The IRS Form 15112 is a document used by the Internal Revenue Service to enable taxpayers to opt out of receiving paper copies of tax-related documents and instead receive them electronically. This can help reduce clutter, increase security, and contribute to a more environmentally friendly practice. Here are the 5 steps to complete IRS Form 15112:

Why Opt for Electronic Documents?

Before we dive into the steps, it's essential to understand the benefits of opting for electronic documents. Not only does it help reduce the amount of paper waste, but it also increases security and makes it easier to access and manage your tax-related documents. With electronic documents, you can quickly and easily access your information, reducing the risk of lost or misplaced documents.

Step 1: Gather Required Information

To complete IRS Form 15112, you will need to gather some information beforehand. This includes:

- Your name and address as they appear on your tax return

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your date of birth

Make sure you have this information readily available before proceeding to the next step.

Step 2: Download and Print the Form

You can download IRS Form 15112 from the official IRS website. Once you have downloaded the form, print it out and make sure you have a pen or pencil ready to fill it out. If you prefer to fill out the form electronically, you can use a PDF editor to complete it.

Step 3: Fill Out the Form

Carefully read through the form and fill out the required information. Make sure to write clearly and accurately. You will need to provide your name, address, Social Security number or ITIN, and date of birth. You will also need to specify which tax-related documents you want to receive electronically.

- Part I: Taxpayer Information

- Provide your name, address, and Social Security number or ITIN

- Specify your date of birth

- Part II: Electronic Document Preferences

- Check the boxes next to the tax-related documents you want to receive electronically

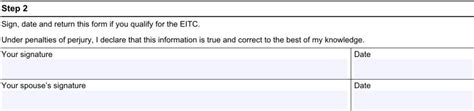

Step 4: Sign and Date the Form

Once you have completed the form, sign and date it. Make sure your signature is legible and matches the name on the form.

Step 5: Submit the Form

You can submit the completed form to the IRS by mail or fax. Make sure to follow the instructions provided on the form for the correct mailing address or fax number.

Benefits of Electronic Documents

By opting for electronic documents, you can enjoy several benefits, including:

- Reduced clutter and increased organization

- Increased security and reduced risk of lost or misplaced documents

- Faster access to your tax-related information

- Contribution to a more environmentally friendly practice

Additional Tips

- Make sure to keep a copy of the completed form for your records

- If you have any questions or concerns, you can contact the IRS for assistance

- You can also use the IRS online services to opt out of receiving paper copies of tax-related documents

Wrapping Up

Completing IRS Form 15112 is a straightforward process that can help you reduce clutter, increase security, and contribute to a more environmentally friendly practice. By following these 5 steps, you can easily opt out of receiving paper copies of tax-related documents and instead receive them electronically.

Call to Action

If you're ready to make the switch to electronic documents, start by downloading IRS Form 15112 and following the steps outlined above. If you have any questions or concerns, feel free to comment below or share this article with a friend who may be interested.

FAQ Section

What is IRS Form 15112?

+IRS Form 15112 is a document used by the Internal Revenue Service to enable taxpayers to opt out of receiving paper copies of tax-related documents and instead receive them electronically.

What are the benefits of opting for electronic documents?

+By opting for electronic documents, you can enjoy several benefits, including reduced clutter and increased organization, increased security and reduced risk of lost or misplaced documents, faster access to your tax-related information, and contribution to a more environmentally friendly practice.

How do I submit IRS Form 15112?

+You can submit the completed form to the IRS by mail or fax. Make sure to follow the instructions provided on the form for the correct mailing address or fax number.