Maryland's long form financial statement is a crucial document for individuals and businesses operating within the state. It provides a comprehensive snapshot of one's financial situation, which is essential for various purposes such as taxation, loan applications, and financial planning. In this article, we will delve into the details of Maryland's long form financial statement, exploring its importance, benefits, and the information required to complete it.

Understanding the Importance of Maryland's Long Form Financial Statement

Maryland's long form financial statement is a detailed document that outlines an individual's or business's financial position, including income, expenses, assets, liabilities, and equity. This statement is typically required by the state of Maryland for various purposes, such as:

- Taxation: The long form financial statement helps the state assess an individual's or business's tax liability.

- Loan applications: Lenders often require a long form financial statement to evaluate the creditworthiness of an individual or business.

- Financial planning: The statement provides a comprehensive view of one's financial situation, enabling informed decisions about investments, savings, and debt management.

Benefits of Using Maryland's Long Form Financial Statement

The long form financial statement offers several benefits, including:

- Improved financial management: By providing a detailed snapshot of one's financial situation, the statement enables individuals and businesses to identify areas for improvement and make informed decisions.

- Enhanced credibility: A completed long form financial statement demonstrates transparency and accountability, which can enhance credibility with lenders, investors, and other stakeholders.

- Simplified tax compliance: The statement helps individuals and businesses comply with tax regulations, reducing the risk of errors and penalties.

Who Needs to File a Maryland Long Form Financial Statement?

The following individuals and businesses are required to file a Maryland long form financial statement:

- Individuals with a gross income exceeding $100,000

- Businesses with a gross income exceeding $500,000

- Estates and trusts with a gross income exceeding $25,000

- Non-resident individuals and businesses with Maryland-sourced income

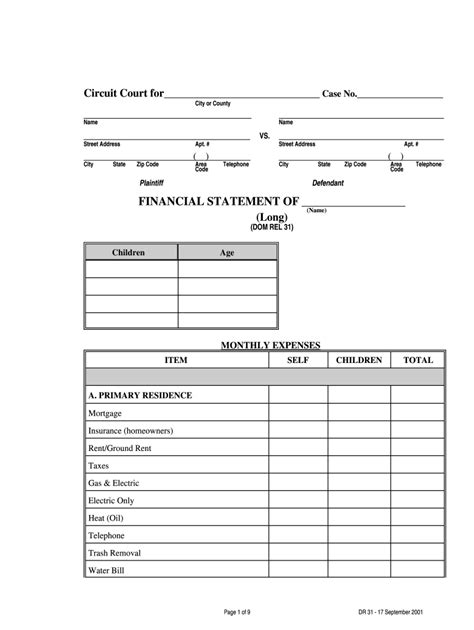

Information Required to Complete Maryland's Long Form Financial Statement

To complete Maryland's long form financial statement, individuals and businesses will need to provide the following information:

- Income statement:

- Gross income from all sources

- Deductions and exemptions

- Net income

- Balance sheet:

- Assets, including cash, investments, and property

- Liabilities, including debts and loans

- Equity, including owner's capital and retained earnings

- Supporting schedules:

- Depreciation and amortization

- Capital gains and losses

- Dividends and interest income

Steps to Complete Maryland's Long Form Financial Statement

To complete Maryland's long form financial statement, follow these steps:

- Gather necessary documents, including tax returns, financial statements, and supporting schedules.

- Review the statement's instructions and ensure you understand the required information.

- Complete the income statement, balance sheet, and supporting schedules.

- Review the statement for accuracy and completeness.

- Sign and date the statement.

Common Mistakes to Avoid When Completing Maryland's Long Form Financial Statement

- Inaccurate or incomplete information

- Failure to report all income and expenses

- Incorrect calculation of net income

- Failure to sign and date the statement

Conclusion

Maryland's long form financial statement is a critical document that provides a comprehensive view of an individual's or business's financial situation. By understanding the importance, benefits, and requirements of this statement, individuals and businesses can ensure accurate and timely completion, avoiding potential penalties and complications. If you're unsure about any aspect of the statement, consider consulting a financial professional or tax advisor for guidance.

What is the purpose of Maryland's long form financial statement?

+The purpose of Maryland's long form financial statement is to provide a comprehensive snapshot of an individual's or business's financial situation, including income, expenses, assets, liabilities, and equity.

Who needs to file a Maryland long form financial statement?

+Individuals and businesses with a gross income exceeding certain thresholds, as well as estates and trusts with a gross income exceeding $25,000, are required to file a Maryland long form financial statement.

What information is required to complete Maryland's long form financial statement?

+To complete Maryland's long form financial statement, individuals and businesses will need to provide information on their income, expenses, assets, liabilities, and equity, as well as supporting schedules for depreciation, capital gains, and dividends.