Maryland 1099-G form:

- Carefully review the form: Make sure to carefully review the information contained on the 1099-G form to ensure that it is accurate.

- Report all income: Make sure to report all income from the 1099-G form on your tax return.

- Claim withholding credits: Claim any withholding credits you are eligible for on Schedule 3 of your tax return.

- Seek professional help: If you are unsure about how to report income from the 1099-G form on your tax return, consider seeking the help of a tax professional.

Common Mistakes to Avoid When Filing the Maryland 1099-G Form

Here are some common mistakes to avoid when filing the Maryland 1099-G form:

- Failing to report all income: Make sure to report all income from the 1099-G form on your tax return.

- Failing to claim withholding credits: Claim any withholding credits you are eligible for on Schedule 3 of your tax return.

- Entering incorrect information: Make sure to enter all information from the 1099-G form correctly on your tax return.

Conclusion

In conclusion, the Maryland 1099-G form is an important tax document that is used to report various types of income, including unemployment benefits, state and local income tax refunds, and certain types of gambling winnings. By understanding the sections of the form and how to report income from the form on your tax return, you can ensure that you are in compliance with state and federal tax laws. Remember to carefully review the form, report all income, claim withholding credits, and seek professional help if you are unsure about how to report income from the 1099-G form on your tax return.

We hope this article has been helpful in explaining the Maryland 1099-G form. If you have any questions or comments, please don't hesitate to leave them in the section below.

What is the purpose of the Maryland 1099-G form?

+The Maryland 1099-G form is used to report various types of income, including unemployment benefits, state and local income tax refunds, and certain types of gambling winnings.

Who needs to file the Maryland 1099-G form?

+The Maryland 1099-G form is typically issued to individuals who have received unemployment benefits, as well as those who have received state and local income tax refunds.

How do I report income from the Maryland 1099-G form on my tax return?

+Report the amount of unemployment benefits, state and local income tax refunds, and certain types of gambling winnings on Schedule 1 of your tax return.